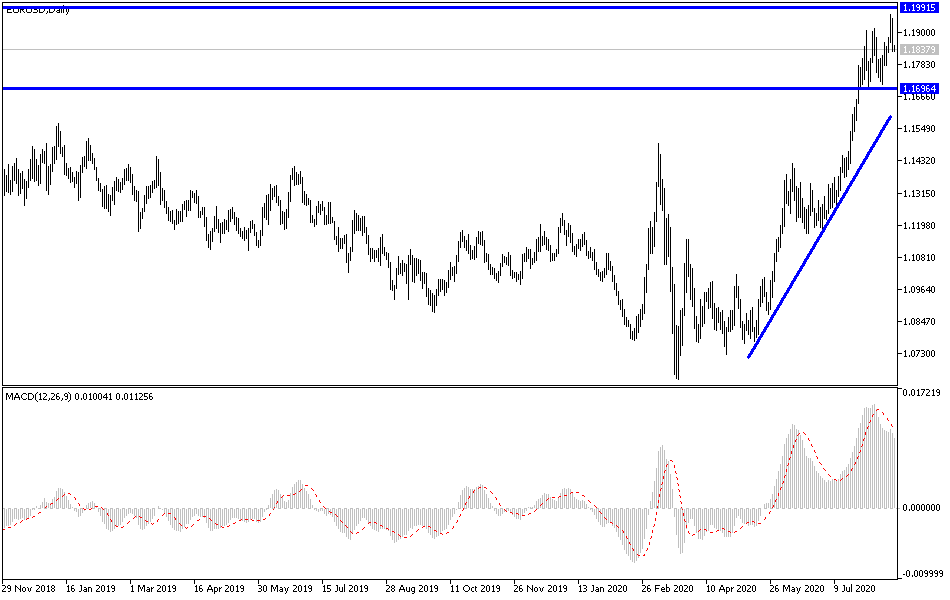

The recent strong EUR/USD gains stopped around the 1.1965 resistance, and with technical indicators reaching overbought areas, the profit-taking activities were activated, which pushed the pair towards the 1.1830 support at the time of writing. Supporting the correction was the announcement of the latest US Federal Reserve Bank’s MoM, which confirmed that US central bank officials, during their meeting in late July, reduced their estimates of economic growth during the second half of the year, and as it is known, they always present their own expectations at the eight interest-rate committee meetings at the central bank every year.

At the last meeting on July 28-29, US monetary policy officials said they expected the rate of recovery in GDP and the pace of decline in the unemployment rate to be "somewhat less robust than it was in previous expectations." Officials blamed the slowdown on the increasing spread of the coronavirus since mid-June and the slowdown in the country's reopening of businesses. In their policy statement released after the July meeting, Fed officials emphasized that the trajectory of the economy would depend heavily on the trajectory of the coronavirus pandemic. At this meeting, Fed officials decided to keep interest rates at zero and to maintain monthly purchases of $120 billion in US Treasury bonds and mortgage-backed securities.

For his part, Fed Chairman Jerome Powell said that the central bank "is not even considering raising interest rates."

Returning to the path of the pair, the EUR/USD was looking for a foothold above the previous technical resistance, which it recorded during the Wednesday session after it broke through new high levels in the previous session, and the performance was amid doubts by some technical analysts regarding the possibility of maintaining such high rises without a setback. The pair managed to maintain its gains yesterday ahead of the Federal Reserve minutes, as the market interacted with official data that revealed an increase in the current account surplus for the Eurozone for the month of June, which came along with other figures that confirmed that the core inflation rate for July remained around 1.2%. According to the ECB statement, “In the financial account, Eurozone residents made net acquisitions of foreign portfolio investment bonds totaling 514 billion Euros in the 12-month period to June 2020 (up from 134 billion euros in the 12 months to June 2019). During the same period, non-residents made net acquisitions of investment securities in the Eurozone portfolio that amounted to 439 billion euros (up from 132 billion euros).”

The current account surplus of 20.7 billion Euros for the month of June met expectations of a balance of + 7 billion Euros only, but it is related to the end of the second quarter and a period when the economic results in the Eurozone were already known. It was not surprising to all that the core inflation rate remained stable, but rather a warning signal to speculators on the rise in the EUR/USD.

The single European currency rose about 10% in the three months to mid-August and rose 6.49% for 2020 through Wednesday.

According to the technical analysis of the pair: Despite the recent downward correction of the EUR/USD pair, the general trend is still bullish, and as I mentioned previously, stability above 1.19 will remain strong support for the move towards the 1.2000 psychological resistance, taking into account overbought signals from technical indicators. The real threat to the current bullish trend will be the pair moving towards the 1.1650 support. The divergence of economic performance and the stimulus policy currently is still in favor of the Euro, and therefore it is preferable to buy this pair from the support levels at 1.1790 and 1.1700, respectively.

As for the economic calendar data today: From the Eurozone, the German producer price index, then the monetary policy bulletin of the European Central Bank will be announced. From the United States, the reading of the Philadelphia Industrial Index and the Unemployed claims will be announced.