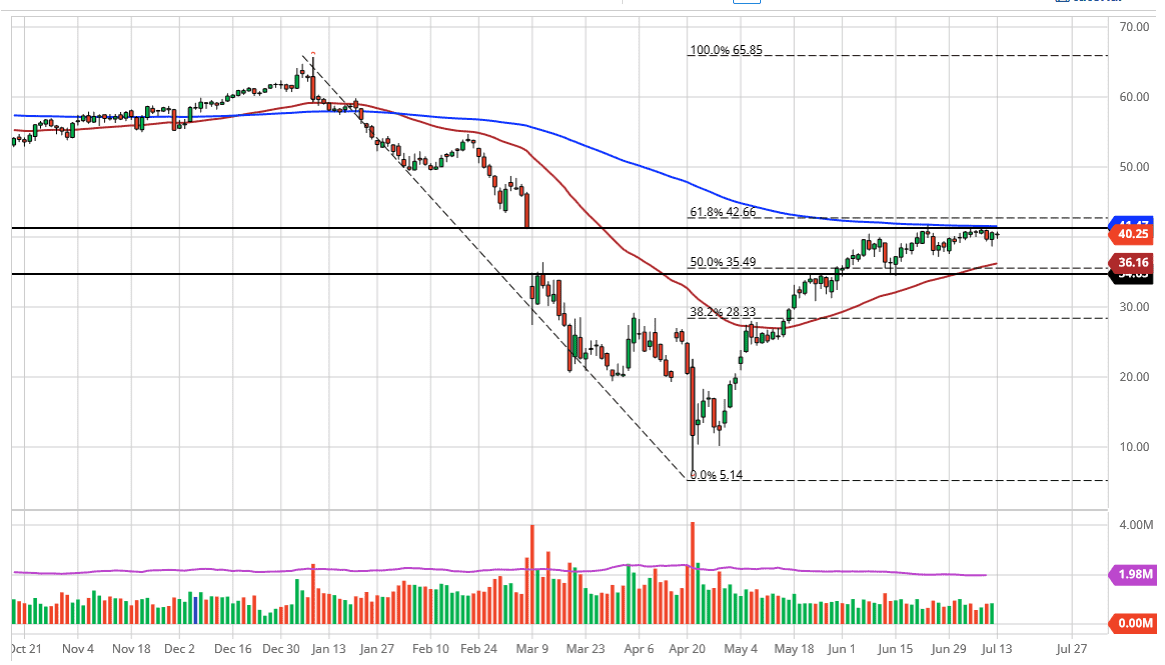

The West Texas Intermediate Crude Oil market had a choppy session again on Monday as traders came back to work. The area just above continues to be a bit of an issue for this market, as it is the top of the previous gap. There seems to be a bit of a “brick wall” near the $41 level as we have repeatedly failed to break through it.

Further substantiating the resistance is not only the top of the gap, but the fact that the 200 day EMA is sitting there, and of course, we have the 61.8% Fibonacci retracement level offering resistance as well. This could, at least in theory, be a perfect “fill the gap and then return” type of trading scenario. Quite often, you will see a massive gap like this get filled before you get a continuation to the downside. The market most certainly has lost momentum after shooting higher, and you could make an argument for some type of “rounded top” trying to form. I think it is a bit early to suggest that is going to be the case, but it is always a possibility.

However, if we did break above the $42 level on a daily close, and then possibly even the $42.60 level where the 61.8% Fibonacci retracement level sits, then it opens up a big move towards the $49 level above. In that vicinity, I would anticipate seeing quite a bit of resistance as you are getting dangerously close to the $50 handle. To the downside, I think there are buyers as well, so I am not looking for some type of meltdown in the short term. I believe that the 50 day EMA, currently sitting at the $36.15 area, should continue to be supported. In fact, most of the time that a market is trading between the 50 day EMA and the 200 day EMA, you see a lot of consolidation as longer-term traders are getting their signals crossed. With that, I believe it is more likely than not we just simply pullback from here only to try to rally yet again. This market will continue to be very noisy and lost, which makes sense considering that there are a lot of questions when it comes to whether or not there will be demand. After all, the world is still running at incredibly low capacities since the virus hit.