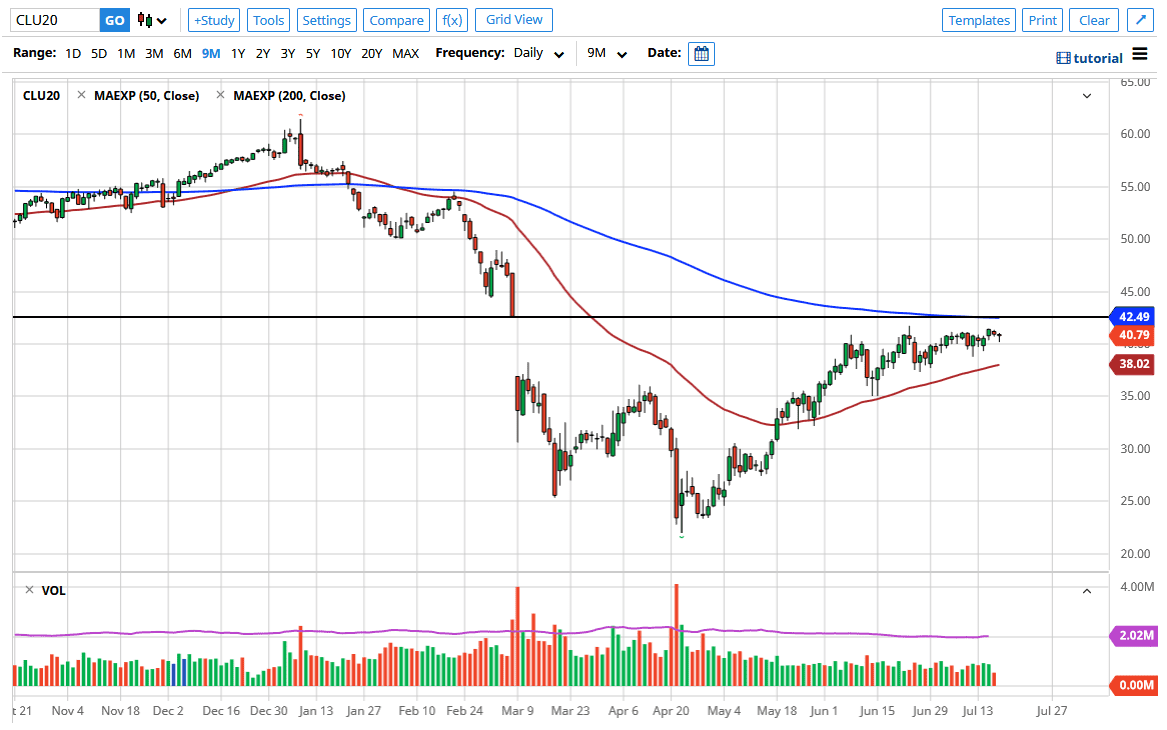

The West Texas Intermediate Crude Oil market initially pulled back a bit during the trading session on Friday but turned around to show signs of life again near the $40 level. At this point in time, it becomes obvious to me that the crude oil markets are eventually going to try to break out above the resistance barrier above and probably going to try to fill the gap. Ultimately, the 200 day EMA sits there as well, so it should cause pretty significant resistance as well. This tells me that the market will probably at least try to get there because it tends to be the attitude of the market to go looking to test these major barriers.

The US dollar is continuing to fall, and that could help push the crude oil markets higher as well. In fact, you can make the same argument for most commodities. At this point, once we fill the gap, then the real work begins. Having said that, we really have not done anything of the last couple of weeks and I think we are simply waiting for some type of catalyst to send this market either higher or lower. Once we break above the 200 day EMA, then the market could go looking towards the $45 level, possibly even the $50 level.

Underneath, if the market were to break down below the $40 level and then go looking towards the $38 level, which is where the 50 day EMA sits, there are plenty of buyers underneath there as well, all the way down to at least the $35 level. We have been grinding sideways, and I think that will continue to be the same scenario that we are stuck in, simply grinding back and forth with a slight upward tilt. All things being equal, I do not believe that eventually, it will find a reason to break out to the upside, if for no other reason than to react towards the US dollar as it is under so much pressure against everything at this point. The Federal Reserve continues to flood the markets with liquidity, which begins a potential “reflation” trade. I like the idea of buying dips going forward, as short-term trading continues to be the best way going forward.