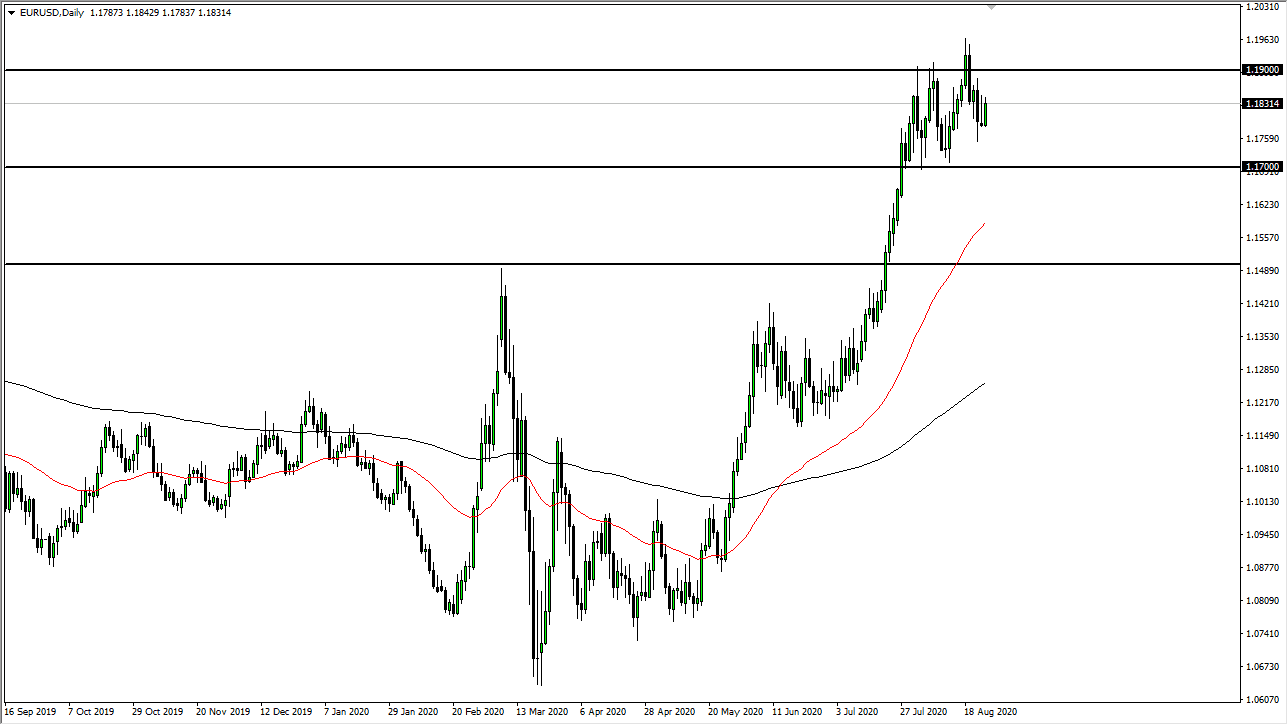

The Euro rallied a bit during the trading session on Tuesday as we have wiped out the losses from Monday. It looks likely that the market is ready to continue going higher, perhaps reaching towards the 1.19 level. Ultimately, it is only a matter of time before the buyers will come back into play, which would be a continuation of the overall uptrend. After all, the Federal Reserve is loosening monetary policy and the Euro has benefited from that.

The Euro is likely to continue to be pushed higher due to the fact that the European Union at least has some type of plan to deal with the coronavirus while the United States is lagging behind. Ultimately, we also have the overall trend going higher, and the fact that we are testing the 1.20 level above in theory at least, we could see a major reversal of fortune. In the short term though, we have been bouncing around between the 1.17 level and the 1.19 level above. As long as we are within that range, one would have to assume that we are essentially grinding back and forth.

If we were to break down below the 1.17 handle, then the market would probably go looking towards the 50 day EMA, and then possibly even the 1.15 handle. That is an area where I would expect to see a lot of support, and therefore I think it is only a matter of time before a lot of longer-term traders will get involved as well. I do think ultimately, we not only go to the 1.20 level above, and then the 1.25 handle after that. We do have the election to deal with between now and then, but I like the idea of buying short-term dips in general because it offers value in what is an obvious trend.

We had recently reversed the trend quite violently, so do not be surprised at all if we stay in this 200 point range, you can probably trade back and forth and take advantage of what seems to be somewhat obvious, as the market has been contained quite nicely. We did not break above the top of the candlestick from the previous session, so it is not technically an inverted hammer, but it certainly looks as if we are trying to make itself.