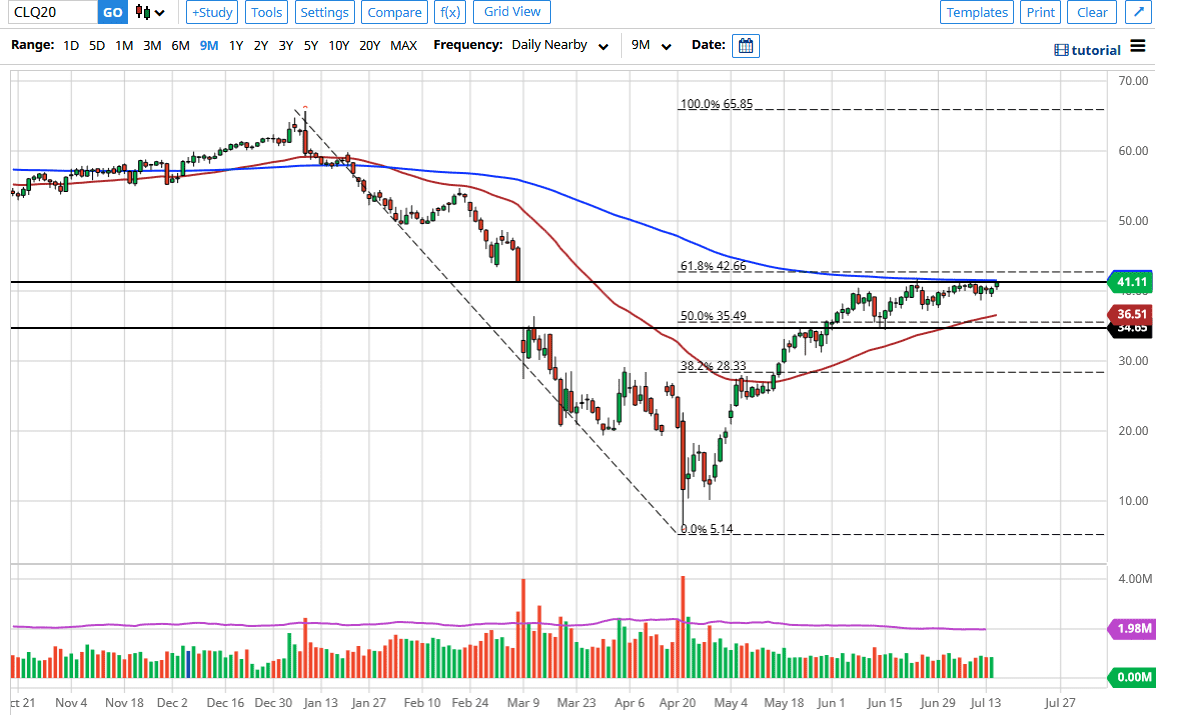

The West Texas Intermediate Crude Oil market has rallied rather significantly during the trading session, crashing into the 200 day EMA. This is an area that I have been talking about for what seems like a lifetime, as it is so difficult to overcome. We are closing at the top of the range for the session and although this is a very bullish sign, I would urge you to wait until a daily close well above it in order to get involved. This is because you could have an issue with some type of “false break out”, which is quite typical at these levels.

Clearly, you cannot necessarily short this market, but you can recognize that there could be a bit of a pullback coming. I would use that to my advantage, looking for opportunities to buy crude oil at the $40 level yet again. The market is likely to see a lot of volatility, but I do think that a pullback makes quite a bit of sense. To the downside, I think that the market is likely to continue to see plenty of buyers but that does not mean that we will have the occasional wicked move. The inventory draw being bigger than anticipated during the trading session on Wednesday certainly helped. However, we have not broken out yet so there is no need to be the first person through the door. Let the market break through all of that resistance before you get involved.

If it does pull back, then look at it as an opportunity. I have no interest whatsoever in trying to short this market, as I think there are multiple areas beyond the $40 level that could come into play. It is likely that we will see noisy trading at best, but once we get that daily close above the 200 day EMA, that would be the signal to start buying from what I see. At that point, it is highly likely we go looking towards the $49 level above, which was the major area of selling that led towards the massive gap that we have just grind it our way through. Expect noise, but ultimately the failing US dollar is probably going to help this scenario as well.