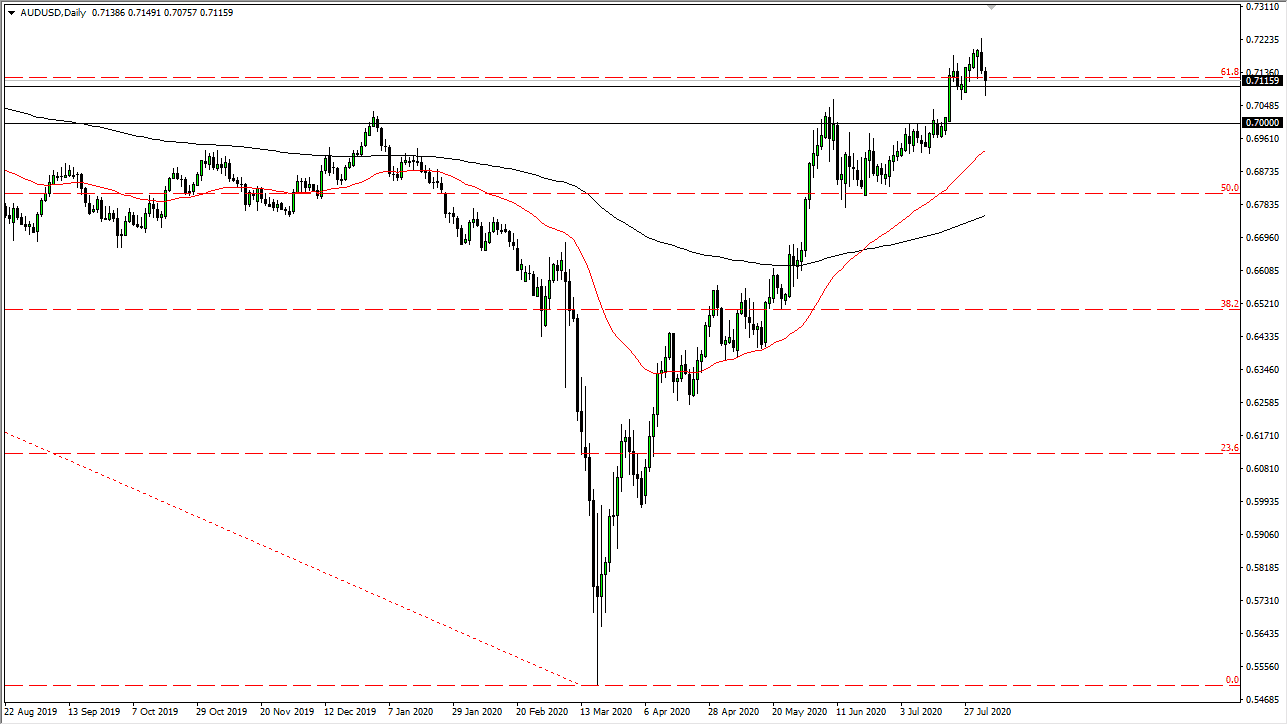

The Australian dollar has pulled back a bit during the trading session on Monday to kick off the week but seems to have plenty of support near the 0.71 level. The 0.71 level begins a significant amount of support underneath that extends down to the 0.70 level. I think that it is only a matter of time before we find buyers that get involved and lift this market. This is an area that I think will continue to be very crucial, so therefore I think that the next couple of days could be rather crucial. The shape of the candlestick is a bit of a hammer, so that is something worth paying attention to as well.

As long as the Federal Reserve continues to work against the value of the US dollar, this pair will continue to go higher. After all, with the Federal Reserve flooding the markets with liquidity, it brings down the value of the US dollar in general. The Australian dollar has been the main beneficiary of this, and unlike a couple of the other major currencies that I follow, it is not as overextended. In other words, I think that the Aussie has a decent shot at rallying from here. With that in mind, the Aussie could very well go looking towards the 0.73 level, perhaps even further than that over the next week or so.

To the downside, even if we were to break down below the 0.70 level, I think there is plenty of support at the 50 day EMA and the 0.68 handle where we see the 200 day EMA racing towards. This is also an area that has been structurally important in the past so do not be overly surprised if it is again. With that, I like the idea of buying dips in the Aussie, as we have most certainly done everything, we can change the overall trend. Trend changes are major events in the Forex market, something that does not happen every day and therefore tends to be very noisy and messy, to say the least. With this, I remain bullish, but I also recognize that it will be choppy at times. Use that choppiness as a way to pick up a bit of value in the Aussie when it dips. Longer-term, I believe we go looking towards the 0.80 level above.