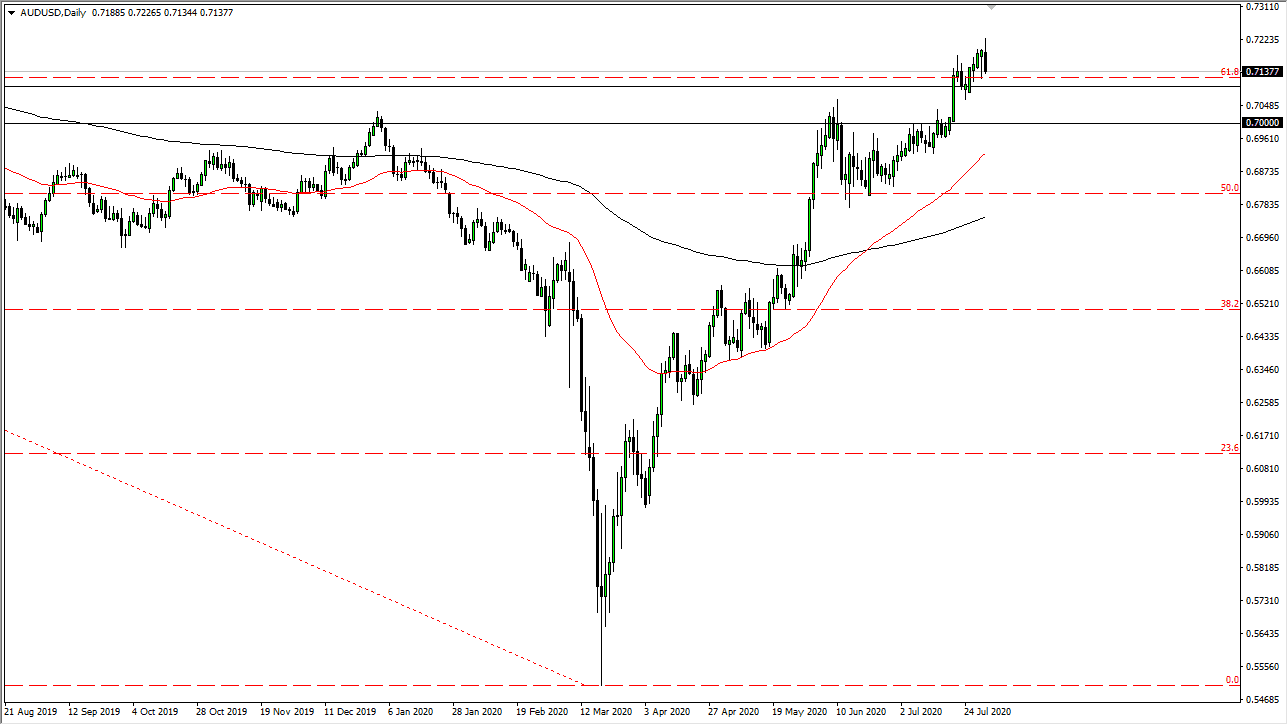

The Australian dollar initially tried to rally again on Friday but gave out the gains as we got a bit overdone. I think a lot of this probably was more or less profit-taking, because so many traders out there make quite a bit of money shorting the US dollar. The 0.71 level is a major level of support, that extends down to the 0.70 level. I anticipate that there is going to be a lot of volatility kicking off the week, but it still looks very much like a market that is trying to pick when it wants to take off.

If we end up below the 0.70 level, then it is likely that the market could go down to the 0.68 handle. That is an area where I would define the overall trend, so as long as we can stay above there it is likely that we will find buyers sooner or later.The Australian dollar is simply benefiting from the Federal Reserve, which of course has been aggressive in its monetary policy will continue to be so, and therefore I like the idea of buying on dips as it offers quite a bit of value. The trend has changed its attitude in general, so I think that continues to be the main story here. However, you cannot simply jump into this marketplace and start buying at these levels.

Longer-term, I think that the market goes looking towards the 0.80 level above, which is a major structural area on the chart, and a large, round, psychologically significant figure. Ultimately, this is a market that has a long way to go to the upside, but we may need to pullback a little bit to collect the necessary momentum to make that happen. I will be a seller of this pair until we break cleanly below the 0.68 handle, something that does not look likely to happen anytime soon. If it does, then we could go looking towards the 0.65 handle underneath, perhaps even lower. In general, this is a market that also is influenced by the US/China trade situation, but that seems to be playing second fiddle to the Federal Reserve, just like it is in many other currency pairs at the moment. Ultimately, I like the idea of this is a longer-term core position, adding slowly as we go along.