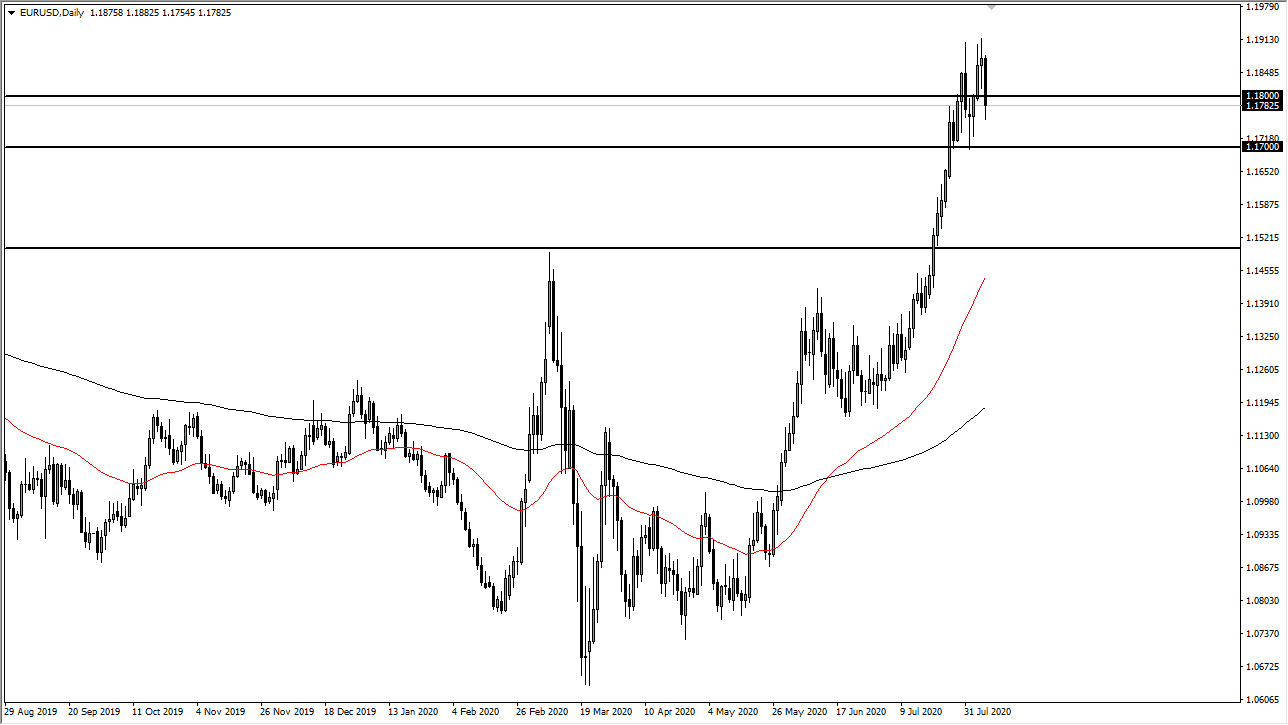

The Euro has broken down significantly during the trading session on Friday after the Non-Farm Payroll number came out. That being said, this is a market that is a bit overbought so it should not be too surprising at all to see that we need to take a bit of a break. The 1.17 level underneath should be massively supportive, and therefore I think it is only a matter of time before we could have a bit of value hunting. The 1.17 level could break down, if we do break down below there will become even more interest in the Euro down near the 1.15 level. Ultimately, I think the buyers will return sooner or later and I will be watching daily candlestick’s on the way down there in order to take advantage of value.

The size of the candlestick on Friday was very negative, so it makes sense that we will see a little bit of a follow-through early in the week. Ultimately though, the Euro will continue to gain based upon the misfortune of the US dollar due to the Federal Reserve printing greenbacks as quickly as they can. With that being the case, the market is likely to see a lot of volatility, and perhaps short-term negativity. However, short-term negativity should continue to find buyers underneath as the market is trying to figure out what to do long term. I believe that the trend has changed to the outside and this type of noisy trading is quite common when you have a bottoming pattern.

To the upside, I believe that we will go looking towards 1.20 level, possibly even the 1.25 level given enough time. However, that does not mean that we need to go straight up in the air. Ultimately, we will need to find momentum, and that means more buyers. Pain for the Euro up here is “chasing the trade”, which is the worst way possible to trade as it leads to losses. Quite frankly, the risk to reward ratio gets much better on the occasional pullback. Longer-term, it is obvious that the Federal Reserve is the only thing that matters, so pay attention to what they are doing but right now what they are doing is devaluing the greenback. Economic growth is starting to be seen in the European Union much quicker than the United States, so that has an effect as well.