The positive results of the economic releases received from the Eurozone continue to stimulate the EUR/USD price to hold onto its gains around and above the 1.1800 resistance, which supports stronger control of the bulls and paves the way for a test of the 1.2000 psychological resistance. Corrections at the beginning of this week's trading did not exceed the 1.1695 support and are now settling around the 1.1800 level. The US currency is negatively affected by the lack of agreement on new stimulus plans to revive the US economy, with the country leading the figures for cases and deaths from the Coronavirus. As talks between Democrats and Republicans stalled over the upcoming relief package, house speaker Nancy Pelosi does not expect progress this week, and White House Chief of Staff Mark Meadows - the Financial Falcon - opposes spending over a trillion dollars.

Federal unemployment benefits of $600/week expired in the past week and may already have led to lower consumption. Calculations show that this increase equals more than 5% of US disposable income. The longer the stalemate, the more damage will be done to the US economy, which could prompt the Fed to act. Currently, US central bank officials are reluctant to act in place of the government. In this regard, Charles Evans, head of the Federal Reserve Bank's Chicago branch, said the ball is now in Congress’s court. However, the pressure may increase to add more monetary stimulus - such as pushing the yield curve down. Lower yields on US debt, in turn, could put pressure on the US dollar as was the case not so long ago.

Another factor weighing on the dollar is the data - while the ISM manufacturing PMI exceeded expectations by 54.2 in July, the employment component remained well below 50 - indicating further stimulus in the industrial sector. Factory orders numbers for June declined but was better than expected, and the greatest attention will be to US jobs’ numbers, which will be announced on Friday.

The good news from the US is that COVID-19 virus statistics are lower, however, this was likely due to the weekend effect. Tuesday's figures may continue to show the stability of the cases curve, but mortality is expected to rise above 1,000 again.

On the European continent, many countries are witnessing an outbreak, but the situation appears to be under control. The largest number of new cases per 100,000 cases was in Spain. In terms of employment, the number of unemployed fell unexpectedly by nearly 90,000 in the fourth-largest economy in the Eurozone in July.

All in all, the dollar has grounds for a pullback while Euro bulls seem to have no cause for concern.

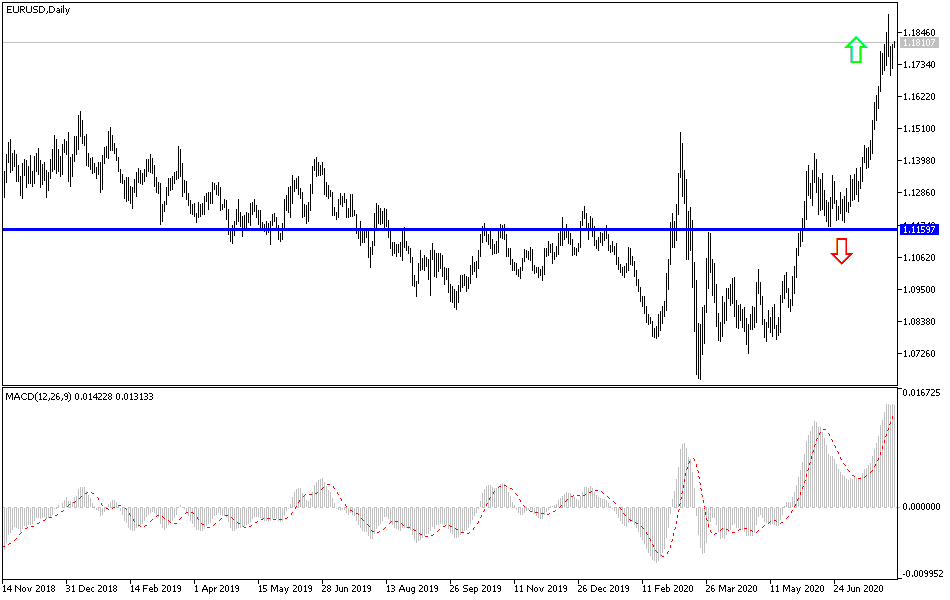

According to the technical analysis of the pair: the EUR/USD is still moving within its bullish channel, and the latest move was not affected by reversal attempts, and this will not happen without the pair moving towards the 1.1588 support. As I mentioned before, the 1.1800 resistance will motivate the bulls to push the pair towards the 1.2000 psychological resistance, and beyond if the American job numbers came in less than expected. The Euro awaits the announcement of the services sector PMI reading and then the Eurozone retail sales figures. From the United States of America, the ADP survey will be announced to measure the change in US employment in the non-agricultural sector, and then the ISM PMI for the services sector will be released.