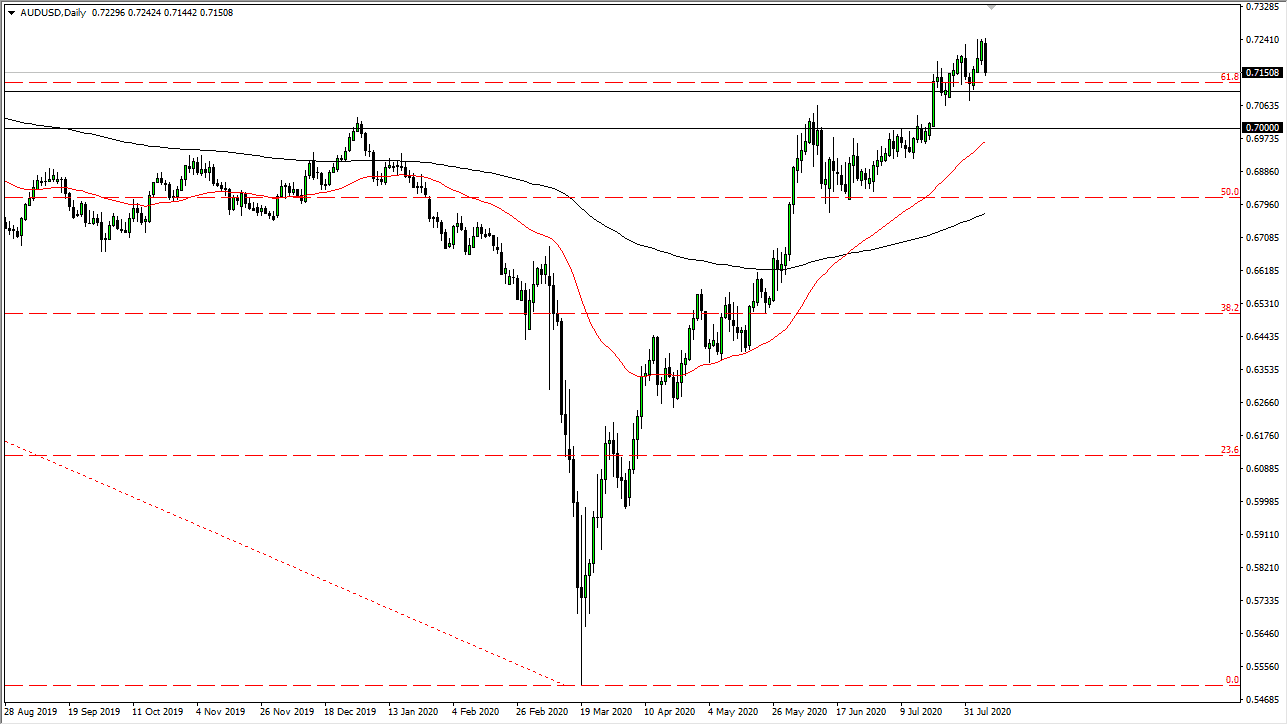

The Australian dollar has had a rough trading session on Friday, giving back the gains after the Non-Farm Payroll announcement came out. That being said, the market is likely to continue finding buyers underneath, so I am simply going to kill a little bit of time here and wait for the value to appear. The 0.71 level is the beginning of significant support that extends down to the 0.70 level. I do not have any interest in shorting this market, and I recognize that sooner or later we will get some type of value that we can take advantage of.

Even if we were to break down below the 0.70 level, something that I highly doubt happens, there is still another major area of support at the 0.68 handle. In fact, it is not until we break down below there that I would be concerned about the Australian dollar. We had covered a lot of real estate and in a relatively short amount of time so it does make a certain amount of sense that we would have to pull back in order to find support. The 50 day EMA sits just below the 0.70 level, which is starting to stretch even higher. Ultimately, I think it is only a matter of time before the buyers get involved and push this market to the upside.

The Australian dollar is getting quite a bit of momentum due to the fact that the US dollar is so weak. However, keep in mind that there are a lot of US/China trade tensions right now, as Donald Trump has upped the ante lately. That could have an effect on the Australian dollar as people start to short all things China-related, so that could continue the downward pressure for a little while. That being said, the Federal Reserve working against the value of the US dollar by liquefying everything will eventually overwhelm everything else. At this point, I think you should look at pullbacks as potential value, and certainly do not need to be fighting the trend anytime soon. Longer-term, I think that the Australian dollar goes looking towards the 0.73 handle, and then eventually the 0.80 level above there as well. However, it is going to take quite some time to get there so that is a longer-term call. In fact, we could be talking about sometime later next year. Nonetheless, the trend is decidedly bullish until we break down below the 0.68 handle.