The West Texas Intermediate Crude Oil market initially took off to the upside during the trading session on Monday to open up the week, but we have a significant amount of resistance just above to cause issues. We have the top of the gap that still has not been broken above and is offering resistance which is something that you would anticipate. With that being said, it looks like we will continue to find quite a bit of selling pressure in that area. Furthermore, the candlestick for the trading session is starting to form a little bit of a shooting star.

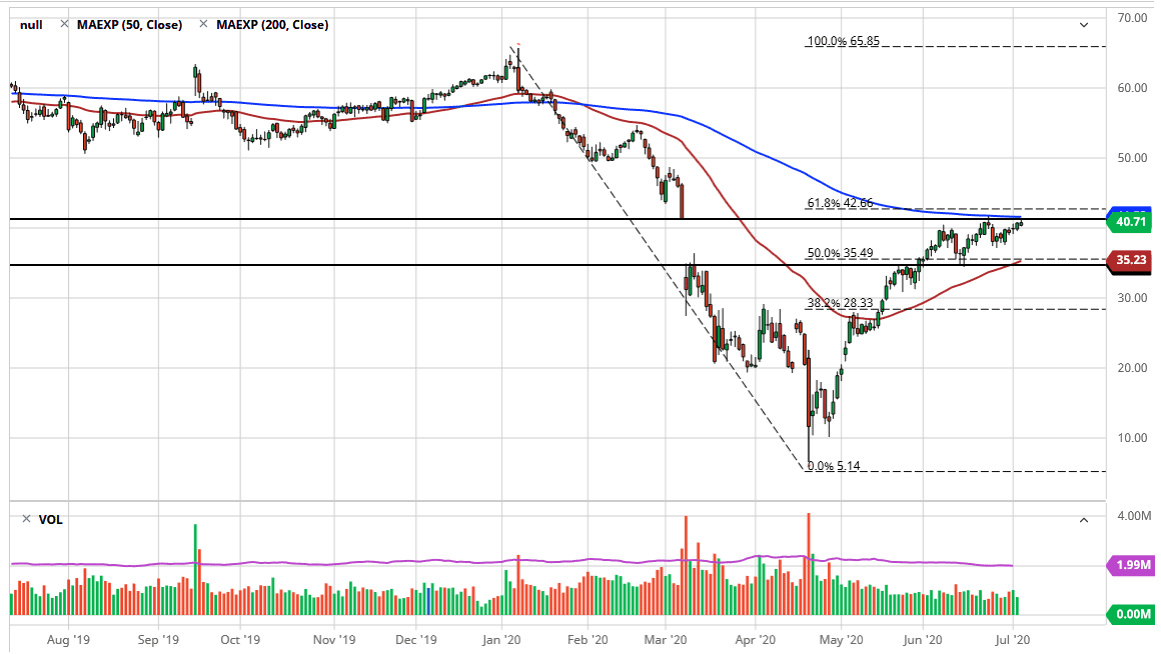

Beyond the top of the gap, we also have the 200 day EMA that is sitting in the same area, so that of course will take quite a bit of selling pressure into the marketplace or are at the very least a bit of profit-taking. The 200 day EMA seems to be well respected over the longer term, so keep that in mind. Furthermore, we also have the 61.8% Fibonacci retracement level just above there, so there are a multitude of reasons to think that this market may not be able to break to the upside right away.

The fact that the Brent market has not filled the gap is interesting. The question then becomes whether or not it will do so, and if it does will the West Texas Intermediate Crude Oil market rally as well, as the two do tend to move in the same overall direction. This is the outside influence in this market that you should be paid attention to. The other possibility is that the US dollar gets hammered hard enough to send this market higher, but I think in and of itself as far as the fundamental analysis and technical analysis of crude oil itself is not going to be enough to send this market higher.

If we do pull back, and I do anticipate this happening, I would anticipate also that there should be buyers underneath. Somewhere near the $37.50 level should be an area of interest, and therefore I think that the buyers will show up in that same general vicinity. It would make a bit of sense, especially if we are going to break out to the upside that we would need to pull back and build up momentum.