AUD/USD: Gains will continue to be threatened

Today’s AUD/USD Signals

- Risk 0.75%.

- Trades must be entered from 8 am New York time to 5 pm Tokyo time today.

Long Trade Ideas

- Long entry following bullish price action on the H1 time frame immediately upon the next touch of 0.7070 or 0.6980.

- Place the stop loss 1 pip below the lowest recent price.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade Ideas

- Short entry following bearish price action on the H1 time frame immediately upon the next touch of 0.7180 or 0.7275.

- Place the stop loss 1 pip above the highest recent price.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

The Australian dollar has been one of the most profitable currencies in the Forex currency trading during 2020, the year that saw a global pandemic that destabilized global financial markets. The AUD/USD pair was on an upward path, having achieved 15.5% gains since April 1, and to be fair, much of the pair's gains are due to the weakening of the US currency rather than the investors falling in love with the Australian dollar - the risk currency - in a time that the Covid-19 virus suffocated global economic activity, as the strong US economy was severely hit, as many US states were unable to ease the tightening restrictions to contain the spread of the virus.

This pandemic has caused tensions between the United States of America and China to widen, and the latter is important for the future of the Australian economy and its currency.

The month of July was the fourth consecutive monthly rise in the Australian dollar, as it appreciated by 16.5%. It is now 1.75% higher for the year. In contrast, the outbreak of the COVID-19 virus in Victoria providence underscores the need for more government support, and accordingly, it is expected that the deficit for the current fiscal year will be about 10% of GDP. The government will also extend loan guarantees to small businesses and extend job search and maintenance programs that would initially have ended at the end of this quarter. Accordingly, the Australian Central Bank can increase bond purchases if necessary.

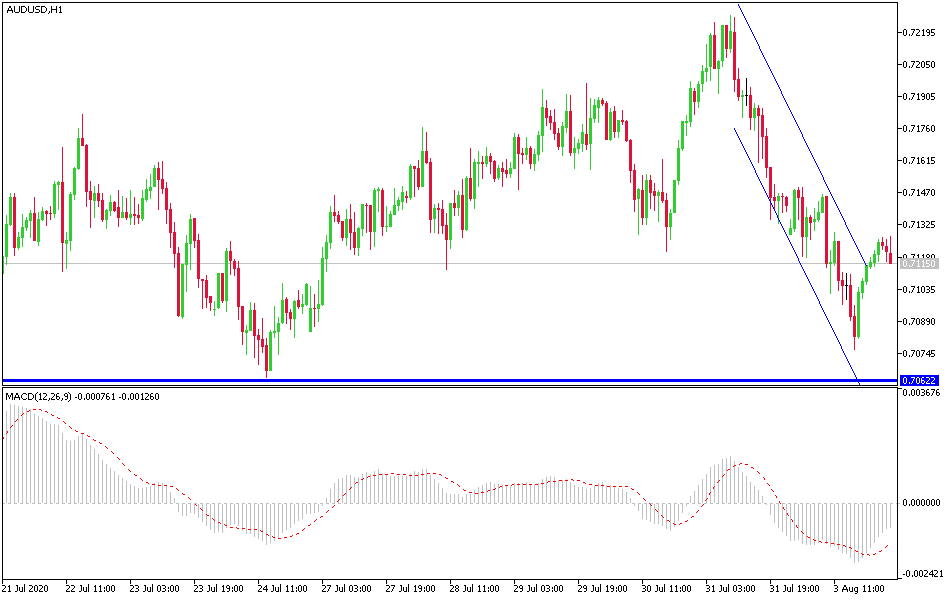

After several attempts for the AUD/USD to push above the important resistance at 0.7200, bulls succeeded in going up before the end of the week by breaking up to the 0.7227 resistance, but they quickly exhausted their strength and noted this by the arrival of technical indicators to overbought areas that will be followed by profit-taking selloffs, and accordingly, the pair was sold down to 0.7076 support before settling around 0.7122 ahead of the Australian Reserve announcement of its monetary policy. The beginning of August trading faces a six-week march of gains, the longest in about two and a half years. Therefore, the correction we expect is likely to extend to the 0.7000- 0.7050 area.

As for the Australian dollar, all focus is on the RBA announcement and the remarks of its Governor. As for the US dollar, US factory order numbers will be released.