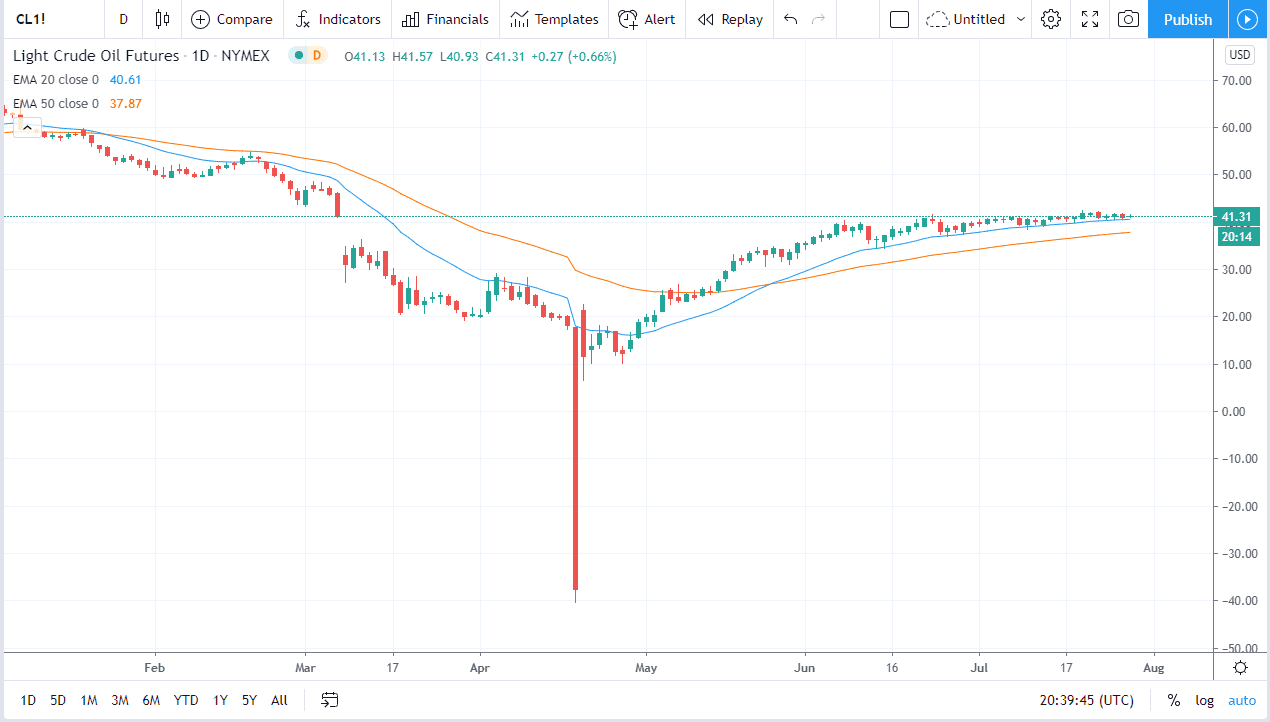

The West Texas Intermediate Crude Oil market continues to go back and forth, doing nothing at all, as we are sitting around the $41 level. Ultimately, this is a market that I think will try to break out one way or the other, but watching it move lately has been like watching paint dry, and as a side note I used to be a painting contractor in a previous life so I know what I am talking about!

The 20 day EMA currently sits at the $41.30 level, and it is offering support. I also recognize that the 50 day EMA underneath will offer support and it is essentially a “zone of support” that we are paying attention to. If we can get some type of impulsive candlestick to the upside, then we could get a run towards $49 level. That is an area where we have seen a lot of selling and of course the $50 level is a significant psychological area that people will pay attention to as well, so it is very likely that there will be a lot of selling pressure at that area.

To the downside, if we break down below the 50 day EMA it is likely that the market could go looking towards the $35 level, perhaps even down to the $30 level. All things being equal though, I think that probably go sideways for a while until we decide whether or not the weakening US dollar or perhaps some type of fundamentals will push this market. The demand for crude oil of course is diminished due to the fact that there simply has not been anything going on for a while. Global travel is nonexistent, and of course economies around the world are limping along. With that being the case, it is very unlikely that we will see a sustainable rally anytime soon. That does not mean we cannot go higher; it just means that I do not think this market breaks $50 anytime soon. To the downside, the $30 level should be massive support. Until we get an impulsive candlestick though, it is just simple scalping back and forth. If you are one to trade the short-term charts like this, you have probably made a fortune as of late. Do not think that the high-frequency traders have not noticed either as there has been a massive push back and forth in a very quiet market.