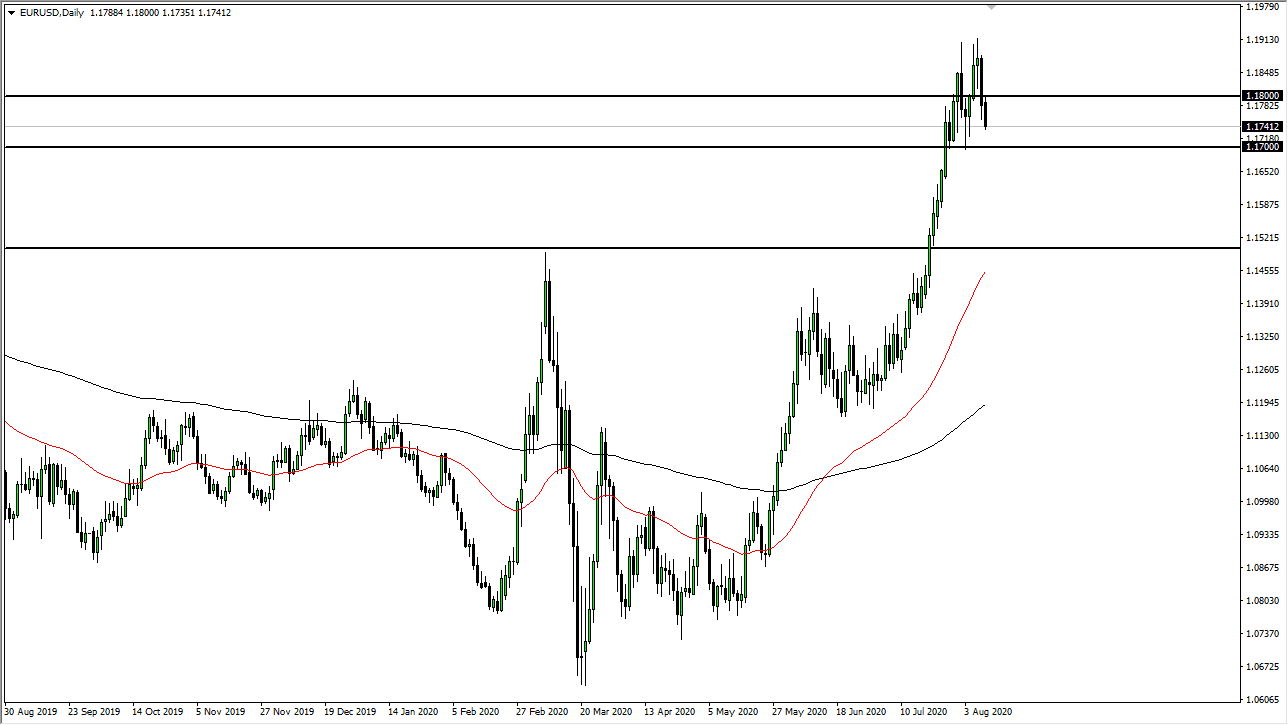

The Euro has fallen a bit during the trading session on Monday, reaching down toward support underneath. The 1.17 level underneath will be massive support so at this point in time I think we are going to bounce around and try to find some type of footing. If we break down below the 1.17 level, then we could go lower, but at this point in time, I think we are more likely to see choppiness more than anything else.

If we do break down below the 1.17 level, then it is likely that we go down to the 1.15 level after that. That is an area that is massive support that I think will come into play as not only does the 50 day EMA sits just below there, but it is also an area where we had previously seen plenty of selling so now it makes quite a bit of sense that we would see plenty of “market memory” in that area. I am waiting to see some type of bounce or supportive candle in order to go long but it looks like we might be taking a bit of a breather at this point.

Going forward I anticipate that this market will reach towards 1.20 level, but we have some work to do to get there. After all we have to digest all of those massive gains that we recently had, as the market had gotten far too ahead of itself. The one thing I want is to sell this pair unless the Federal Reserve changes its tune, something that I highly doubt it is going to do any time soon. The candlestick is ugly, but we are sitting above support so that probably comes into play in its own right.

Longer-term, I believe that we probably go as high as the 1.25 level, but that is probably going to take some time to get hit. Buying dips continues to work and even though we have seen a significant pullback during the day on Monday, I do not think that in the end, it will last too long. After all, these types of impulsive move certainly mean that the trend has changed, although it does not necessarily have to keep moving at the ferocity that we had seen recently. I believe at this point in time it is likely that we will continue that “buy on the dips” mentality.