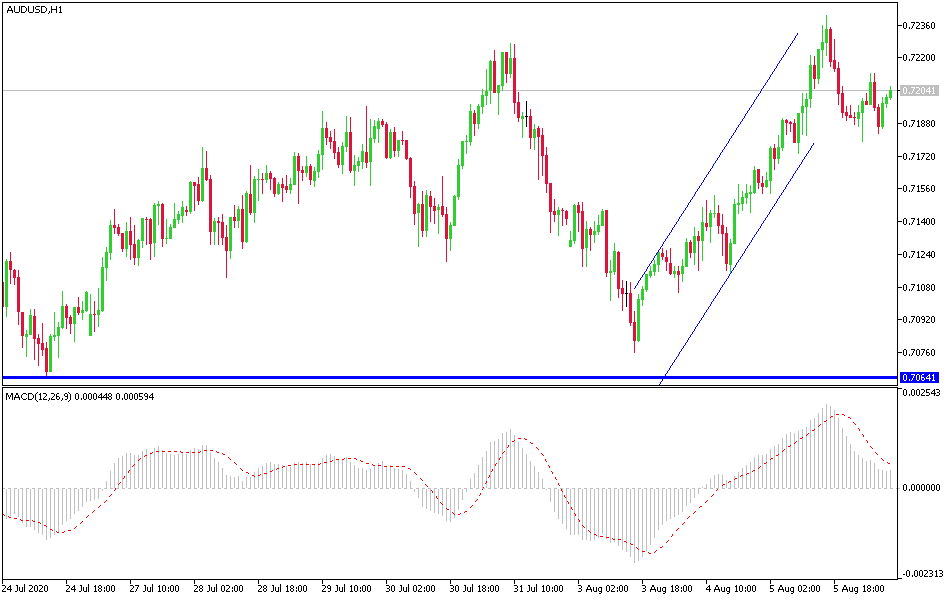

AUD/USD: Temporary pause of the uptrend.

Today’s AUD/USD Signals

- Risk 0.75%.

- Trades must be entered from 8 am New York time to 5 pm Tokyo time today.

Long Trade Ideas

- Long entry following bullish price action on the H1 time frame immediately upon the next touch of 0.7155 or 0.7090.

- Place the stop loss 1 pip below the lowest recent price.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade Ideas

- Short entry following bearish price action on the H1 time frame immediately upon the next touch of 0.7330 or 0.7255.

- Place the stop loss 1 pip above the highest recent price.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

As I mentioned yesterday, the AUD/USD pair completely ignored the dispute between the United States and China, with the latter being an important and strategic partner of Australia. The pair tested the 0.7240 resistance, its highest level in months, before settling around 0.7210 now. The gains in the pair came from the support of the US dollar, as the DXY index hit its lowest level in two years. Final survey data from IHS Markit showed that Australian service sector activity gained momentum in July as the economy gradually reopened after the COVID-19 outbreak was contained. The Services PMI rose to a reading of 58.2 in July from 53.1 in June. This was the highest reading for the index since April 2017. A reading above the 50 level indicates growth.

Demand increased further, which contributed to another accumulation in backlogs. The companies remained optimistic about the outlook for next year. While some companies are still reducing staff numbers, the decrease in overall employment has been marginal. Meanwhile, input costs rose again, but fees fell. The final composite output index - which includes the manufacturing and services sectors together - rose to 57.8 in July from 52.7, indicating the fastest rise in private sector business activity in more than three years.

On the other hand, China's services sector continued to grow in July, albeit at a slower pace, according to the latest Caixin PMI survey with a score of 54.1, which was lower than the 10-year high of 58.4 in June, although it is still above the breakeven line at 50 that separates growth from contraction. The latest data indicated slight pressures in capacity, as backlog increased for the second month in a row. Committee members linked growth to recent gains in upcoming new work. The Composite PMI came in at 54.5, down from 55.7 in the previous month.

In general, the increasing tensions between the United States and China may negatively affect the Australian dollar's long-term gains.

I am still sticking to selling the AUD/USD as it crossed the 0.7255 resistance level.

Regarding the Australian dollar, no economic releases are expected from Australia today. For the US dollar, unemployed claims will be announced.