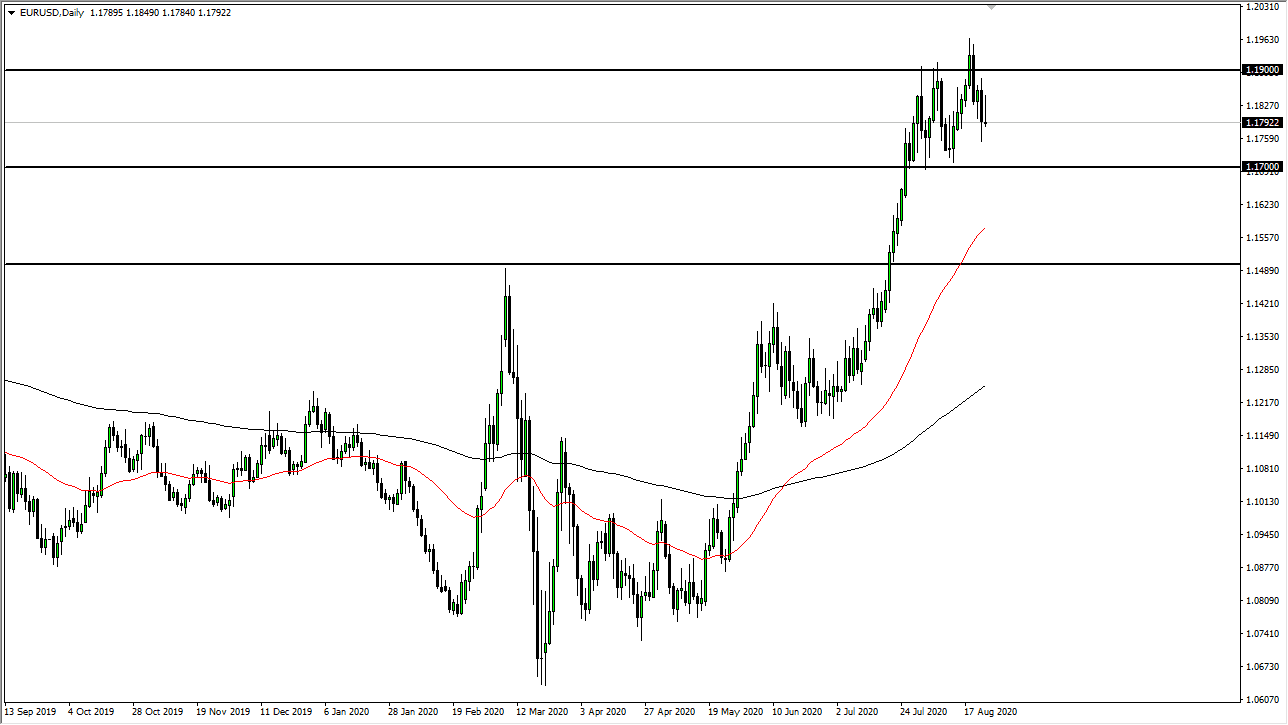

The Euro initially rally during the trading session on Monday but has fallen quite a bit from the highs in order to form a less than ideal candlestick. At this point in time we are still very much in a trading range, between the 1.17 level on the bottom and the 1.19 level on the top. Until we break out of this range, I would not read too much into the candlestick other than we have no idea what to do with ourselves right now. The Euro of course is likely to continue to be somewhat vulnerable due to the fact that the US dollar is oversold in general. If you look at the US Dollar, it formed a massive hammer on the weekly chart last week, which of course is a very bullish candlestick. That does not mean that the US dollar needs to rally significantly, just that it may be getting a little bit oversold.

The Euro is the natural place for traders to get involved in, as the US Dollar Index is comprised 50% or more of just the Euro. Because of this, I think it is only a matter of time before the markets will find some type of reason to move back and forth, because there are so many moving pieces out there right now that people are completely confused. We have the United States and questions as to whether or not they can do stimulus, while the ECB is going to be stimulating the European Union as much as possible. This should foster growth, at least in theory. With this being the case, I think it is only a matter of time before the market needs to make a bigger move, and the Euro has been on a tear to the upside but we probably need to consolidate a bit in order for traders to come back in and pick up the Euro.

Even if we break down below the 1.17 level, then it is likely that the 50 day EMA or the 1.15 level underneath will offer an of buying pressure to attract traders again. At this point in time, it is likely that we will continue to see value hunters out there, and therefore I think it comes into play that eventually the value hunters take over. In the short term though, it looks like we will probably drip down towards the 1.17 handle.