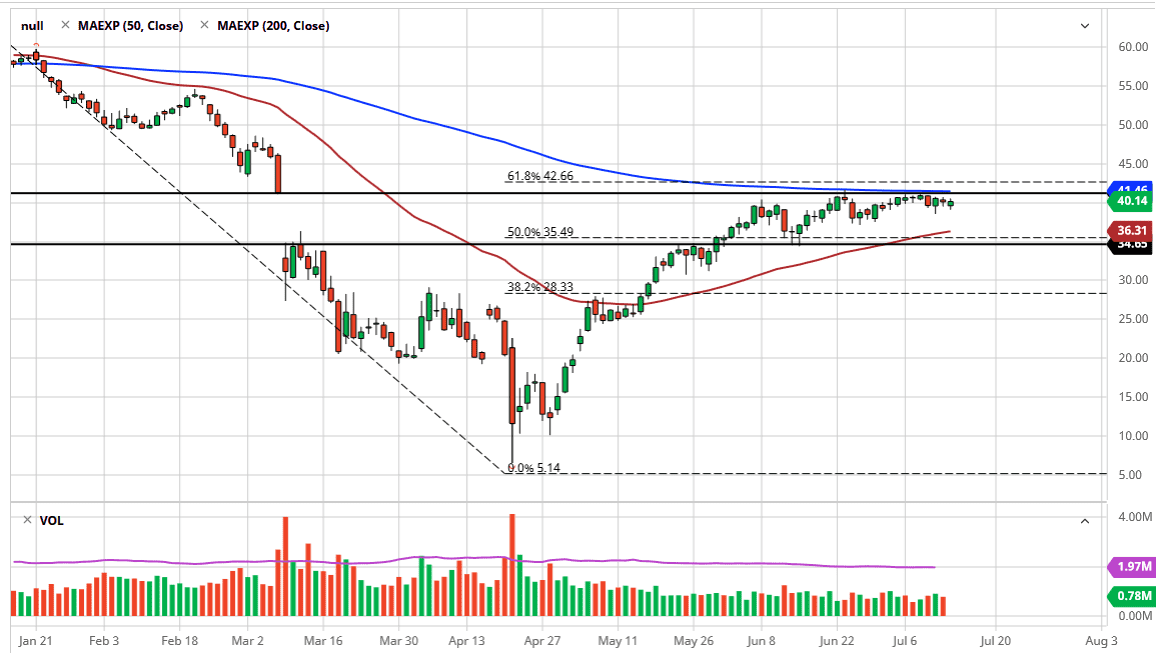

The West Texas Intermediate Crude Oil market initially gapped a bit lower, and then drove down during the Globex session. However, we continue to see a lot of resiliency just underneath so the fact that we are turning around to break above the $40 level makes quite a bit of sense, and therefore I think the buyers continue to jump in to this market and try to finally build up the necessary momentum to break out.

In the area just above, we have the 200 day EMA and the top of the previous gap that has now been filled. The question is whether or not we can break above that gap, because that is an extraordinarily bullish sign. When a gap gets filled and then broken, quite often it means that you are going to have a rather significant continuation. At this point, it is difficult to imagine a scenario where we can simply break to the upside and continue going higher. Furthermore, there is the likelihood of a target of traders would be to see this Hold, and it could send this market down to the 50 day EMA. We obviously have to pay attention to the inventory figures, and unfortunately, the coronavirus figures which seem to be driving most markets.

OPEC has been rather stringent about sticking to the production cuts, so that is something to pay attention to. Having said that, the market is likely to see a lot of choppiness in this general vicinity, as we continue to go back and forth. To the upside we have a lot of resistance in the form of the top of the gap, and of course the 200 day EMA which even beyond there we have to worry about the 61.8% Fibonacci retracement level. It is going to take a long time to break through all that so we may be trying to carve out a bit of a range, perhaps between the $35 level and the $41 level. At this point the market looks susceptible to negativity simply because of how resistive the area just above has been. If we get some type of extreme shot, that could send this market right back down. However, if we were to break above the 61.8% Fibonacci retracement level, then the market is probably likely to reach towards the $49 level rather rapidly.