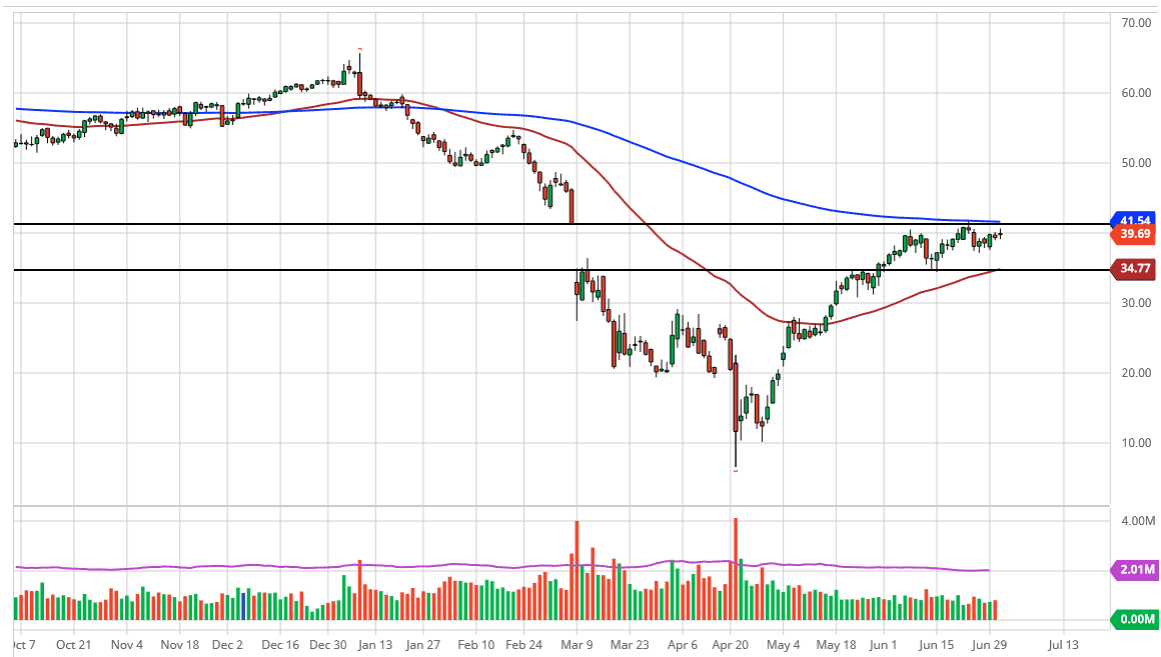

The West Texas Intermediate Crude Oil market has gone back and forth during trading on Wednesday, in a relatively tight range. Ultimately, this is a market that I think is waiting for the jobs figure to come out on Thursday, and as such it could give us an idea as to where demand may be coming from and whether or not we have more or less coming. The crude oil markets are currently trading between the 200 day EMA above and the 50 day EMA below. At this point, the market is likely to continue seeing both buyers and sellers in both directions.

We are also in the middle of the previous gap, so that makes quite a bit of sense that we may slow down at this point. Looking at this chart, it looks as if we are simply going sideways, and it appears that we are stuck between the top of that gap, and the bottom of it as well. Currently, it looks like the $40 level is essentially the beginning of serious resistance. However, if we were to break above the 200 day EMA on a daily close, it is likely that the WTI market could continue to go higher, perhaps reaching into the $49 region.

On the other hand, if we were to continue in this range it is likely that we will probably drop down towards the $35 area, where the 50 day EMA is going to be at. The area is crucial, and therefore I think we will stay in this area until we get some type of certainty as to whether or not we are going higher or lower. Just as the 200 day EMA is broken to the upside would be a buying opportunity, breaking down below the 50 day EMA would be a selling opportunity. Until then, all moves are simply going to be short-term and back and forth more than anything else. With that being the case, I would look for short-term trades until we get some type of daily close above or below these moving averages. Production cuts continue to be held onto stringently by OPEC, but at the end of the day we have to worry about demand as well. If the jobs number comes out relatively strong, then that could be the catalyst for oil to rise. Obviously, the opposite could be true as well.