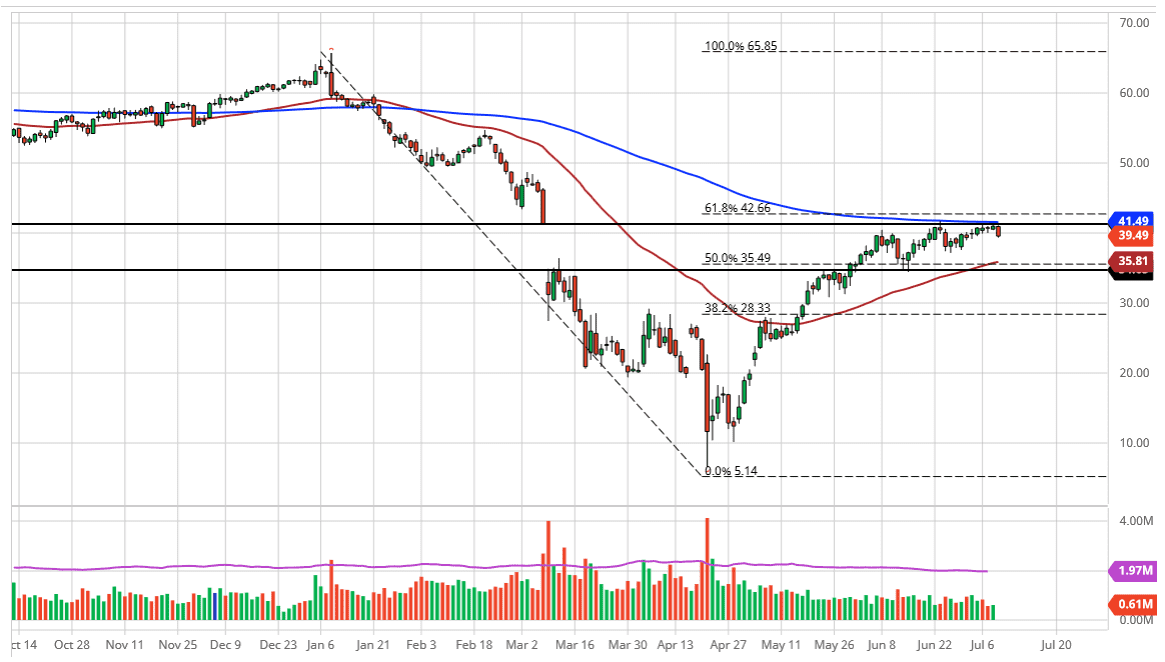

The West Texas Intermediate Crude Oil market broke down a bit during the trading session on Thursday, which is good news considering how we had been struggling for the last several days at the 200 day EMA and the top of the gap that had been so prevalent in this market. Now that we have pulled back from there it gives us an opportunity to go looking for value underneath. Furthermore, at the bottom of the gap there is the 50 day EMA which will come into play with buyers looking to take advantage of that technical signal near the $35.60 level. This being the case, I think we may have another day or two of negativity that we can look forward to, perhaps offering a bit of a buying opportunity on this dip.

One of the main reasons I think we will see a bit of negativity is that it looks like the US dollar is going to try to strengthen going forward. Overall, this is a market that continues to see a lot of noise in general, so I like the idea of letting it come back to a lower level and taken advantage of value. That being said, there are also a lot of concerns about coronavirus numbers increasing, so if that is going to be the case it could be a bit of an early morning sign of trouble but I think at this point the market still continues to find reasons to rally, and therefore the Federal Reserve taking although the liquidity measures that have been such a major focus of the market should continue to make commodities rise in the perceived “reflation trade.”

If we did break down below the $35 level, then it could open up a move down towards the $30 level, but I think it may take some time to get down there. Although I do not think this is not necessarily going to happen anytime soon it is a bit of a possibility. I think at this point we are just looking at a day or two of grinding lower, and then value hunting coming rather soon. Ultimately, we could turn right back around a break above the 200 day EMA and the $42 level, which would mean that we would go looking towards the $49 level which was the major resistance barrier above there.