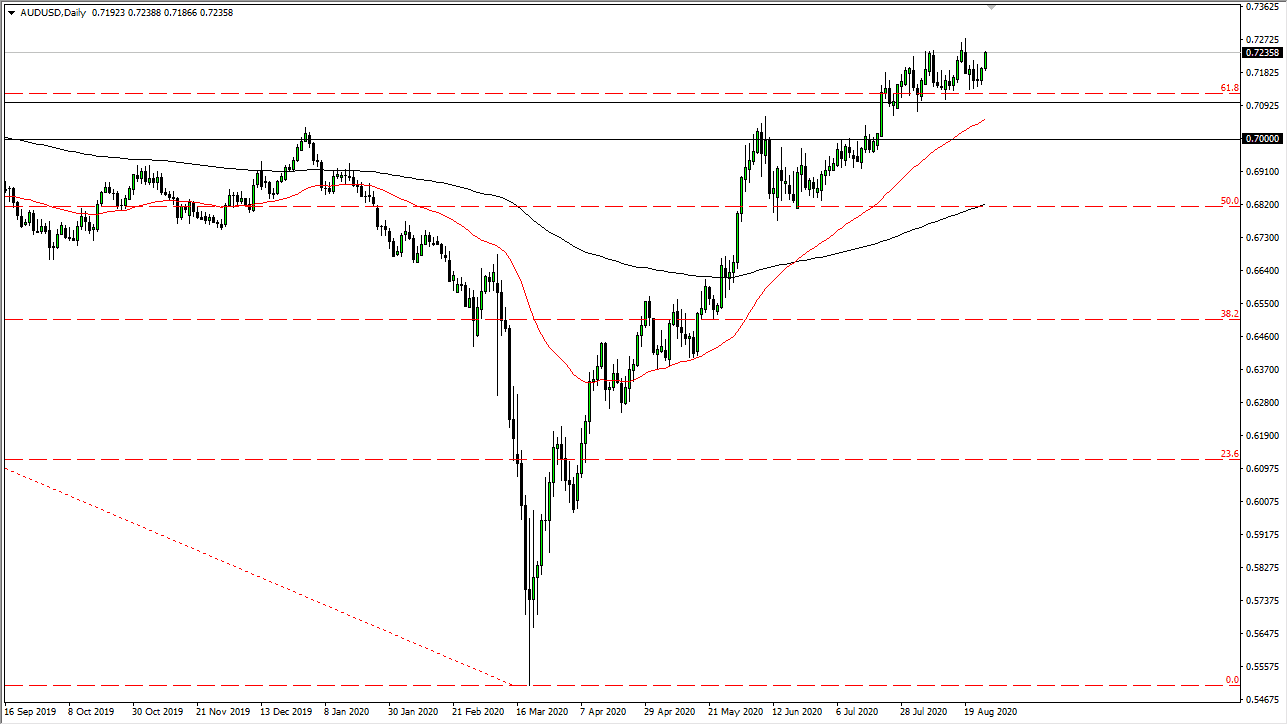

The Australian dollar rallied again during the trading session on Wednesday, as we have pressed the 0.7250 level yet again. Ultimately, this is a market that looks as if it is trying to break out, but there is so much in the way of noise just above it is difficult to simply jump in. Having said that, we have the Federal Reserve Chairman speaking on Thursday at a virtual conference, and that could have people looking towards the US dollar again. If he is overly bearish, then it is likely that we will see some type of move to the upside.

The size of the candle is somewhat impressive considering that we had struggled previously, and if you go back and read my analysis from the previous session, it did suggest that we were going to go higher as we finally broke to the upside and closed at the top of the candlestick. The question now is whether or not we can continue to go higher? I do not know, because I think a lot of this is going to come down to how the market reacts to Chairman Powell. If we do break to a fresh, new high, then we will continue to grind towards the upside.

In the meantime, I do like the idea of buying short-term pullbacks as a potential value play. The Australian dollar seems as if it has much further to go, perhaps as high as the 0.75 handle, maybe even the 0.80 level over the longer term. This is about the Federal Reserve and its willingness to flood the markets with liquidity, so therefore I think it makes quite a bit of sense that we will see this pair react more to the Federal Reserve than anything else right now. With that being the case, I would fully anticipate that we could get a short-term pullback, but certainly Chairman Powell will be watching the US dollar. If he can do something to push risk appetite out there further, he most certainly will. Underneath, the 0.71 level is massive support that should extend all the way down to the 0.70 level. The 50 day EMA slices through that area, so I would anticipate that it should also offer support based upon that as well. I have no interest in shorting this pair, at least not anytime soon.