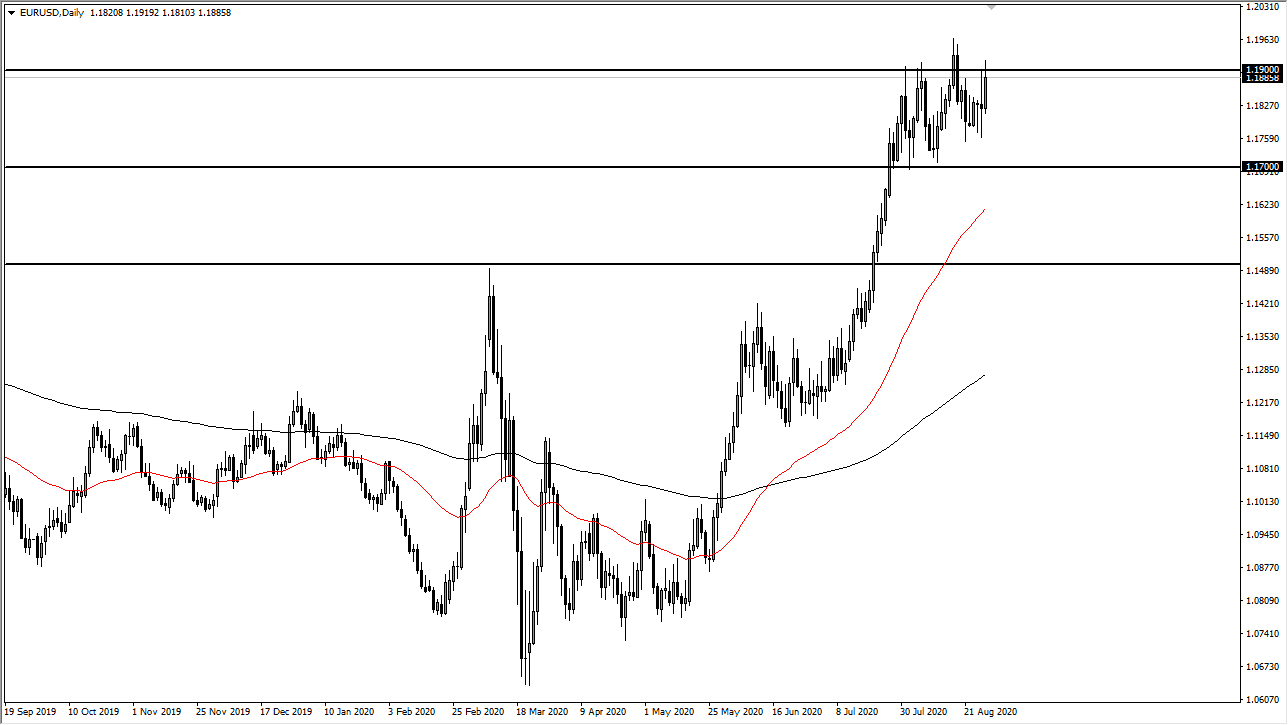

The Euro rallied significantly during the trading session on Friday to test the 1.19 level above. We did pull back a bit from there but this is an area that I think eventually will get broken and we will then go much higher, perhaps reaching towards 1.20 level. That is a large, round, psychologically significant figure, and it is likely that we will continue to see that area be respected, but eventually, we will breakthrough there. Ultimately, this is a market that I think will eventually continue higher, but we need some type of catalyst. The fact that we are heading into the weekend probably did not help the situation as well.

As the Federal Reserve is going to raise the bar for interest-rate hikes, it does make quite a bit of sense that we will continue to see negative pressure on the US dollar, and thereby the Euro should be a beneficiary. That does not mean that we take off right away, so with that being the case it is very likely that we will see an occasional pullback, but those pullbacks should be thought of as buying opportunities. I fully anticipate that one day I am going to wake up and the Euro will have cracked through massive resistance. I plan on being long of the currency pair that points in waking up to nice profits.

To the downside, the market is likely to have massive support near the 1.17 level, as we have seen more than once. All things being equal, this market is grinding higher and tilting to the upside, but at this point in time, I think it just shows that more pressure is coming out. Ultimately, I think that short-term pullbacks are buying opportunities and I think that we are going to continue to see value hunters coming back in. I have a significant amount of support marked on my chart near the 1.15 level as well, which is the previous resistance that will more than likely bring in a lot of the value hunters as well. With Jerome Powell suggesting that the bar to raising interest rates has gotten even higher, it makes sense that the US dollar gets torched, despite the fact that the European Union has a whole host of its own problems. Ultimately, I think we go towards the 1.25 handle.