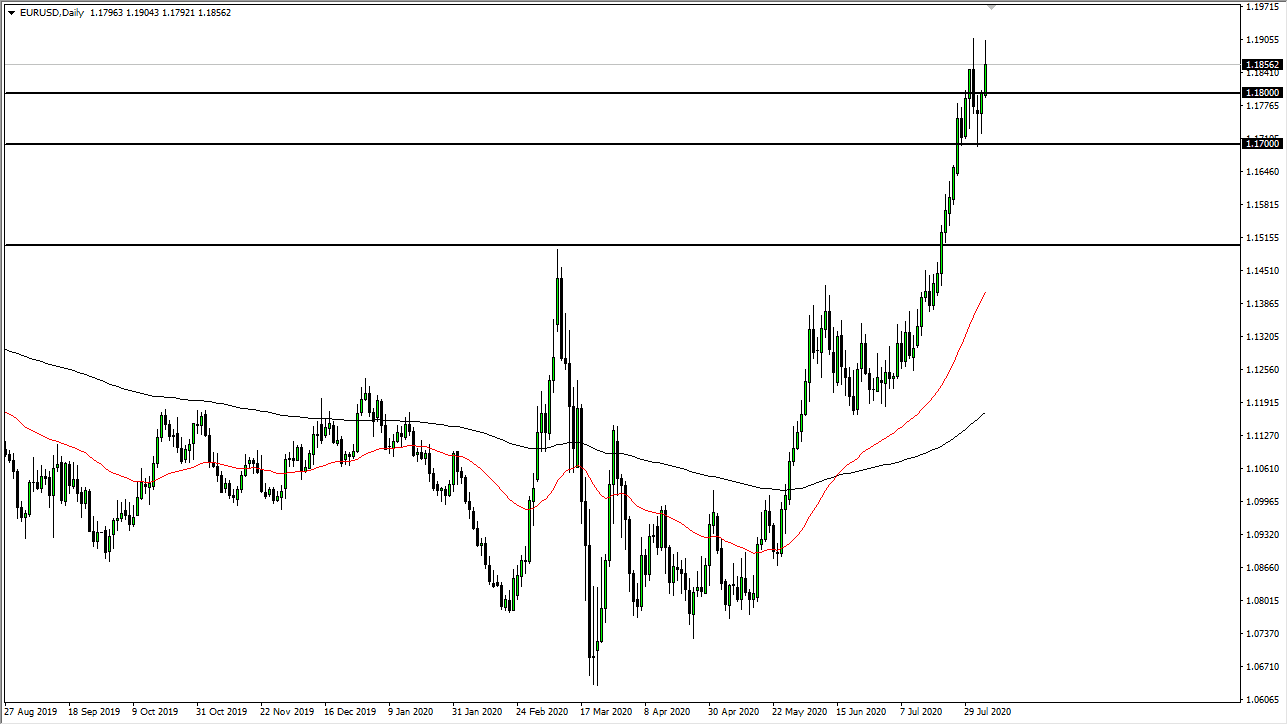

The Euro has rallied a bit during the trading session on Tuesday as we reached towards the 1.19 level yet again. That is an area that has been important previously as we pull back from that high. Ultimately, I think that we have a scenario where the market is going to continue to see this area as important, and the fact that we reached here is something worth paying attention to. Having said that, I do think that it is only a matter of time before we break out above there, but we might be a little stretched in the short term.

Looking at the candlesticks over the last couple of days, it is obvious that we have seen a massive surge higher. That being the case, the question now is whether or not we are forming some type of consolidation area? So far, it does look like that could be the case, especially considering some of the major announcements coming later this week. With the jobs number looming large, it is likely that we could see a lot of the market simply go sideways for a while, trying to figure out where to go next. We also have a lot of concern around the world, and that has people going back and forth with the US dollar.

The 1.17 level underneath is crucial, and that is an area that I think continues to offer massive support. With that being the case, I think it is only a matter of time before buyers would jump into that area, and perhaps take advantage of “cheap euros” at that point. However, if we were to break down below there then I would look towards the 1.16 level for support, and the 1.15 level for support which I think is the “floor” in the overall uptrend that we should continue to see play out. If we were to break down below there it would obviously change a lot of things, but I do not see that happening anytime soon. I believe that we are more likely to see the Euro go looking towards the 1.20 level than anything else over the next couple of weeks as the Federal Reserve continues to crank US dollars into the financial system, thereby devaluing the currency overall. With everything being how it is, there is no need to fight this trend and simply looking for value continues to work.