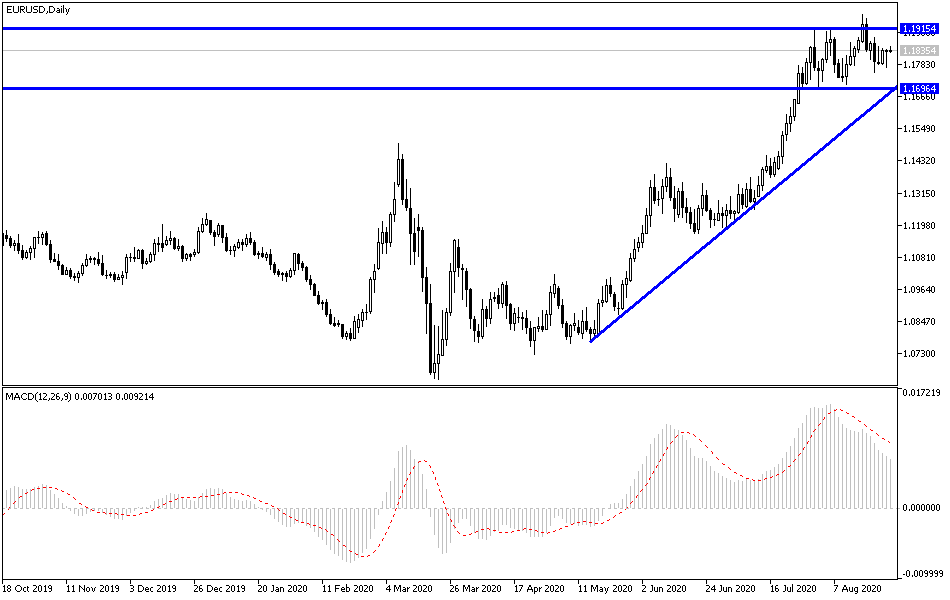

For four trading sessions in a row, the EUR/USD currency pair was trying to correct upwards, but its gains did not exceed the 1.1844 resistance, where it is stable around at the time of writing. This is before the most important event for this week, which is the statements of US Federal Reserve Governor Jerome Powell at the Jackson Hole symposium, which will help to determine features of the bank’s monetary policy with the new adjustments to the bank’s objectives. The lowest level for the pair during this week’s trading was at the 1.1772 support. Commenting on the recent performance of the pair, analysts at ING believe that the EUR/USD exchange rate is on its way to drop below 1.17, as they see that the period of superior economic performance in the Eurozone is fading.

Expectations of a rapid and world-leading economic recovery in the Eurozone were dampened last week after the release of the PMI data for August, which showed a slowing pace of the recovery. “The EUR/USD sell-off gained some momentum on Friday when the Eurozone PMIs for August were largely disappointed - led by the weak services sector,” said Francesco Bisol, Forex Strategist at ING. Coinciding with the resurgence of COVID-19 cases in many parts of the world, the fear now is that we have seen the best recovery numbers, and that the V-shaped recovery forecast will be affected in September. "The EUR/USD may drop for a while below 1.17 if the correction gains momentum," the analyst said.

August's composite PMI - which includes manufacturing and services numbers according to their share of the overall economy - settled at 51.6, lower than expected 54.9 and 54.9 from July. The Eurozone Services PMI reading for August was at 50.1 according to IHS Markit, which is below expectations of 54.5 and below the 54.7 reading in July.

At the same time, ING analysts do not see "sweeping changes taking place in the factors that have driven the rally, so we are happy to maintain our target for the month at 1.20".

It seems that the exchange rate of the EUR/USD has entered this week’s trading in a stable and steady phase, as technical indicators indicate that the pair's bullish momentum is waning as the dollar finds itself better supported. The Euro was set at 1.1837, after rising around 1.1965 highs last week ahead of the release of disappointing PMI data and the return of dollar strength.

In the same context, Lars Merkelin, senior analyst at Danske Bank, says, “In our view, US dollar weakness is expected to fade as doubts may arise about the strength of the deflationary story and the European outperformance of US assets is unlikely to continue. Therefore, we see the risks of the EUR/USD falling to the target of 1.16 in the period from one month to three months.”

Contrary to these expectations, analysts at Goldman Sachs believe that the pair is likely to ultimately remain on its way to achieving its expected target at a high of 1.25.

According to the technical analysis of the pair: The EUR/USD bullish rebound attempts are still in need of stronger momentum. This may be achieved if the pair moves above the 1.1920 resistance, which in turn supports the pair's move towards the 1.2000 psychological resistance after that. On the downside, a reversal of the general downtrend may occur if the pair moves below the 1.1750 support. Still, I would prefer to buy the pair from every lower level.

As for today's economic calendar data: From the Eurozone, Money Supply and Private Loans data will be announced. From the US, the GDP growth rate, jobless claims and pending home sales data will be released, and then the comments by Fed Governor Jerome Powell.