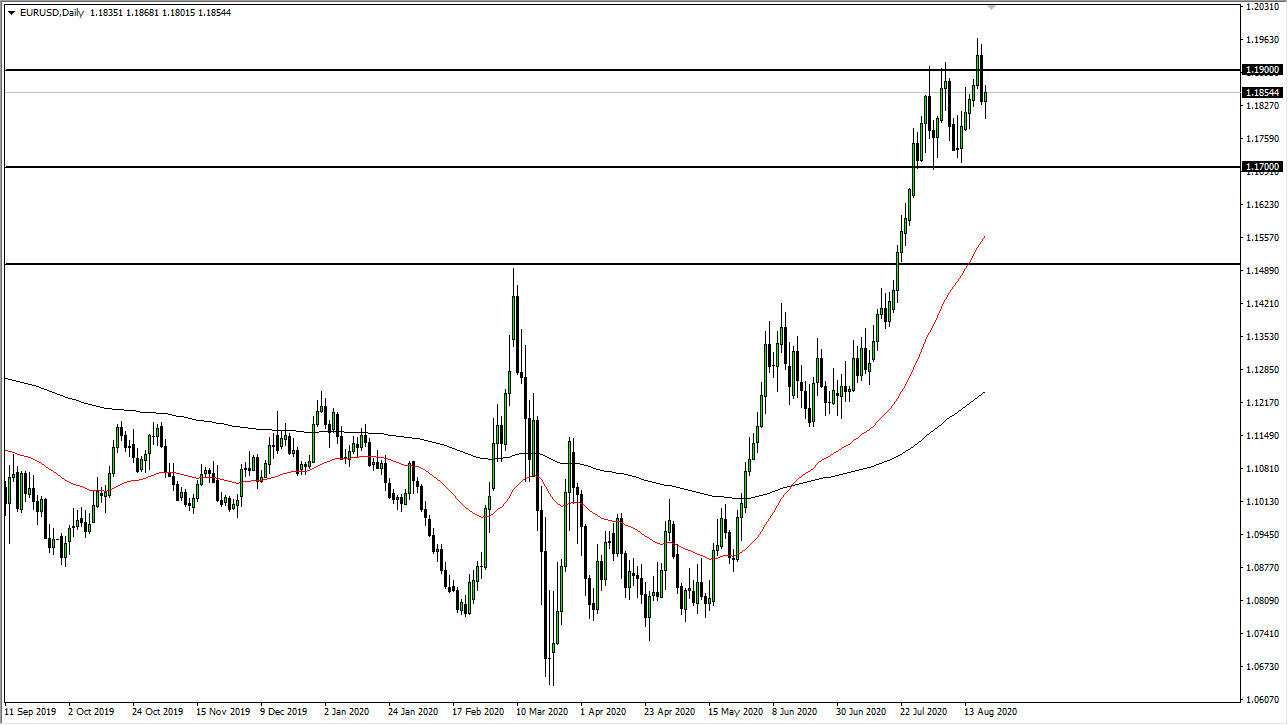

The Euro has gone back and forth during the trading session on Thursday as we continue to see a lot of volatility in general. Looking at the Euro, this currency pair is not necessarily going to be about the Euro itself, but probably more to do with the US dollar, and of course the Federal Reserve flooding the markets with those very same US dollars. You can make an argument for a supportive looking candlestick for the trading session on Thursday, and that possibly we will try to rally from here. However, it is also a Friday session and that tends to be a little bit more on the quiet side at times.

To the downside, I believe that the 1.17 level will be massive support, and that any move towards that area will probably be bought into as it should show a significant amount of interest. This is an area where we have seen buyers return to a couple of times already, so it is not a huge surprise or stretch of the imagination to see that happen again. I think we may not even get that low, and clearly, we are in a bullish trend anyway, so there is no point in trying to fight it.

The shape of the candlestick is positive, but we are getting a little bit stretched in general. Another thing that I am paying attention to is the fact that the Thursday candlestick was so bearish. I think we probably need to pullback in order to find a little bit of value, so therefore I am not in a huge rush to start buying all the way up here. That being said, I clearly would not be a seller of this market as it is so bullish, and it is obvious now that the trend has most certainly changed drastically as of late. I believe that the 1.20 level will be the target, and if we overcome that level, then we are going to be looking towards 1.25 level at the very least after that. Granted, it is can it take a long time to get there but what I am describing is a complete trend change. I do not have any interest in shorting this pair right now, especially with the Federal Reserve going out of its way to flood the markets with the dollar itself.