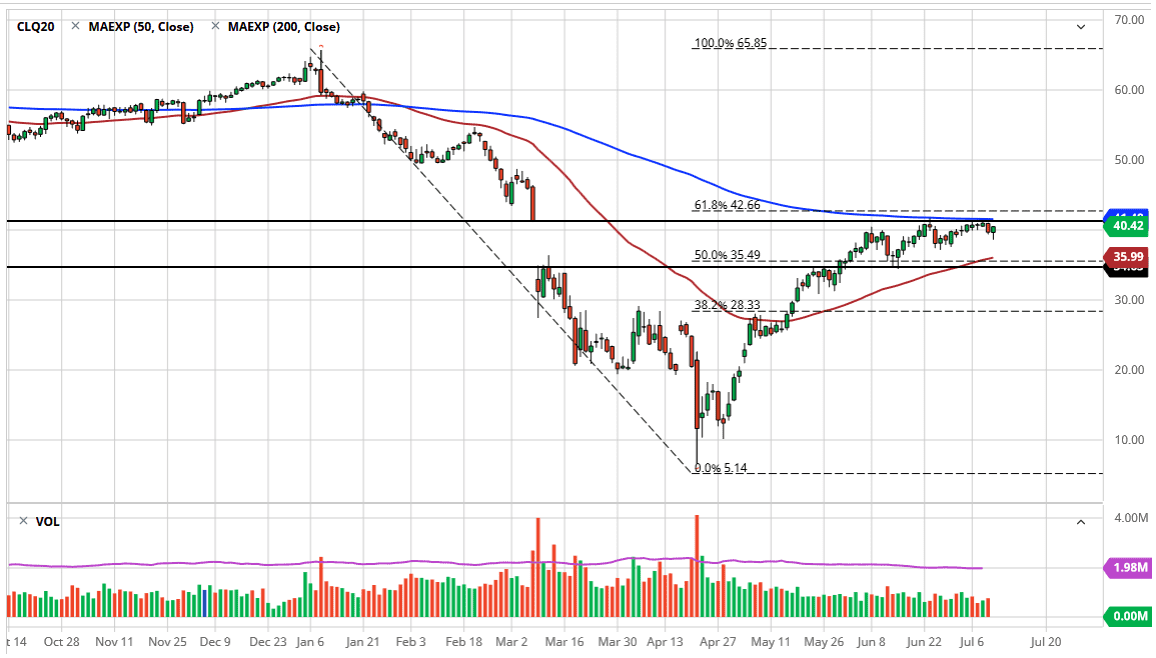

The West Texas Intermediate Crude Oil market has initially pulled back on Friday to show signs of weakness but turned right back around to form a hammer. This is a very bullish sign and it suggests that we are in fact going to continue to try to break out above the top of the previous gap. The $40 level offered support in general, and the fact that we have formed this candle suggests that we are going to continue to try to break out to the upside and clear the 200 day EMA. Once we do, then the next thing we have to deal with is the 61.8% Fibonacci retracement level.

If we were to break down below the bottom of the candlestick for the Friday session it is likely that we would then go down towards the 50 day EMA underneath. That is an area that sits just above the top of the bottom of the gap, so I think that makes quite a bit of sense that we would see support there. As we are stuck between the 50 day EMA and the 200 day EMA indicators, it is likely that we will see a lot of noise. I believe that it is only a matter of time we see buyers on these dips because the US dollar is getting hammered. As long as that is going to be the case, the oil markets may get a little bit of a boost.

If economies around the world continue to open up, then it could help crude oil as well. That being said though, there still is a massive oversupply of crude out there, so it is difficult to make this market out to be one that is extraordinarily bullish. If we can break above both the 200 day EMA and the 61.8% Fibonacci level, it is likely that we could continue to go towards the $49 level above. That is an area where we have seen a lot of resistance, so I think that would be the next target. I think it is going to continue to be very noisy but is likely that there is still enough out there as far as buying pressure is concerned to continue to make the challenge. One should look at pullbacks as value, although I must admit I was a little bit surprised to see just how quickly we bounced, as I was hoping for even better pricing.