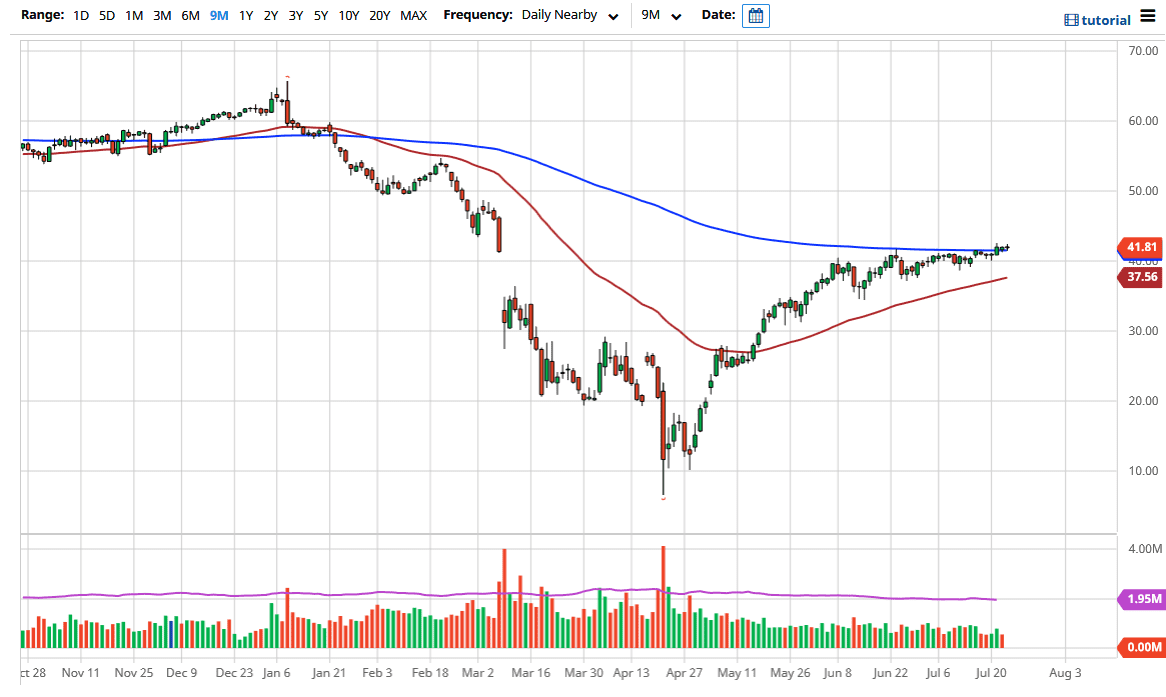

The West Texas Intermediate Crude Oil market has been grinding sideways for some time, as we have seen almost nothing in the way of momentum over the last several sessions, with the market having the occasional hiccup to the upside but it is obvious that the 200 day EMA continues to offer a bit of resistance, as we typically will see over the longer term. Ultimately, this is a market that I think sees more of a grind than anything else, but it certainly seems to have more of a significant upward tilt than anything else. This is the way it has been for several weeks, so there is nothing to suggest that things are going to change in the short term.

To the downside, I believe that the $40 level will offer significant support, just as the 50 day EMA underneath will be. Overall, the market continues to see an attempt to break out to the upside, but it is obviously going to struggle in the short term. If we can break above the 200 day EMA with an impulsive daily candlestick, then I think it is likely to go looking towards the $49 level. Between the $49 level and the $50 level there should be a significant amount of selling pressure, but I think it makes a decent target between now and then. The problem of course is just how slow this market is moving.

Overall, I believe that this is a market that you will probably be looking at the short term charts in order to scalp little dips. I think it is difficult to imagine shorting this market, even though we could very well pull back a bit. The market remains in a tight range but clearly the buyers are still rather aggressive in the sense that they are not worried about the lack of demand that is clearly a major issue. I think one of the main drivers is going to be the US dollar falling in strength, and that is clearly something that continues to be an issue for the currency markets. As long as the US dollar gets cheaper, then the idea is that it will take more of those US dollars to pick up a barrel of oil. Ultimately, this is a market that is playing the currency markets and the noise over there more than anything else. Nonetheless, we have been grinding higher and that is the most important thing.