Bitcoin/USD Daily outlook: Greatly Benefiting from Decline of the US dollar

Today’s BTC/USD Signals

- Risk 0.50% per trade.

- Trades may only be entered prior to 5 pm Tokyo today.

Long Trade Ideas

- Long entry after a bullish price action reversal on the H1 time frame following the next touch of $10170 or $9700.

- Place the stop loss $50 below the local swing low.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

Short Trade Ideas

- Short entry at the next touch of $13,000.

- Place the stop loss $50 above the local swing high.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

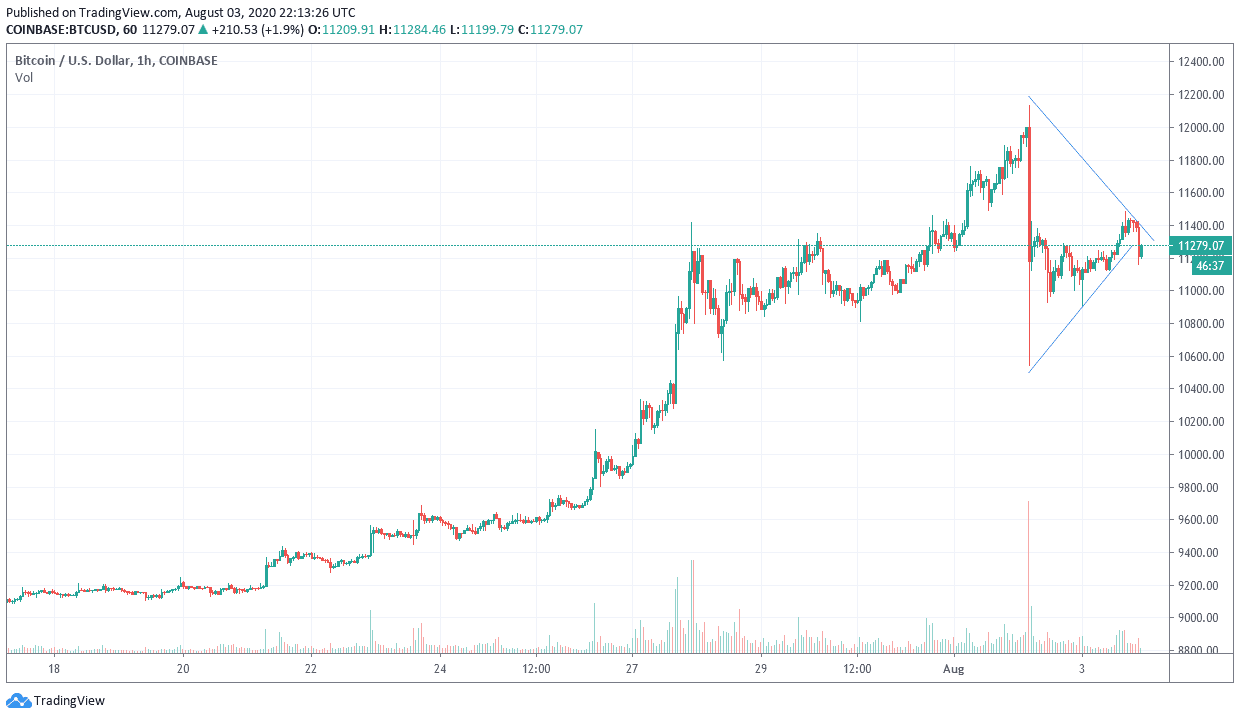

Bitcoin/USD Analysis

The price of the BTC/USD pair continues to benefit greatly from the decline of the US dollar, despite its decline to $11150 at the time of writing. The upside path remains intact, and as I mentioned yesterday, the stability of the pair above the $10,000 psychological resistance will continue to support the bullish trend. The market value of the world's first cryptocurrency, the Bitcoin, is stable around 206 billion dollars. The $9000 support may be of particular importance to digital currency traders because it is a psychological level. As with both stocks and cryptocurrencies, integers like $5,000, $9,000, $10,000, $20,000, etc. are levels that attract buyers and sellers.

Going back to 2017, it can be seen that the $9000 level was first achieved on November 26, 2017, and this level was tested by two candles on the daily chart, however, there was no noise of any kind. Regardless, the importance of this level was noticed during the possible drop in Bitcoin price as bears took control. Between February 1 and May 11, Bitcoin competed at the $9,000 level 42 times. In the event that the bulls fail to take advantage of the decline in the US currency, the BTC/USD is expected to drop to the $9000 support before starting the second wave of the sharp rise.

From July 22 to the present day, the price of Bitcoin increased by more than 20 percent. Analysts believe that the dollar fell against other currencies due to the slowdown in the US economy as the United States has the largest number of coronavirus cases, causing a sharp and record slowdown in economic growth.

Regarding the US dollar, ISM services PMI, ADP survey numbers for jobs in the non-agricultural sector, and trade balance data will be announced.