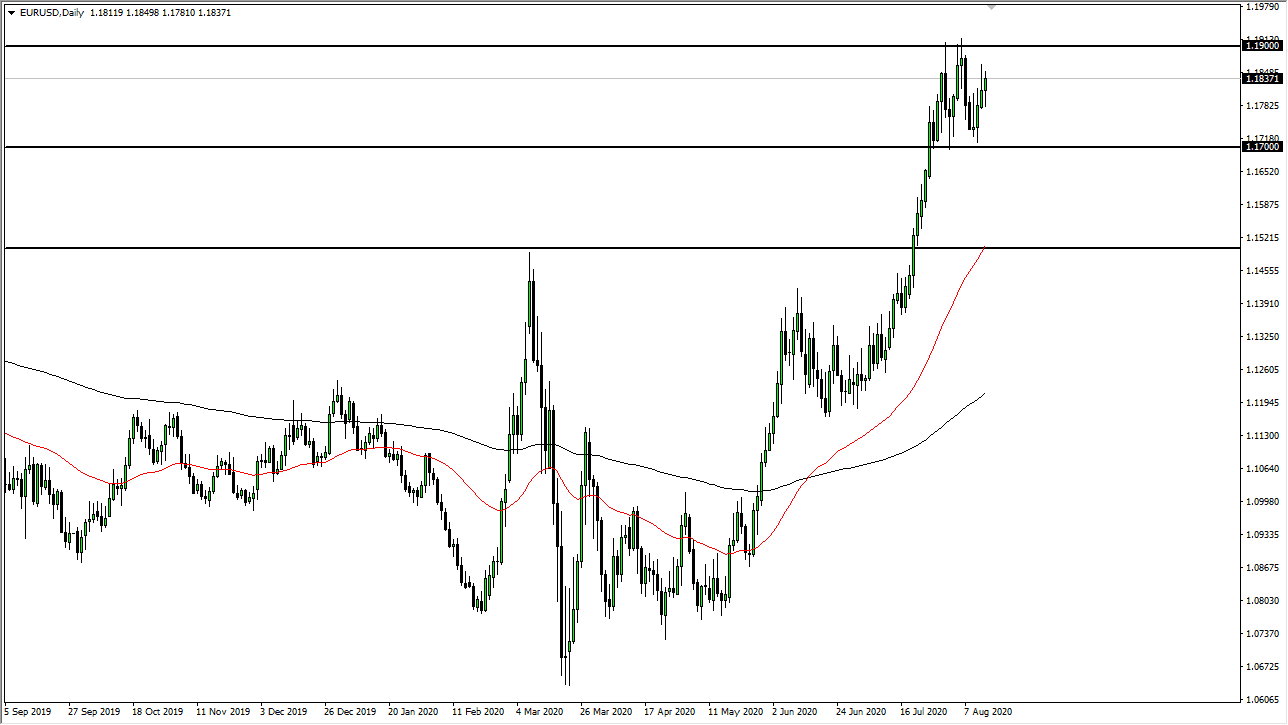

The Euro pulled back a bit during the trading session on Friday but has recovered quite nicely to form a green candlestick. That being said though, the market is currently going back and forth between the 1.19 level above and the 1.17 level underneath. Longer-term, I think that we break out but there are multiple levels that we need to pay attention to.

If we break down below the 1.17 level, it is likely that we would drop towards the 1.15 handle. That was previously resistance and it is a large, round, psychologically significant figure. Because of this, it is likely that the markets will find it as being extremely supportive. Furthermore, we also have the 50 day EMA at the 1.15 handle, so at this point in time, it is likely that the area would serve as a massive “floor” in the uptrend. The Euro is benefiting from the Federal Reserve flooding the market with the US dollar, so therefore it should bring down the value of the greenback. Having said that, the market has come too far in too short of a timeframe to continue this type of momentum. With that being the case, we could get that pullback but think of it as value.

The other scenario would be that we simply go sideways for some time to digest some of the gains as we may have gotten a bit overdone. Going sideways, traders can get to the idea of the Euro being at this high level, and therefore think it is only a matter of time before we will break out to the upside if we go sideways as well. Once we do, the 1.20 level will be a target and the 1.25 level after that. I do not have any interest in selling this pair, regardless of whether or not we see some type of breakdown. I think that if you look for value, you can probably continue to trade this market to the upside. I do not have any interest in trying to second-guess the market because the Federal Reserve has already been quoted as stating “We are not thinking about tightening monetary policy.” Follow the trend, it’s the only thing you can do and clearly it looks as if the trend has changed, perhaps opening up a longer-term scenario to the upside.