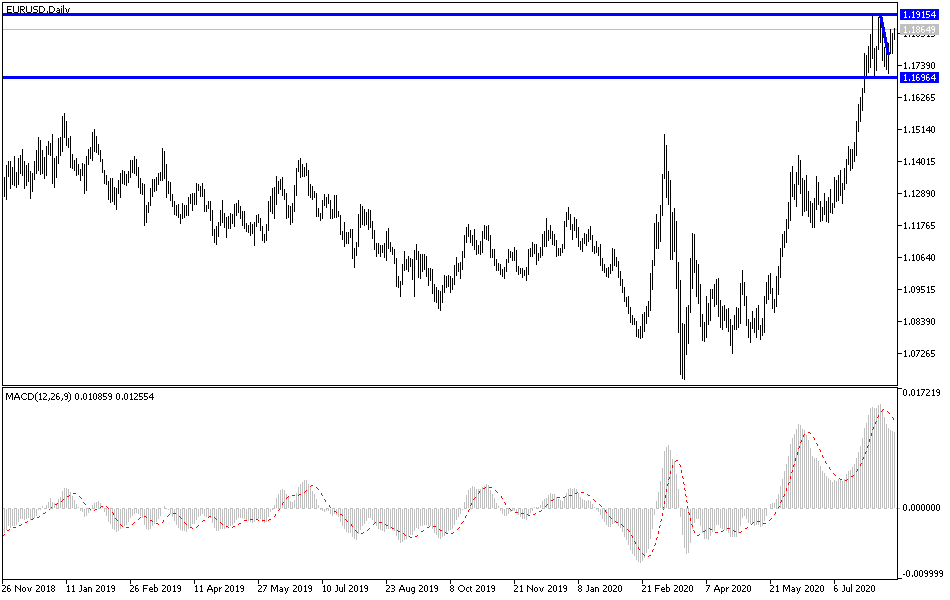

The US dollar is desperately trying to make up for its losses against most other major currencies. During last week's trading, the EUR/USD pair fell to the 1.1710 support, but the pair quickly revised back to the 1.1864 resistance before closing last week's trading on the 1.1840 resistance. Bulls’ control over performance strengthened expectations of the possibility of reaching the 1.2000 psychological resistance as soon as possible. Commenting on the impact on the Single European Currency, Athanasios Famfakidis, Head of Foreign Exchange Strategy at BofA Global Research, said: "The EU Recovery Fund is an important step, but it is not a game changer. From our point of view, we remain concerned about high debt levels in individual Eurozone economies". "We see a balanced risk of the US dollar in the short term, with a number of balancing forces ... such as Brexit, so our fundamental situation is not an extension of the transition period and a basic free trade agreement by the end of the year."

A strong price gain for the EUR/USD pair happened last month, destroying everything in its path including technical resistance levels and a number of emerging market currencies, and the single European currency continues to maintain bullish momentum at the end of last week's trading even with reports confirming the extent of fears of the second European wave of COVID-19 cases amid better than expected figures for US retail sales.

France has pledged reciprocal measures after the UK closed its travel route with France due to the sudden rise in new COVID-19 cases. But there are no effects on foreign currencies as a result, and some analysts believe that quarantine could be an effective tool for currency devaluation away from monetary policy. The single European currency is among the biggest heavyweights in the forex market, but during times when the Eurozone currency, which is heavily weighted by trade, has risen above limits seen in the last major recovery in 2017, it may be ready for a correction at any time.

The outbreak of a new COVID-19 wave has disrupted the peak summer holiday season in most of Europe, with authorities in some countries reimposing restrictions on travellers, nightclubs closed again, fireworks displays banned and orders to wear protective masks increased. The warnings have increased across Europe, which suffered severely during the spring, but in recent months seem to have largely helped tame the Coronavirus in ways that the United States couldn’t, with its optimistic scientific prowess and additional preparedness time to handle it. Britain, Italy, France and Spain, which are the most affected countries in Europe, registered death toll of around 140,000.

According to the technical analysis of the pair: As mentioned in the recent technical analysis of EUR/USD pair, stability above the 1.1800 resistance will continue to support the control of bulls performance and may push the pair towards higher resistance levels and the 1.2000 psychological resistance will remain legitimate target for the current upward trend. There will be no real reversal of the trend as I mentioned earlier without a test around and below the 1.1660 support.

There are no important European data released today. From the United States, Empire State Industrial Index and the NAHB Housing Market Index data will be released.