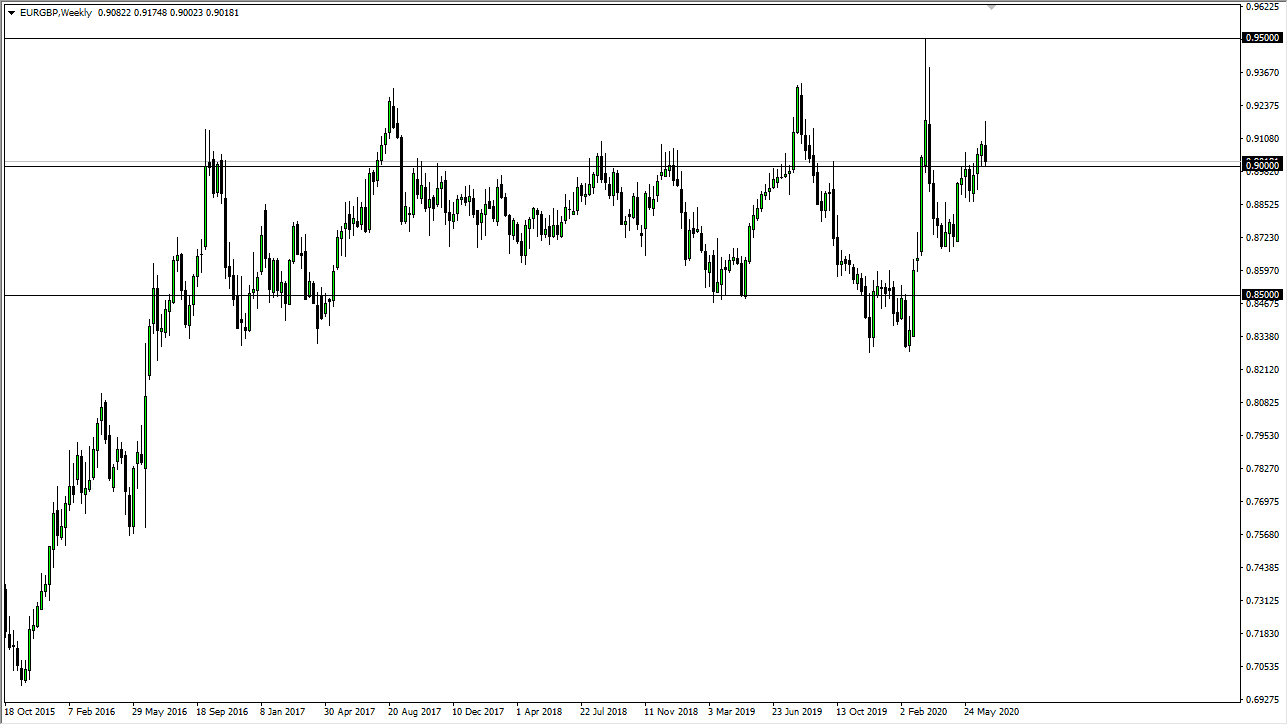

EUR/GBP

The Euro initially rallied during the week but then gave back all of the gains to form a less than tenable candlestick. We closed just above the crucial 0.90 level, an area that is obviously going to attract a certain amount of attention. If we can break down below there then I think this market will probably break down towards the 0.89 handle, which is what I expect to see this week based upon the fact that the Euro is showing signs of weakness again several other currencies.

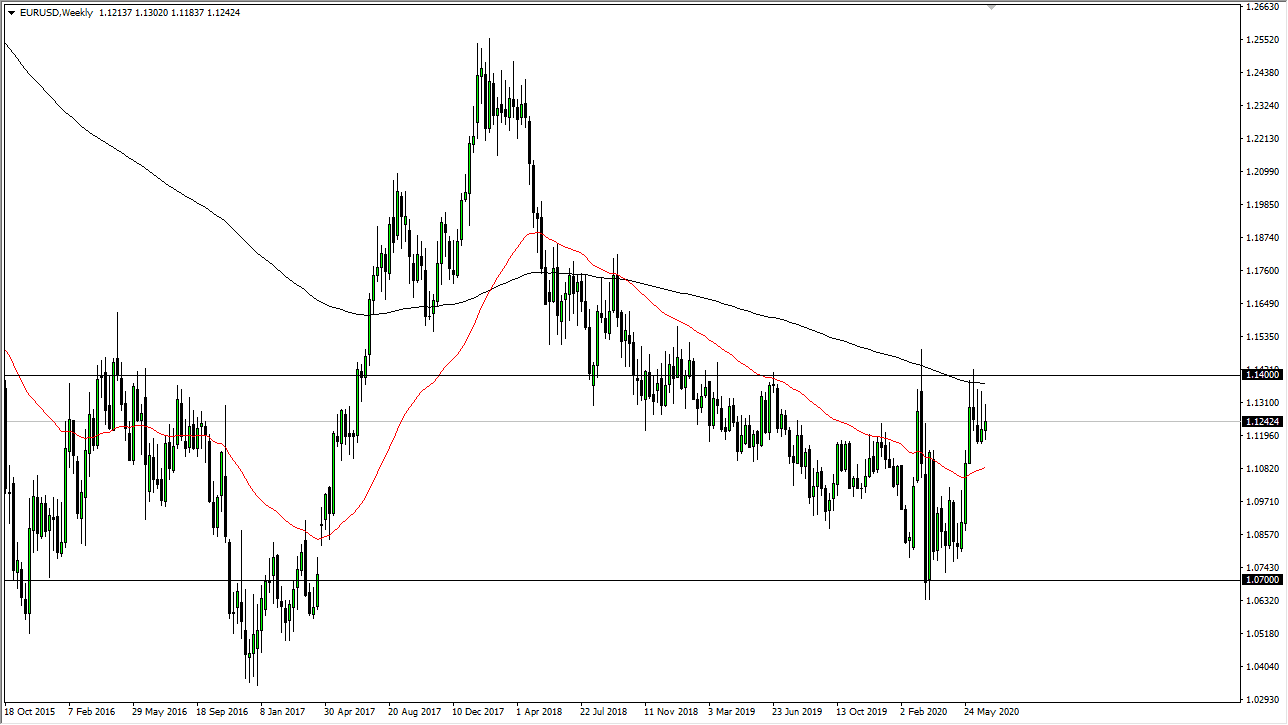

EUR/USD

The Euro rallied during the week again but gave back quite a bit of the gains. The candlestick is not quite a shooting star, but it is close to the previous three shooting stars that we have seen. In other words, this market simply cannot seem to take off to the upside and I think that this week will feature some of the same actions that we have seen previously: we simply should step in and start fading rallies at the first signs of trouble. The 1.14 level continues to be massively resistive, and we have the 200 week EMA offering significant resistance as well. We are close to the top of the overall range of the market, so I am still looking for failures.

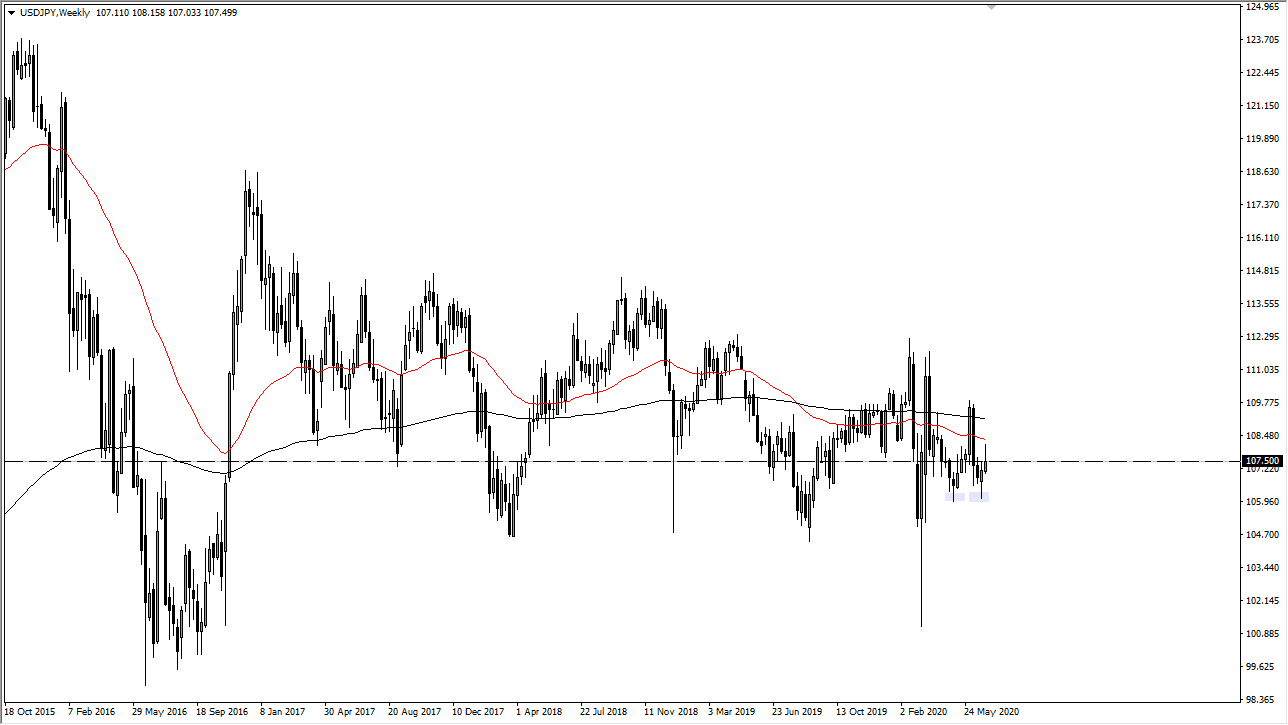

USD/JPY

The US dollar tried to rally during the week but gave back quite a bit of the gains to reach towards the ¥107.50 level yet again. There is a bit of a double bottom down at the ¥106 level, and a lot of resistance at the ¥108.50 level. I anticipate that we are simply going to bounce between these levels for the next several weeks, as this market is essentially at this point a proxy indicator for Japanese yen strength or weakness that I translate into other markets. It is almost like this is the pair where the money went to die.

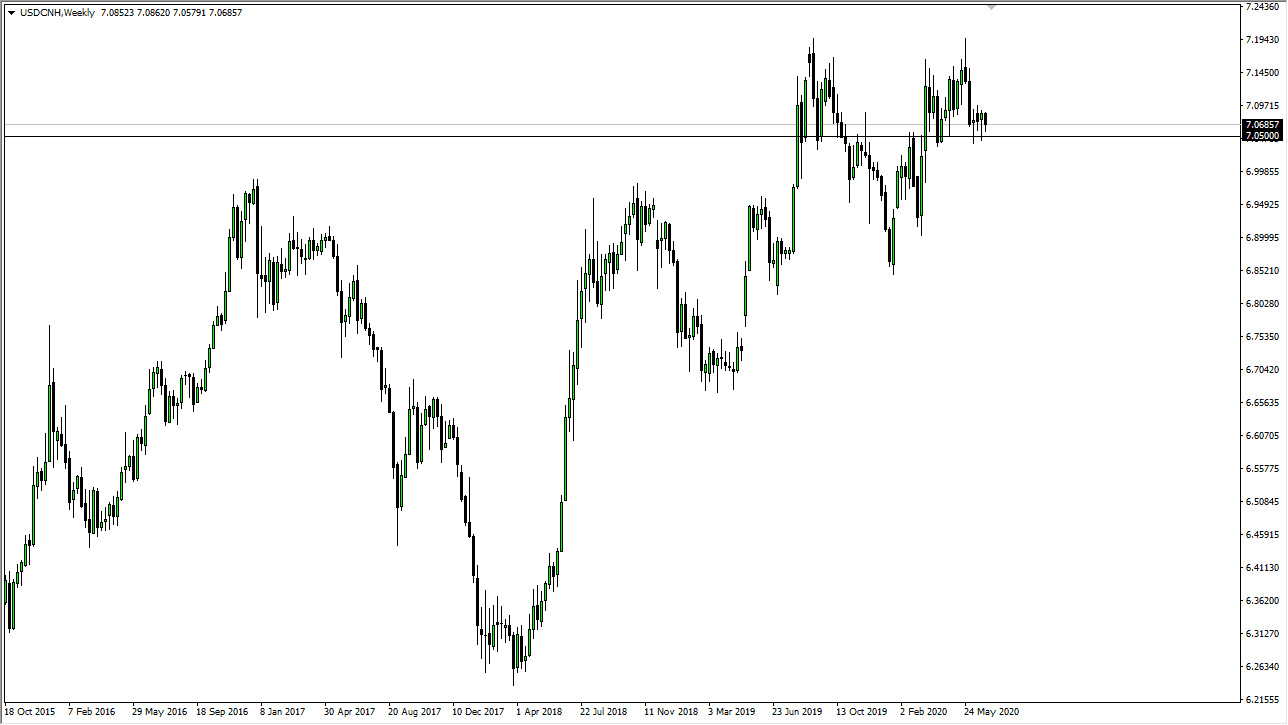

USD/CNH

The US dollar fell a bit against the Chinese Yuan but continues to find quite a bit of support at the 7.05 level. This is an area that has been crucial more than once, and at this point, I think we are more than likely going to see the market rally from here. I do not necessarily think we are going to explode straight up in the air, but it does suggest that perhaps a little bit of risk appetite might be coming off going forward, so keep an eye on this chart as it can give you an idea as to how other pairs will behave.