The Euro initially fell during the trading session on Wednesday but did turn around to show signs of life again by the end of the day. This is a pair that does not really know what to do with itself as we are essentially “killing time” when it comes to this pair. I think at this point in time it is likely that we will see this market have to make some type of longer-term decision, and the first real opportunity for that will happen on Thursday as Chairman Jerome Powell speaks in front of the Jackson Hole Symposium, at least virtually. Traders will be paying attention to his every word because it gives you the idea that the Fed may or may not do something involving monetary policy.

During the trading session on Wednesday it has been speculated that rates could stay extraordinarily low for at least another five years, which if you think about it really is not that remarkable. After all, interest rates a been extraordinarily low for 12 years. Why would another five be any different? A little cynical to say the least, but at the end of the day that is exactly what has happened. Because of this, I believe it is only a matter of time before the market comes to realize this is going to be the way for much longer than most people talk about. That being said, I would anticipate that his speech should be one of acquiescence, groveling in front of the market.

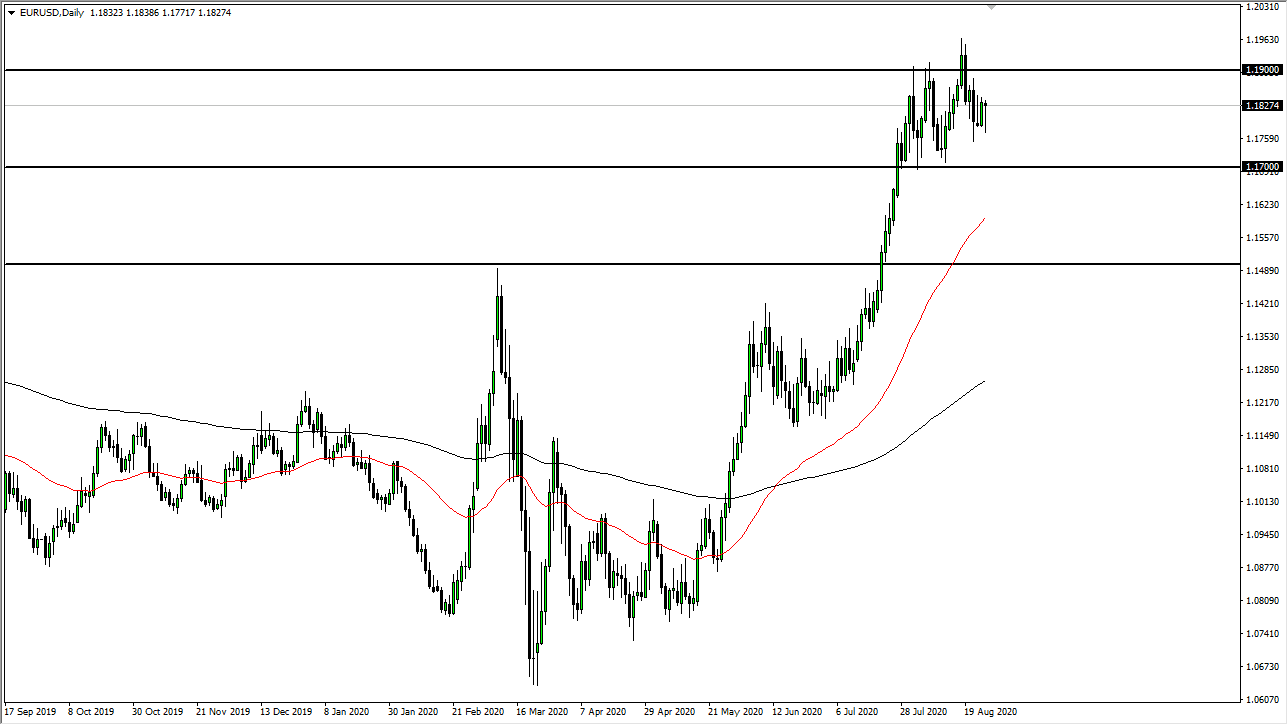

The Euro will be one of the main beneficiaries if he can convince the world that he is going to flood the market with dollars still. That being said, we have rallied rather drastically, so spending a little bit of time in a 200 point range certainly makes some sense. I think ultimately, this is a market that will continue to see choppy behavior in this marketplace. We do have some time to kill though, and I would not be surprised at all to see this pair bounce around until most of the head traders come back to work sometime in September. We have clear support at 1.17 underneath and clear resistance at 1.19. There is even more resistance at 1.20, based upon the psychology of that round figure, so do not be surprised if that ends up being a battleground as well.