The West Texas Intermediate Crude Oil market did rally a little during the trading session on Friday, which makes sense considering that it was the observed Independence Day holiday. Independence Day in the United States is actually on Saturday and not Friday, but most banks and federal offices were closed during the session, so the volume was almost nonexistent. With that being the case, it is not much to imagine that you simply ignore the Friday candlestick.

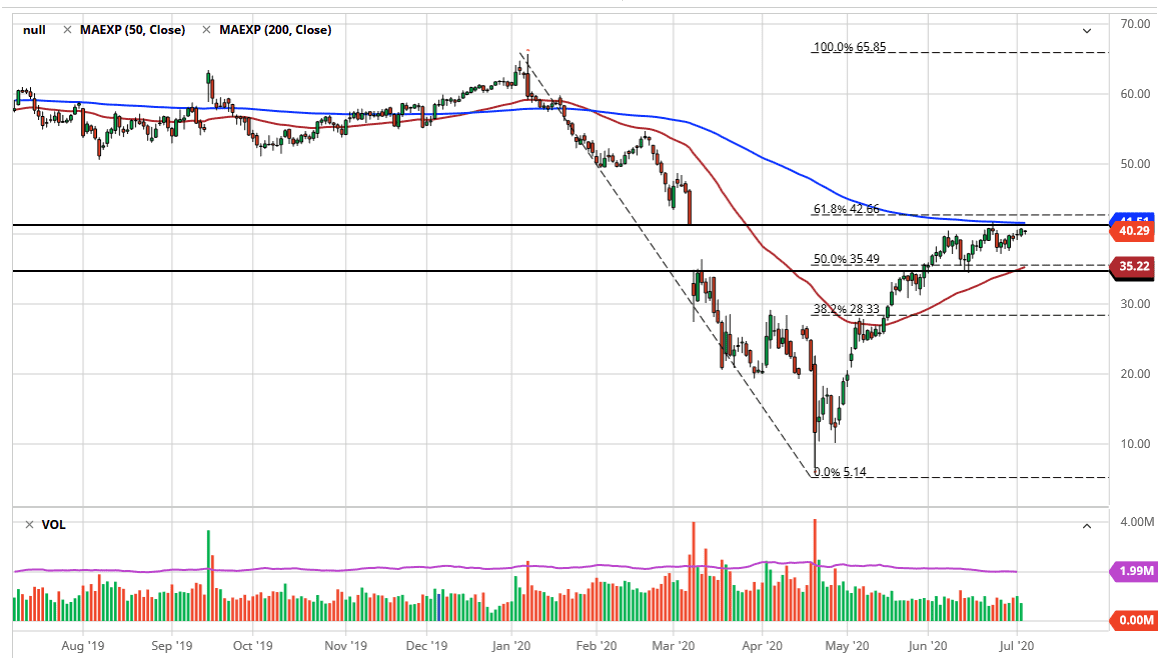

Looking at this chart, the 200 day EMA is sitting just above, and that will cause a significant amount of resistance, and at this point in time we are at the top of the gap from the previous break down, and that is an area that should cause some resistance. Between the top of the gap and the 50 day EMA, it makes quite a bit of sense that there would be sellers here. I think we will probably continue to pull back a little bit but notice how we have been grinding higher. The question now is whether or not we can finally break out, or are we going to form something like a rising wedge which is a bearish signal?

If and when we can break above the 200 day EMA, basically the $42.50 level, then the market is likely to go looking towards the $49 level. If we pull back from here, then we could go down towards the $40 level, and then eventually the $37.50 level. Underneath there, we have the 50 day EMA that is currently crossing above the $35 handle, the bottom of the gap. I think at this point we probably stay between these couple of moving averages, as we get squeezed which right now seems to be favoring the upside more than anything else. That being said, do not try to be the first person through the door, let the market break out before you put money to work. As far as selling is concerned, yes, we could short the crude oil market in the noticeably short term, but I would be a bit cautious doing that as we have seen so much in the way of persistence. If we were to break down below the 50 day EMA, that would be rather negative and could send this market down towards the $30 level for quite some time.