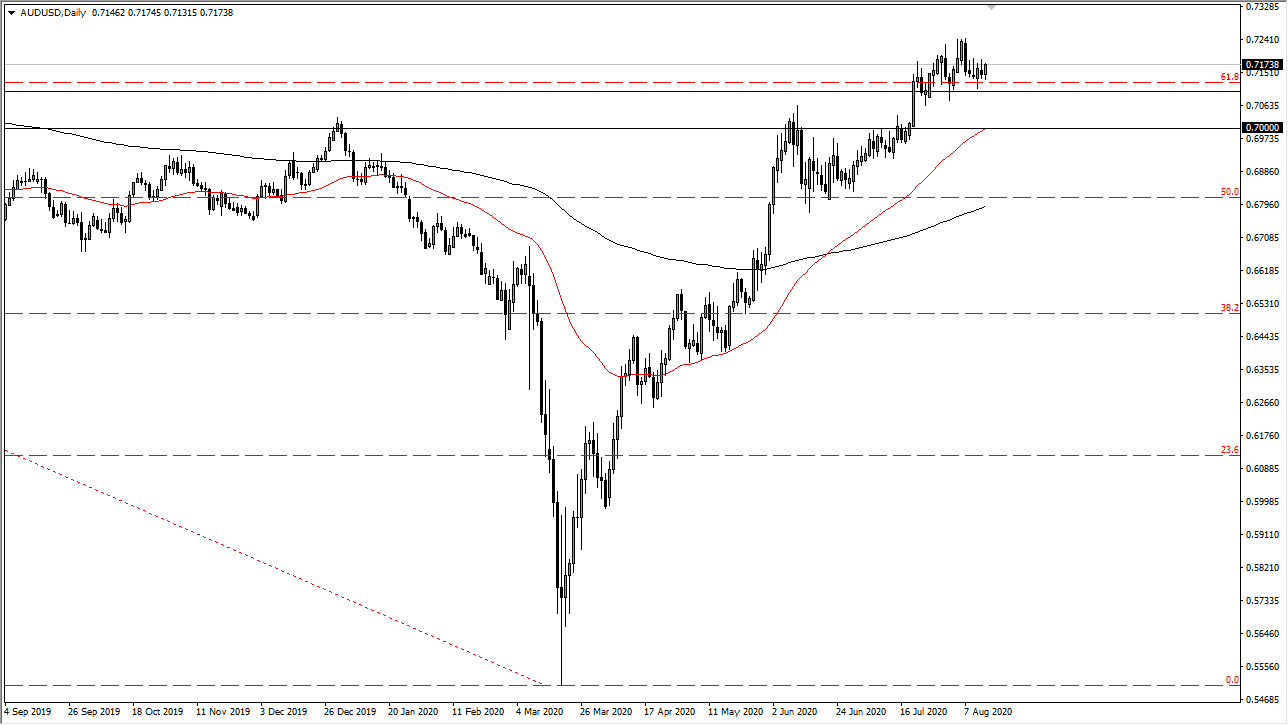

The Australian dollar initially pulled back during the trading session on Friday but continues to find buyers underneath. The 0.71 level has significant support that extends down to the 0.70 level, so I think we will continue to have buyers on dips in this market. To the upside, I believe that the 0.7250 level will continue to be paid attention to as a potential target for short-term traders. On a break above there, then the market is free to continue the overall upward trend that we have been in.

That being said, I do not necessarily think that this market takes off in the short term. The last two weeks of August tend to be very quiet in general as it is the main part of the vacation season for a lot of the world’s largest traders, so at large firms a lot of times you will only have Junior traders amending the desks. Regardless, we are at an inflection point, so it does tend to make the market rather choppy.

Even if we do break down below the 0.71 level, I think there is significant support all the way down to the 0.70 level. There is a huge “zone of support” due to the fact that it was massive resistance previously. Even if we were to break down below there, it is likely that the market goes looking towards the 0.68 level which will also be extraordinarily supported. It is worth noting that the 50 day EMA is sitting right at the 0.70 level, so that lends more credence to that area being important, to begin with.

I do not have any interest in shorting this market, at least not until we break down below the 200 day EMA which is currently at the 0.68 level, an area that I am looking at like the bottom of the overall support. If we were to break down below there, then it obviously would be a major shift in change in general. Because of this, I continue to look at short-term pullbacks as a buying opportunity and I do think that we are more than likely going to go higher, perhaps reaching towards the 0.75 handle, maybe even the 0.80 level above longer term. This is directly influenced by the Federal Reserve flooding the market with US dollars and will continue to react as such given enough time.