Bitcoin/USD: Cautious stability.

Today’s BTC/USD Signals

- Risk 0.50% per trade.

- Trades may only be entered prior to 5 pm Tokyo today.

Long Trade Ideas

- Long entry after a bullish price action reversal on the H1 time frame following the next touch of $12150 or $12500.

- Place the stop loss $50 below the local swing low.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

Short Trade Ideas

- Short entry at the next touch of $11,100.

- Place the stop loss $50 above the local swing high.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

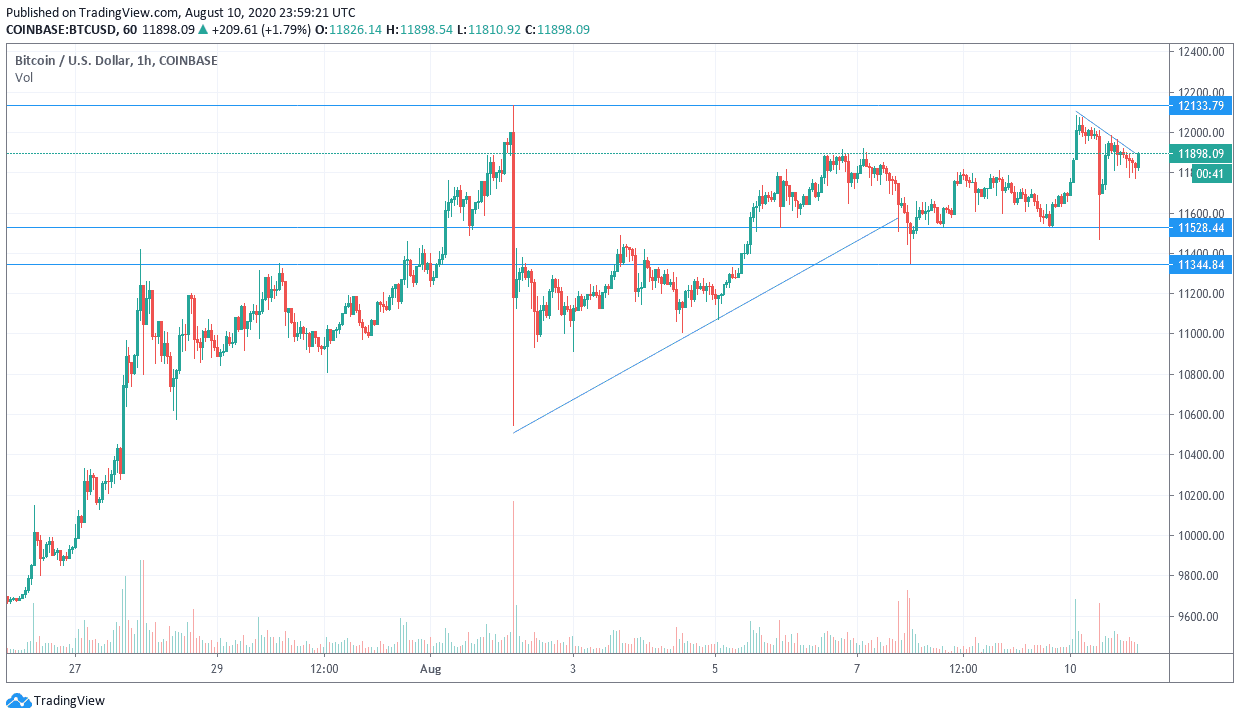

Bitcoin/USD Analysis

As I mentioned in yesterday's analysis, the BTC/USD pair is incapable of continuing the bullish correction, which headed towards the $12,000 resistance. Accordingly, the price of Bitcoin (BTC/USD) had a bearish correction in the afternoon yesterday after the world's largest digital currency moved above $12000 in the same trading session. The bulls failed on the upward momentum, however, and the rapid rebound from the intraday support indicates that the uptrend remains intact. Bitcoin transaction fees appear to have fallen by 58% last week as the market appears to have returned to less insane levels of activity. Data from the Blockchain.com website shows that the per-transaction fee has dropped to $2.72.

The pair's correction reached the 200-DMA which is just above $11,500. However, buyers were able to react once again and bring back price action over two important technical indicators. A convergence of support/resistance levels around $11700 cannot put a cap to bullish move, thus, as long as price action is trading above this area - bitcoin will be bullish in the short term. One of the main characteristics of a strong uptrend is the ability to bounce back from failures.

However, buyers should be concerned that bitcoin buyers have failed to maintain the uptrend above $12,000, due to nearly identical swing highs above $12,000, this position could easily turn into a double top reversal pattern. This would be very bearish for the Bitcoin price as it would open the door for a return to the $9000 support.

Chinese stocks saw a big drop after investors evaluated the recent US sanctions targeting China. Meanwhile, in the US, Morgan Stanley issued a warning about an "explosion of inflation". As the situation continues to evolve, many are looking again at the idea that BTC is a safer asset that is more practical and easier to use than gold itself.

At the time of writing, Bitcoin's price is steady at $11,850, after rising 2.48% in the past 24 hours. Although this is not the biggest growth that BTC has witnessed in the recent period, it may be that all the world's first cryptocurrency needs is to reach $12,000 and breach it for the first time since June 2019. If this happens, the currency can remain higher than $12,000, and may continue to rise, however, experts believe another resistance will await at $12,350.

Regarding the US dollar, PPI reading will be announced.