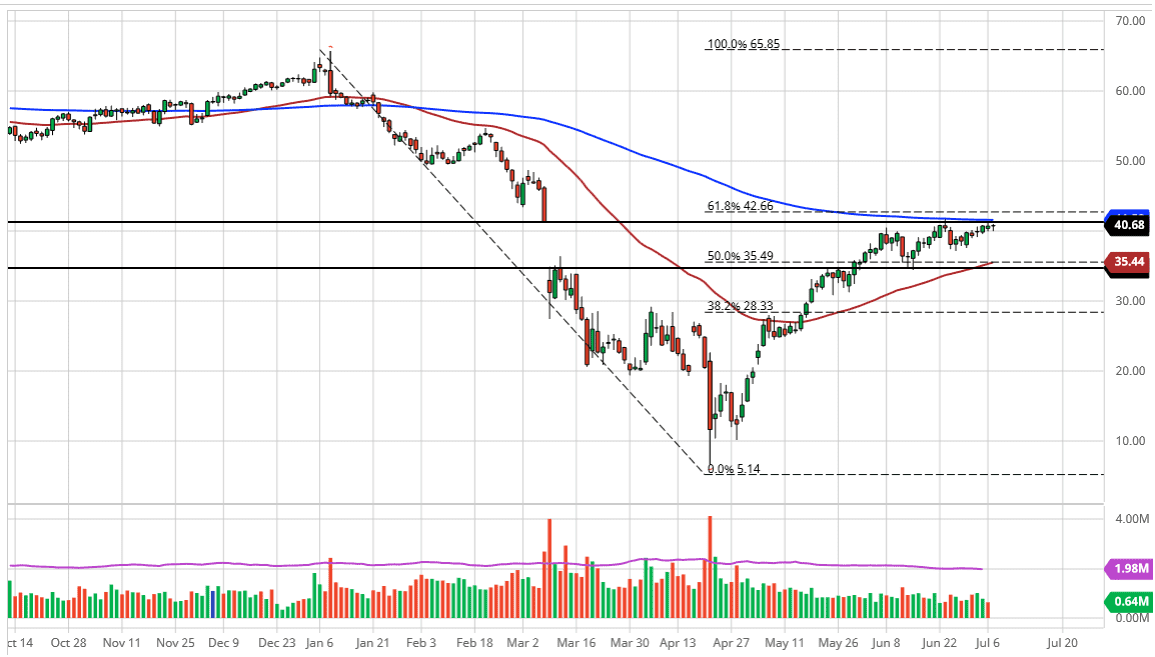

The West Texas Intermediate Crude Oil market has initially fallen during the trading session but bounced on Tuesday to show that we continue to see the $40 level as somewhat important. Perhaps even more crucial though is that we see the area above near the $41.50 level is massive resistance. That is an area that was the top of the previous gap on the chart, so it does make quite a bit of sense that we would see pressure in that region. I think at this point we are likely to see the 200 day EMA offers selling pressure as well, not to mention the 61.8% Fibonacci retracement level. Because of this, I believe that this market is essentially stuck at the moment.

If anything, I would anticipate seeing a little bit of a pullback, but I believe that pullbacks will be short-lived because there is obviously a lot of buying pressure underneath. The 50 day EMA also comes into play near the $35.50 level, just now crossing above the bottom of the previous gap. With that being the case I like the idea of buying dips as they offer a bit of value because I do think that eventually, this market will make a serious attempt at breaking out.

Right now, though, we have a lot of questions when it comes to crude oil and we just have not made any decisions. With that being the case, it is likely that the market will look at pullbacks as an opportunity to take advantage of a little bit of room, but right now we simply do not have it until we clear the 200 day EMA on a significant move. With all that in mind, I think it is simply going to be a sideways grind more than anything else but look at pullbacks as an opportunity. I would not sell this market, at least not until we break down below the 50 day EMA on a daily close. I think there is enough interest in crude oil at the moment to keep the market somewhat levitated, and the OPEC has done a reasonable job of cutting production which is always one of the biggest questions when it comes to crude oil. Because of this, I remain bullish but somewhat tentative in this area as we have a lot of work to do to finally make a bigger move.