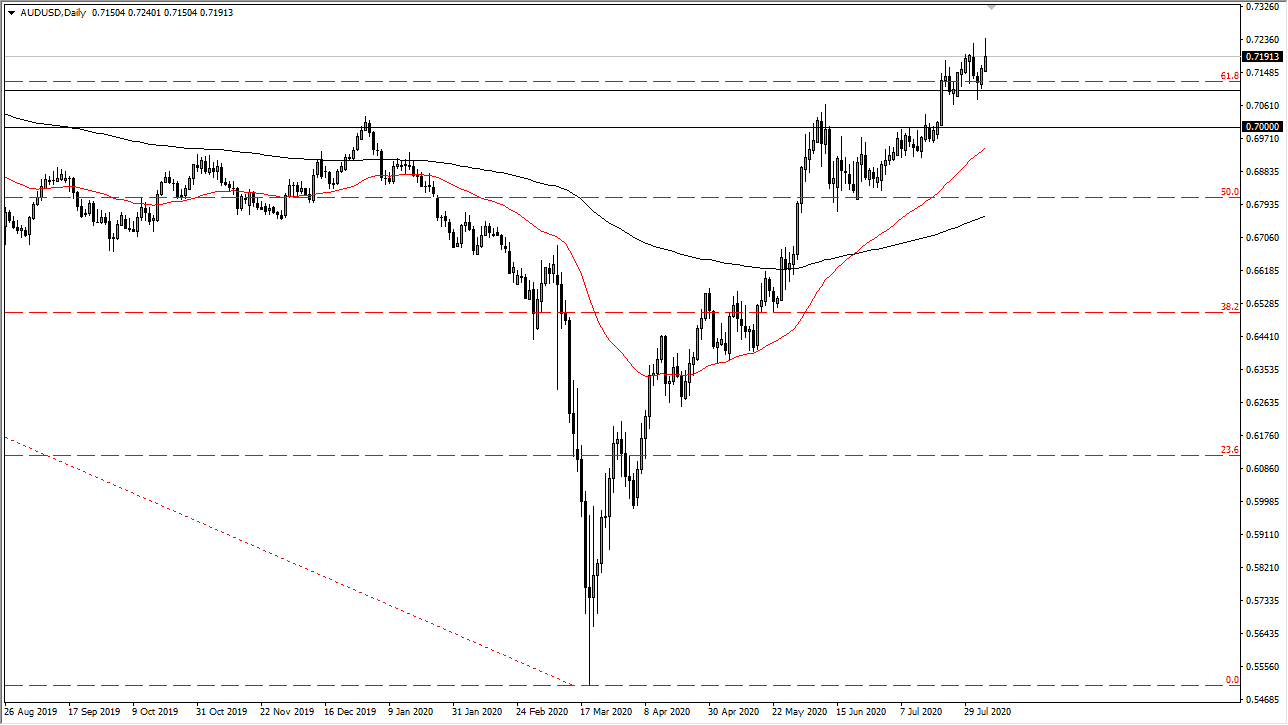

The Australian dollar has rallied during the trading session on Tuesday, breaking to a fresh high again, but gave back the gains towards the end of the session. By doing so, it shows that there is still a desire to go higher, but perhaps the US dollar is a little oversold. I suspect this probably has little do with the Australian dollar, and more to do with that fact overall. The US dollar has been sold off aggressively against pretty much everything out there, including commodities and foreign currency. Markets do not go in one direction forever, and perhaps we are ready to take a short pullback.

As for the Aussie, I see significant support between the 0.71 level underneath and the 0.70 level after that. Because of this, I believe that the market will try to make a bigger move given enough time, and that area should at least in theory hold. If it does not, the next major support level is found near the 0.68 level. With that being the case, I am a buyer of dips and have no interest in shorting this pair. If we break down below the 0.68 handle, then I could rethink the entire situation but right now it is obvious that the Federal Reserve monetary policy continues to work against the value of the greenback.

We are more than likely going to continue to find this market being a “buy on the dips” type of scenario, as the Australian dollar should be a benefactor due to the Federal Reserve's actions. The fact that gold has rallied as the Aussie is quite often used as a proxy for the commodity. If we can get some type of significant growth coming out of China, then that will offer a significant amount of momentum here as well. After all, the Australian economy is highly levered to the Chinese growth situation, as it is a major supplier of hard assets such as iron, aluminum, and copper. If the Chinese economy starts to pick up and it looks like they are going to speed up the manufacturing process, that should help the Aussie in and of itself. All that being in consideration, I still believe that there will be plenty of buying opportunities on this pullback. If we break out above the top of the candlestick for the Tuesday session, then we will march towards the 0.73 level.