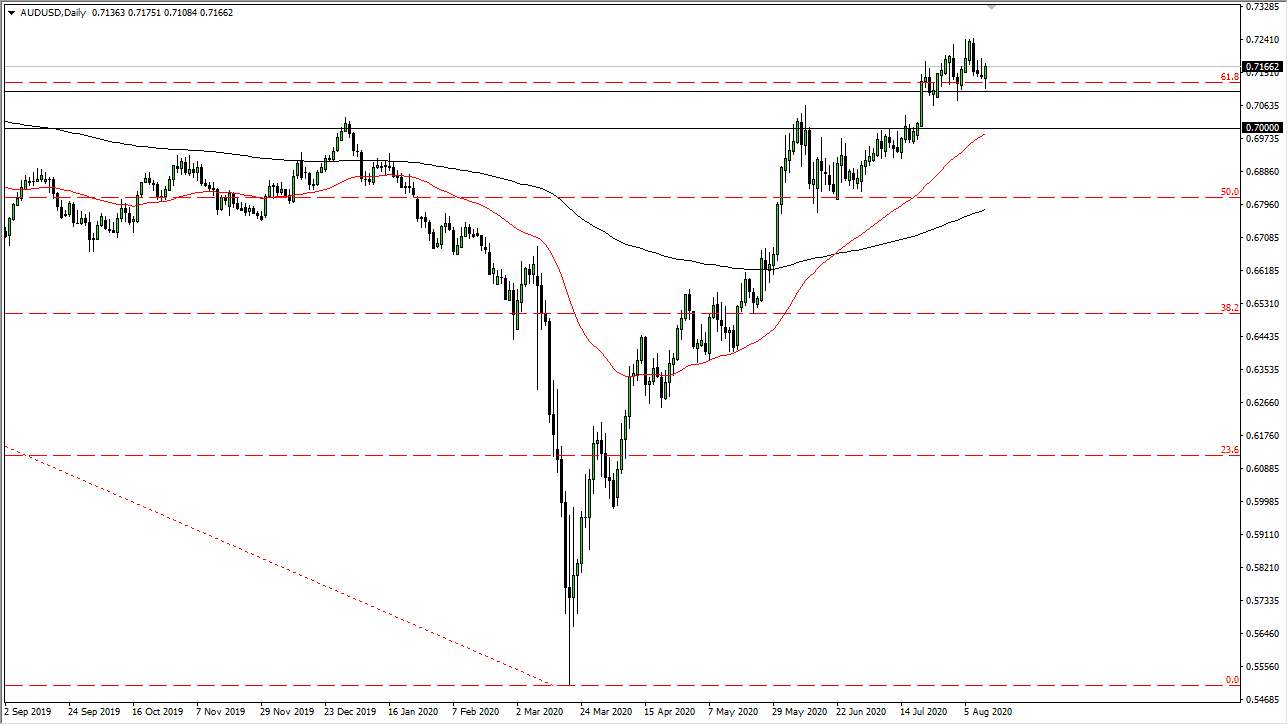

The Australian dollar initially pulled back a bit during the trading session on Wednesday but found enough support near the 0.71 level to turn around and rally quite nicely. That being said, the market looks as if it is ready to go towards the highs again, as the US dollar continues to get hammered. What was truly telling about this pair was that we did not break down significantly while the gold markets fell apart during the same time on Tuesday. The Australian dollar is typically highly correlated to the gold market, so that tells you that perhaps the gold selloff had limited time.

I have believed in buying on the dips for a while now, and I think that the Australian dollar will continue to show itself as being strong. With that being the case, I think that we will not only reach towards the highs, but we may end up breaking out to the upside again. If we do, then I think the Australian dollar is well on its way to breaking towards the 0.73 handle, and then eventually the 0.75 level. After that, and what I believed to be my longer-term target right now we could go looking towards the 0.0 level.

Buying dips has worked so far, and I think it will continue to do so. I recognize that there is a significant amount of support just below the 0.71 level that extends down to the 0.70 level. At this point in time, I think it is only a matter of finding value and taking advantage of it going forward. This is a market that continues to work against the value of the US dollar because regardless of what happens around the world, the Federal Reserve is going to flood the market with US dollars. To quote Jerome Powell, “We are not even thinking about raising rates.” In other words, we probably do not see any type of monetary tightening coming out of the United States for at least a year. Every time the Federal Reserve has tried to tighten monetary policy since the Great Financial Crisis, it ended in disaster. This is more than likely going to be the case going forward as well. The market is going to continue to favor the upside, and when you look at the longer-term charts the Australian dollar is at relatively low levels still, so that helps as well.