AUD/USD Daily outlook: USD uprising and the tensions with China.

Today’s AUD/USD Signals

- Risk 0.75%.

- Trades must be entered from 8 am New York time to 5 pm Tokyo time today.

Long Trade Ideas

- Long entry following bullish price action on the H1 time frame immediately upon the next touch of 0.7180 or 0.7220.

- Place the stop loss 1 pip below the lowest recent price.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade Ideas

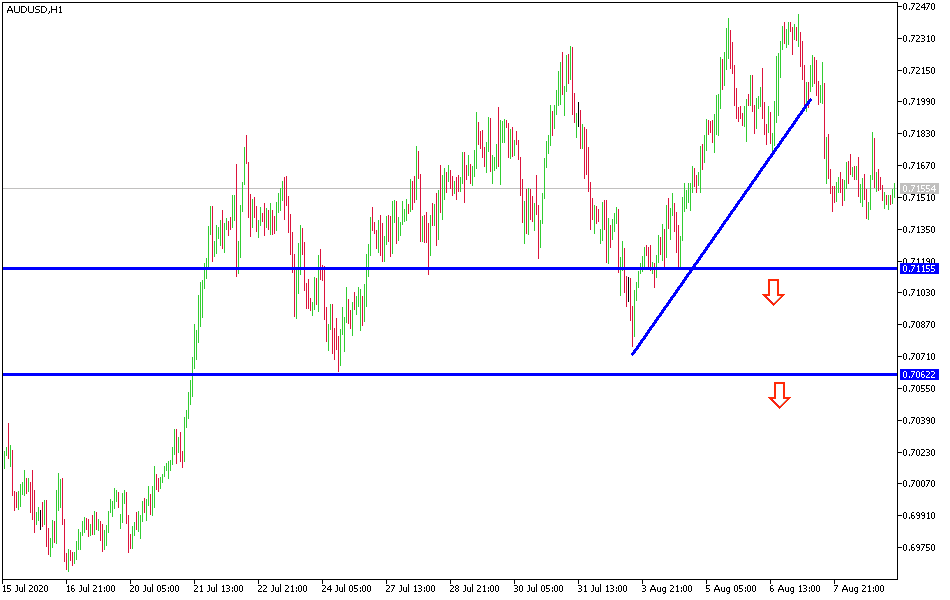

- Short entry following bearish price action on the H1 time frame immediately upon the next touch of 0.7110 or 0.7060.

- Place the stop loss 1 pip above the highest recent price.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

Downward correction moves pushed the AUD/USD to the 0.7140 support. As I mentioned yesterday, the pair's direction is still upward as long as it is stable above the 0.7000 resistance. The US/Chinese tensions returned to pressure the Australian dollar, as China is a strategic partner of Australia. The Reserve Bank of Australia stepped up bond purchases. At its meeting last week, the expected limited rate cut was not implemented. Instead, the bank signaled the resumption of the bond-buying program, which had been suspended over the past three months as the yield control effort to target a 25-basis point yield in 3-year bonds did not call for new purchases.

Last Wednesday and Thursday, the Reserve Bank of Australia bought bonds worth A$500 million, and yesterday bought A$1 billion (targeting maturities from April 2023 to April 2024). The most notable data for the week for Australia is the August 13th jobs report. It is expected to achieve more moderate gain after an increase of nearly 211 thousand jobs in June. The deadly virus outbreak poses negative risks to Australian economic data in general.

China announced that consumer prices for July were at 2.7% year-on-year, which is slightly stronger than expected after rising by 2.5% in June. Floods in China have disrupted supplies, including food, and this appears to be largely responsible for the increase in the core CPI. Pork prices rose 10.3% month over month, for example, the floods curtailed the improvement we've seen recently and left prices up to 86% year over year. Core prices rose 0.5% year-on-year after rising 0.9% in June, which is the lowest level since 2010.

China is practicing reciprocal sanctions with 11 US officials, including two senators (Rubio and Cruz) after the United States imposed sanctions on 11 Hong Kong officials last weekend, including CEO Lam. The United States Secretary of Health and Human Services is the highest-ranking US official to visit Taiwan in nearly three decades. Former Japanese Prime Minister Mori also visited Taiwan at the weekend. These visits can do nothing but provoke China. The United States does not have a joint defense treaty with Taiwan. If Beijing believes that the delicate balance with Taiwan is at stake in the medium or long term, they can make a move.

I am still sticking to selling the AUD/USD as it crossed the 0.7255 resistance level.

Regarding the Australian dollar, NAB consumer confidence survey will be released. For the US dollar PPI will be announced.