BTC/USD: Waiting for a bearish correction

Today’s BTC/USD Signals

- Risk 0.50% per trade.

- Trades may only be entered prior to 5 pm Tokyo time Friday.

Long Trade Ideas

- Long entry after a bullish price action reversal on the H1 time frame following the next touch of $10,800, $10,200, $9700.

- Place the stop loss $50 below the local swing low.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

Short Trade Ideas

- Short entry at the next touch of $13,100.

- Place the stop loss $50 above the local swing high.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

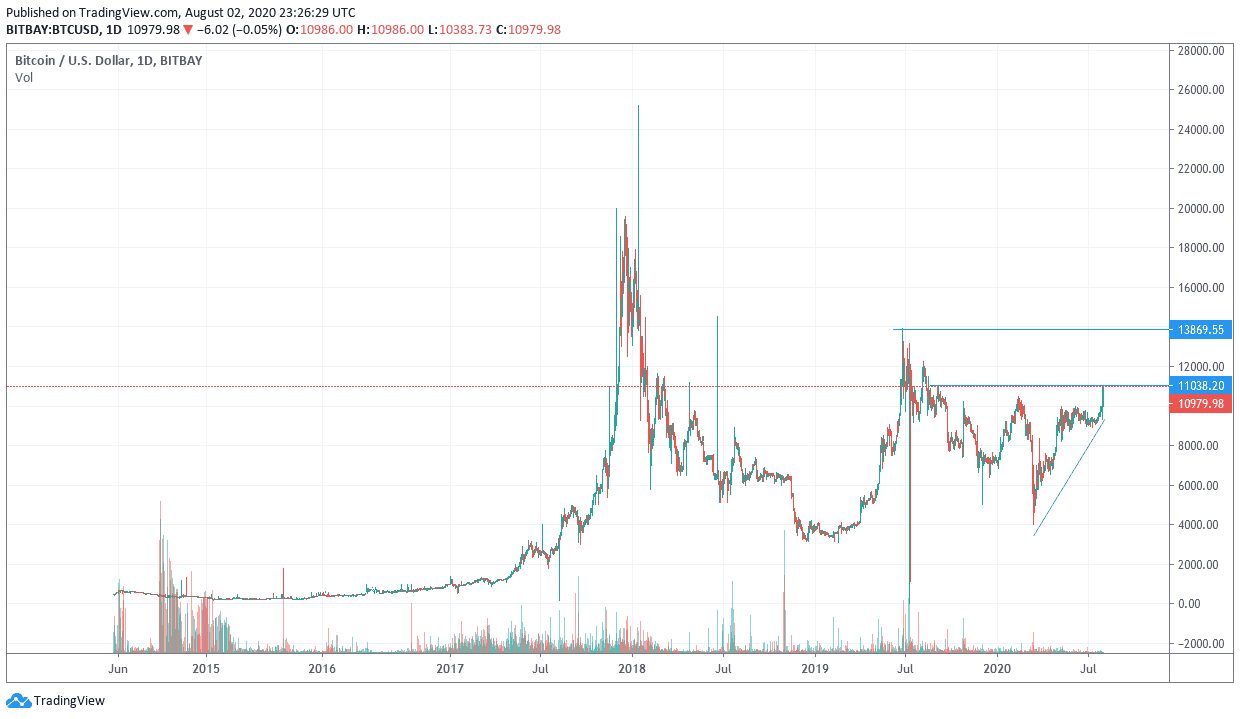

BTC/USD Analysis

Investors increased the purchase of cryptocurrencies led by Bitcoin, as they abandoned the US dollar as a safe-haven currency, while the US continues to lead the global numbers of coronavirus cases and deaths, which motivated investors to buy stronger assets with a prospect such as Bitcoin, gold, and others.

The general trend of the BTC/USD remains bullish as the performance continues above the $10,000 psychological resistance. It must be emphasized that the US dollar losses will not last long. Accordingly, gains will continue to be a selling target to take profits at any time.

As for the US dollar, the ISM Manufacturing PMI and construction spending data will be announced.