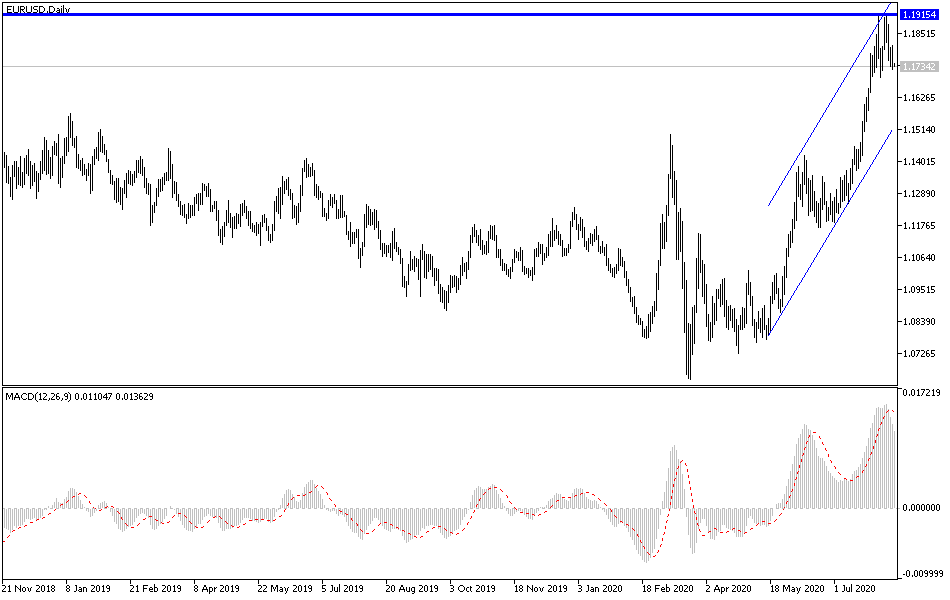

For four trading sessions in a row, the EUR/USD pair was in a downward correction range that pushed it towards the 1.1710 support at the time of writing. The beginning of the correction came from the 1.1916 resistance, its highest level in 26 months, which it reached at the end of last week’s trading. The USD returned to confirm its resilience despite the sharp dispute inside the United States to pass more stimulus plans. Some analysts attributed the recent Euro’s performance to the strong pressures on the Turkish lira's price more than any bright economic story in the Eurozone, especially after the market was attracted to Turkey's aid. Since the beginning of this month’s trading, the Euro is continuing strong gains, complementing what it achieved by the end of July, which many saw as a result of the increasing scorn of investors for the dollar and optimism about the economic outlook for the Eurozone that was developed and sponsored by the developments of the European Union Recovery Fund.

But it also came amid the last quarter of a long and sustained decline in the value of the Turkish lira, partly caused by the monetary policy debate of the Turkish Central Bank.

July 20th saw European leaders backing the massive EUR 750 billion EU economic aid package, which lifted the EUR/USD pair above 1.16 and provided clear support as the EUR/USD pair broke the 1.17 high and began targeting a bigger rally from July 23. These gains led to investors shifting from the “net selling” of the Euro to the “net buying” and making analysts talk of levels above 1.20. Until the Turkish lira crisis came.

Prospects for recovery in Germany and the Eurozone improved in August, according to the latest ZEW survey by the Leibniz Center for European Economic Research of Institutional Investors, marking the fifth month of strong gains for the sentiment gauge towards the bloc and its outlook for the next six months. Investors became more optimistic in their forecasts for the next six months in August, lifting the ZEW economic confidence index from 59.3 to 71.5 for Germany and economists were looking for drop to a reading of 57.0. However, the institutions were more conservative in their assessment of the current economic situation.

The ZEW index, which measures optimism about the current economic situation, decreased by 0.4 points to -81.3 during a period of increasing concern in European capitals, including Berlin, about the possibility of a second wave of Coronavirus infections in some countries of the continent. Professor Akim Wambak, Chair of ZEW, commented on the results: “According to the individual sectors’ assessment, experts expect to witness a general recovery, especially in the local sectors. However, the still very weak earnings outlook for the banking sector and insurance companies for the next six months is a cause for concern.”

For the Eurozone, the ZEW rose from 59.6 to 64.0 and economists had expected a modest decline to end a series of strong multi-month gains in sentiment toward the Eurozone economy. As with Germany, the ZEW measure of optimism about the current economic situation also declined, although this time by -1.1 points to -89.8.

According to the technical analysis of the pair: As I mentioned before, there will be a threat to the uptrend of the EUR/USD pair in the event that the pair moves around and below the 1.1660 support, because it will support stronger control of the bears over performance and test stronger support levels. In return, bulls try to move with full force to return to the vicinity of the 1.1800 resistance and may be unable to do so in the event that investors continue to buy the USD despite the continuing factors of losses from the failure to pass more American stimulus and the continued U.S lead of global COVID-19 numbers.

As for the economic calendar data today: From the Eurozone, the industrial production rate will be announced. From the United States, the CPI, the most important U.S inflation measurement, will be announced.