The Euro has gone back and forth during the training session on Thursday as we await the Non-Farm Payrolls announcement. Ultimately, this is a market that I think will continue to look at the US dollar through the lens of a central bank that is pumping of liquidity into the markets as quickly as it can. Keep in mind that the Non-Farm Payroll Friday session tends to be very noisy, but do not be surprised at all if we end up basically where we start, as that is typically the case.

The idea of trading the Non-Farm Payroll Friday session is something that a lot of brokers have pumped out at retail traders as a great opportunity, but at the end of the day it is not, as it is typically very illiquid. However, if we get some type of conviction after that movie quite often offers a potential move that lasts days. This is very unusual these days though, so keep in mind that the market will likely not do that. However, you certainly can trade this announcement if we get some type of pullback.

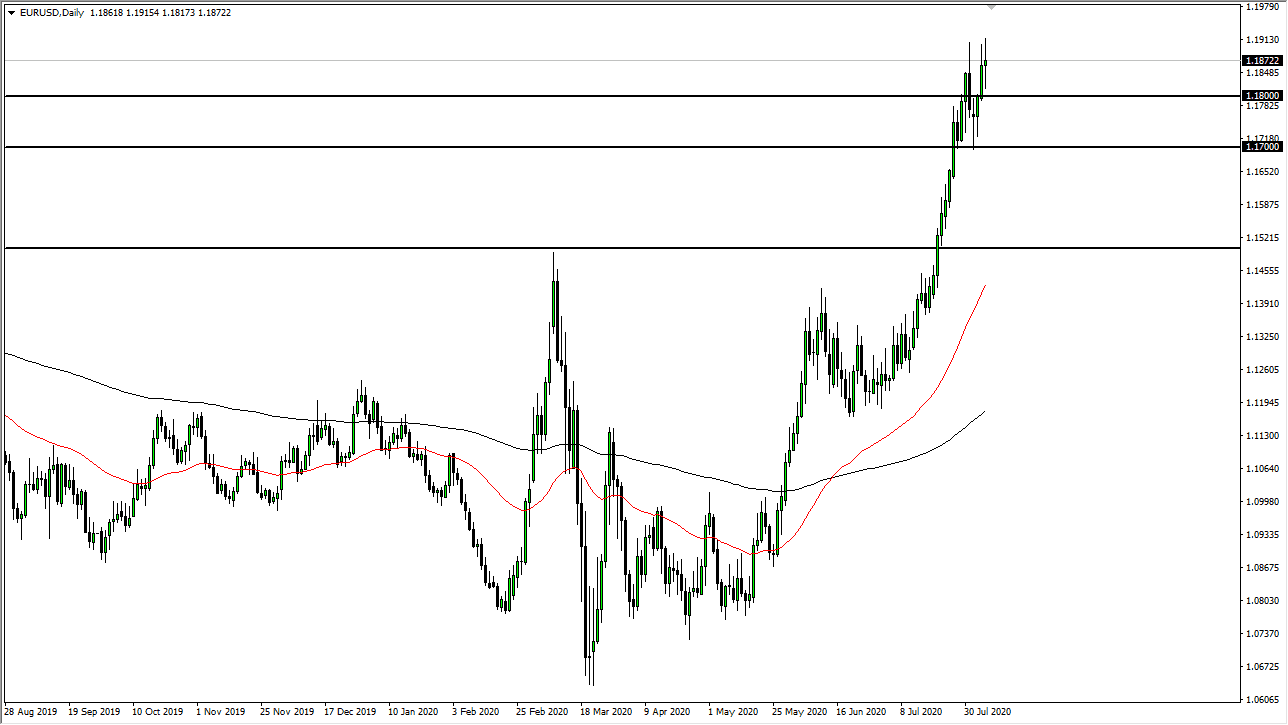

At this point in time, if the announcement causes some type of major pullback, I would be more than willing to buy that pullback as it should offer value. The 1.18 level should offer support, and then the 1.17 level. Ultimately, I think that we are essentially in some type of trading range, trying to build up the necessary momentum to break out to the upside. However, we may have to “kill time” before we make a significant move, which I think leads the Euro to reach towards the 1.20 level, a level that will more than likely cause a lot of issues, albeit from a psychological standpoint. Longer-term, I think we are probably going to make a move towards 1.25 handle.

To the downside, if we were to break down below the 1.17 handle, then the market is going to go looking towards 1.15 level for support. I would be all over that move as it would represent significant value, and therefore a screaming buying opportunity. As far shorting is concerned, something needs to change in the Federal Reserve or the European Union for me to do so. I look at the more time we spend going sideways as the more likelihood that we have a bigger move to the upside as people begin to get comfortable with this idea.