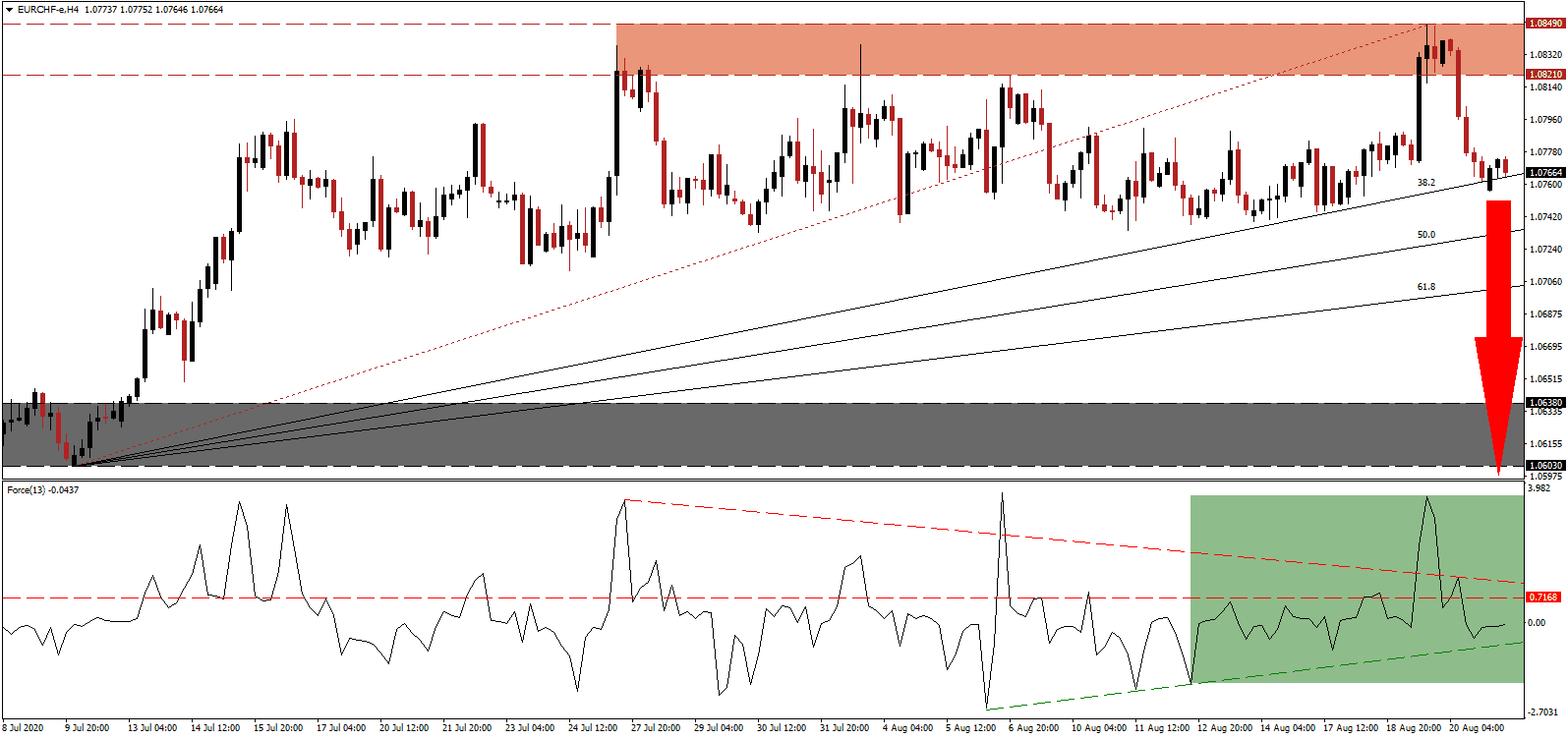

Eurozone governments are poised to rollback support measures for businesses, implemented as a response to the Covid-19 pandemic. It adds to uncertainty over the economy, prompting the European Central Bank (ECB) to consider new stimuli this fall. Seven of the ten most-infected countries in Europe are Eurozone members, and the ECB fears the rise of corporate bankruptcies and persistently high unemployment. Minutes from the last policy meeting suggest more bearish conditions than previously expected. The EUR/CHF plunged below its resistance zone with bearish pressures accumulating rapidly.

The Force Index, a next-generation technical indicator, receded from a marginally lower peak, an initial sign of pending weakness in price action. It has now corrected below its descending resistance level and converted its horizontal support level into resistance, as marked by the green rectangle. This technical indicator additionally moved below the 0 center-line and is favored to drop through its ascending support level, granting bears full control over the EUR/CHF.

A recent poll conducted by Reuters revealed the median outlook for the Eurozone recovery to pre-Covid-19 levels at two years or more. While a third-quarter surge of 8.1% is forecast to follow the second-quarter 12.1% plunge, the pace is expected to slow to 3.0% in the fourth quarter and decrease gradually. Unemployment data is also at risk of printing higher numbers towards the end of 2020. Following the breakdown in the EUR/CHF below its resistance zone located between 1.0821 and 1.0849, as marked by the red rectangle, a more massive correction is likely to materialize.

Due to the ongoing negative economic impacts of the Covid-19 pandemic, the Swiss government asked for an additional CHF770 million. It comes after the CHF30.8 billion in bailout funds approved by the Federal Council since March. The government also underwrites CHF42 billion of loans to struggling companies. Thirteen areas were outlined to receive the fresh round of stimuli, including the railway system and air traffic control. With the EUR/CHF well-positioned to move below its ascending 38.2 Fibonacci Retracement Fan Support Level, a sell-off into its support zone, located between 1.0603 and 1.0638, as identified by the grey rectangle, is anticipated.

EUR/CHF Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 1.0765

- Take Profit @ 1.0600

- Stop Loss @ 1.0805

- Downside Potential: 165 pips

- Upside Risk: 40 pips

- Risk/Reward Ratio: 4.13

Should the Force Index push through its descending resistance level, the EUR/CHF may retrace its most recent breakdown. Forex traders should consider any advance from present levels as an excellent selling opportunity amid the rising safe-haven demand for the Swiss Franc, particularly with the COvid-19 pandemic likely to intensify over the coming weeks. The upside potential is limited to its intra-day high of 1.0914.

EUR/CHF Technical Trading Set-Up - Limited Reversal Scenario

- Long Entry @ 1.0840

- Take Profit @ 1.0910

- Stop Loss @ 1.0805

- Upside Potential: 70 pips

- Downside Risk: 35 pips

- Risk/Reward Ratio: 2.00