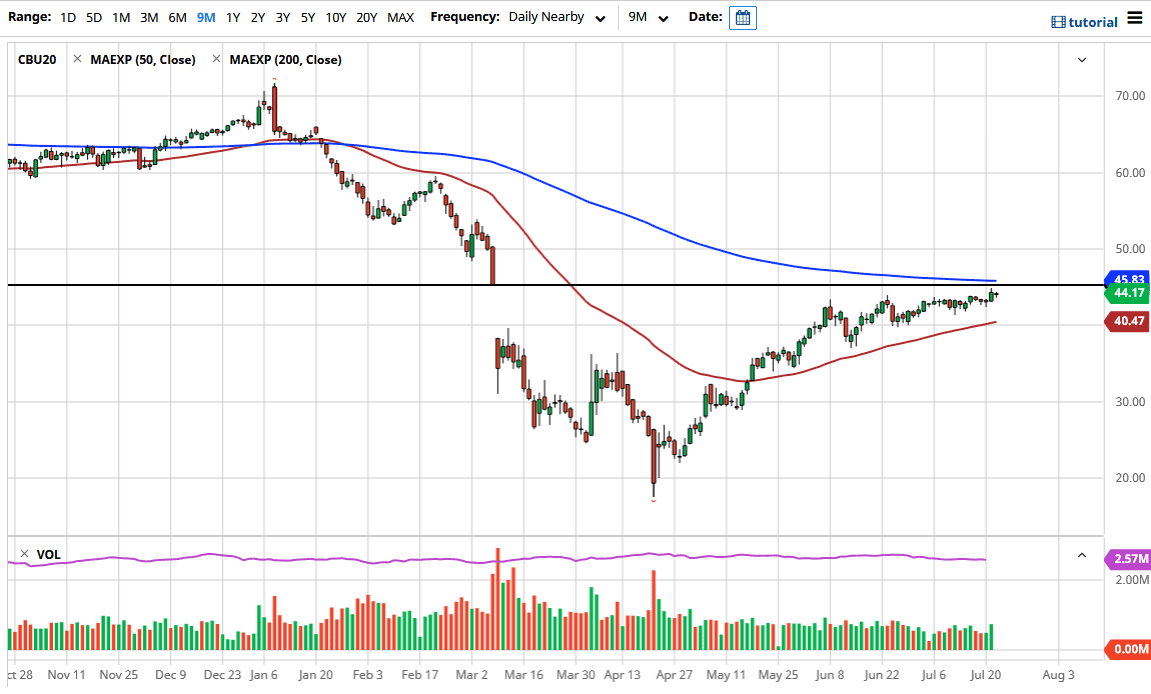

The West Texas Intermediate Crude Oil markets have initially fallen during the trading session on Wednesday but found enough support to turn things around and show signs of strength. Ultimately, this is a market that is currently trading between the 50 day EMA underneath and the 200 day EMA above. With that being said, it is very likely that we will continue to see overall volatility with an upward slant. After all, the US dollar getting crushed certainly helps the crude oil market, as people start to go away from currency and into hard assets. The crude oil markets continue to have a lot of crosswinds though, and that is not helping anything along the lines of clarity.

With that being said, OPEC is currently sticking to its production cuts, so that helps lift oil as well. At the same time though, there is very little in the way of demand as we see economies around the world slow down. It certainly does not help the situation that America itself is slowing down a bit, which is one of the biggest markets for crude oil. More than likely we will continue to see back-and-forth trading, but I do think eventually this market will go looking towards the 200 day EMA as it is too important of a technical indicator to forget. If we break above there, then it would be a very strong sign that we are ready to go higher. Looking at the candlestick from the session on Tuesday, we did see a lot of buying pressure, so I think that was the first “shot across the bow” when it comes to a potential move higher.

In the meantime, if we were to pull back from here, I think there would be plenty of support near the 50 day EMA which is sitting right around the $40 level. That for me would be the short term “floor” in the market and I think that a lot of buyers will be waiting there. We have been grinding in an upward fashion, but ever so slowly. I think short-term pullbacks continue to offer value, and I think short-term traders will continue to look at this market as one that they can profit from little movements like that. If and when we can break above the 200 day EMA, it is likely that we will go looking towards the $50 region.