The Australian dollar has rallied a bit during the trading session on Thursday but gave back a bit of the gains. At this point, it is a simple matter of whether or not we can build up the necessary momentum to continue going higher. I do believe that happens eventually, and traders started to get a bit excited just ahead of the Jerome Powell speech in Jackson Hole during the day but have backed off again as the market did not get enough dovish attitude to short the US dollar significantly. Granted, we did end up the day being positive, but we also gave back some of the absolute top of the candlestick.

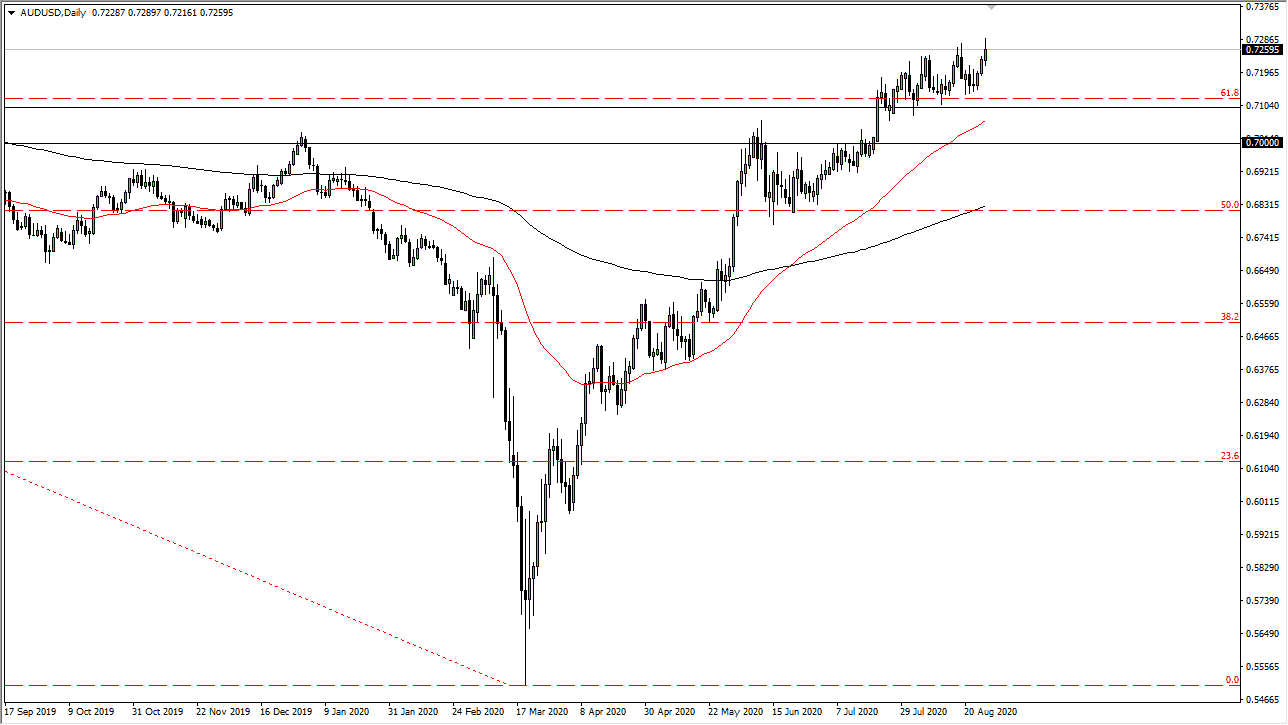

What this tells me is that the market is eventually going to go higher, but there is a bit of a struggle in the meantime. We have been trading in a range for a little while, and it seems as if this up trending channel that we are starting to form will also be important going forward. Furthermore, I believe that the 0.71 level underneath should be massive support, extending down to the 0.70 level. Furthermore, the 50 day EMA is slicing through that 100 point range, so it is yet another reason why the market should continue to see buyers in that area.

The Australian dollar also has significant resistance just above, and we are closing the session near the 0.7250 level, an area that has been a bit of trouble for traders. I think ultimately you are looking for short-term pullbacks to take advantage of, as they offer value in a currency that has been strong for some time. That being said, we may be a little bit overdone so it does make sense that the market may pause in this general vicinity. If it does spend a bunch of time here, then it would help traders get used to the idea of being all the way in this general vicinity. If we can break above the highs of the trading session on Thursday, then I believe that we go looking towards the 0.75 handle, possibly even the 0.80 level over the longer term. Even if we do break down below the 0.70 level, I think that the 200 day EMA which is close to the structurally important 0.68 level will offer massive support. In other words, I have no interest in trying to short this very bullish market.