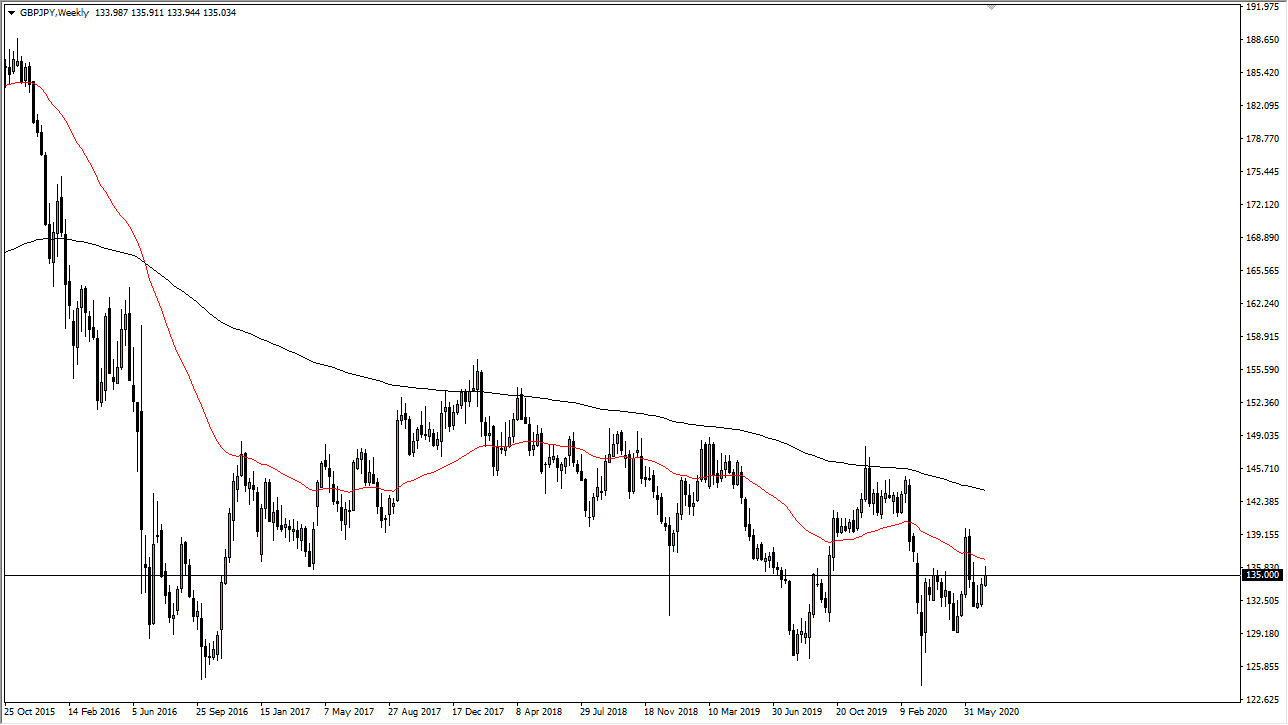

GBP/JPY

The British pound initially broke above the ¥135 level during the week but did pull back quite a bit as this major round figure caused some issues. Having said that, if we can break above the top of the weekly candlestick, I think this pair will then go looking towards the ¥140 level. This is a market that is somewhat risk-sensitive, but it seems as if the British pound will not give it up that easily these days, so do not be surprised to see it diverge from some of the other Japanese yen related currency pairs. If we break down below the bottom of the weekly candlestick then we go looking towards the ¥132 level.

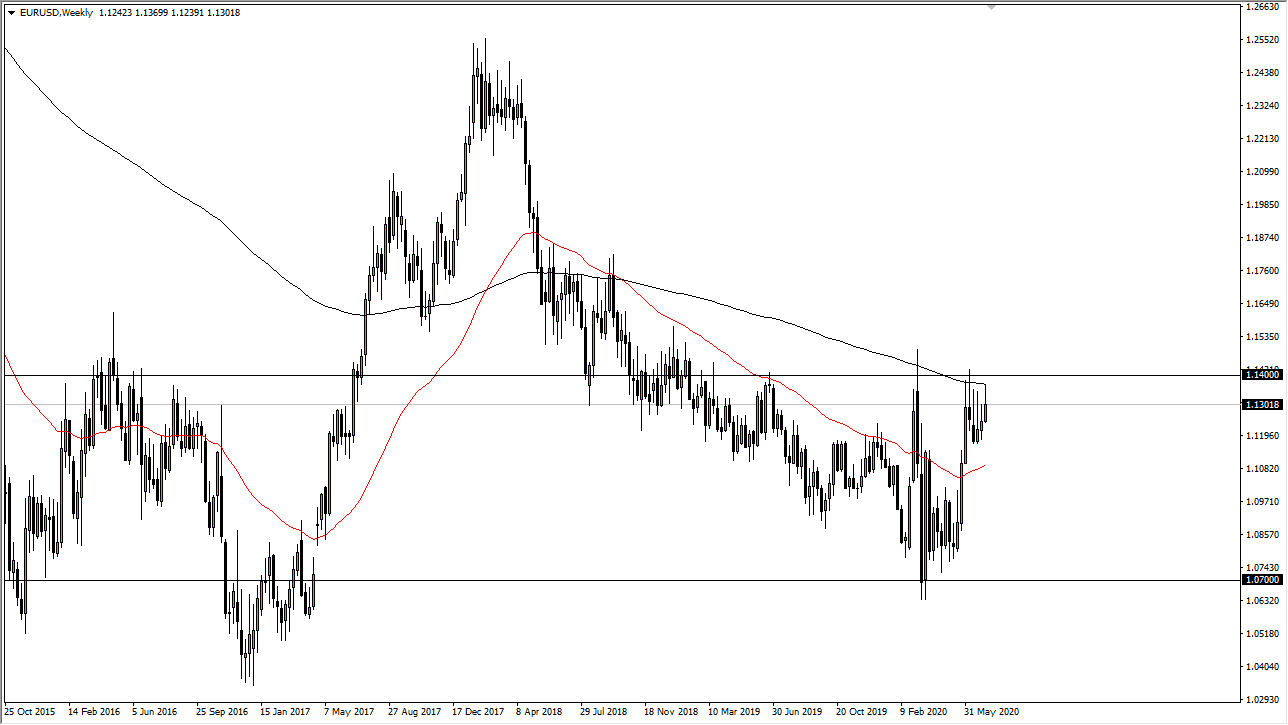

EUR/USD

The Euro has made some gains over the last week and managed to keep more than we had previously. However, we continue to see a lot of resistance in the same region, namely the 1.1350 area. The only difference this time is that the wick is not quite as long as it was during the previous two weeks. With this in mind, I think that the market breaking above the 1.14 level is a major turn of events and could send this market much higher. However, in the meantime, I still think that there is the extreme potential this market running out of momentum, as it clearly has been exhausting itself over the last month or so. This week will more than likely bounce around between 1.14 above and 1.12 below yet again.

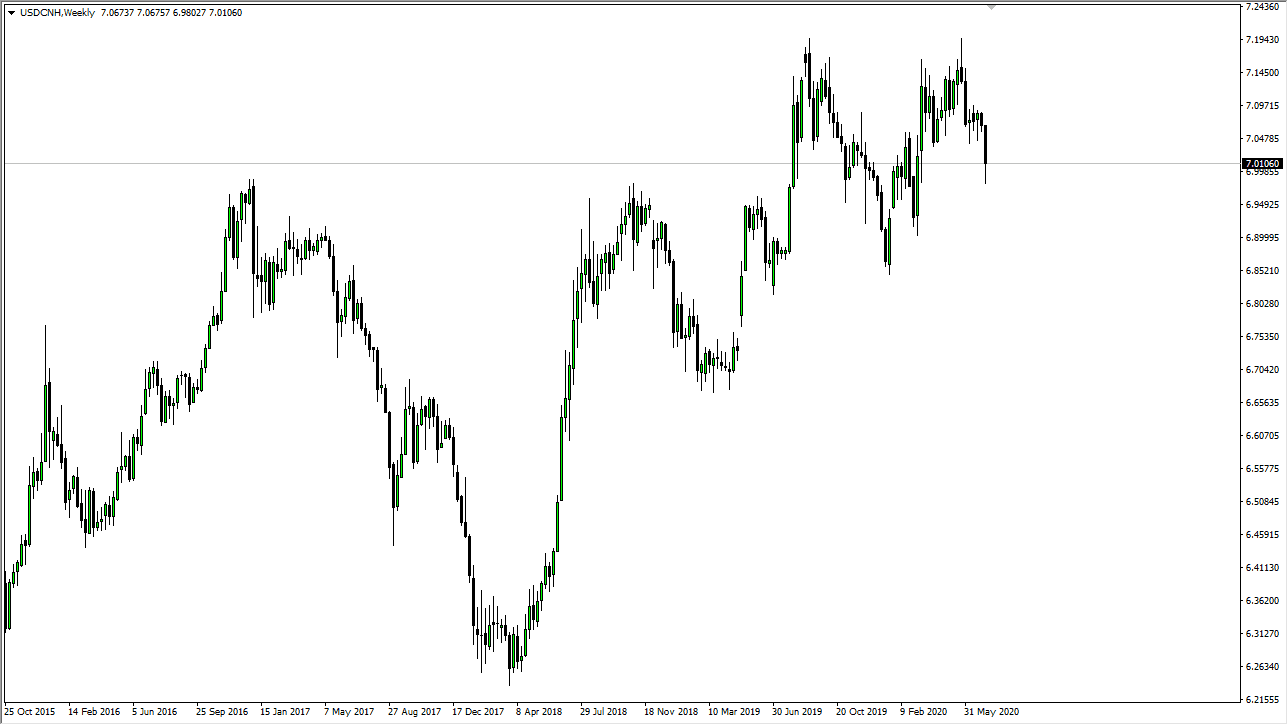

USD/CNH

The US dollar has fallen against the Chinese Yuan during the week, which of course is a bullish sign for risk appetite. However, I would be remiss if I did not point out that the 7.00 yuan level continues to offer support, and we did in fact bounce from that level. This is a market that looks like it wants to continue falling, and that probably has more to do with the Federal Reserve did anything else. That being said, if we clear the 7.05 yuan level, then we could see this market go higher, and what would be a signal of US dollar strength across-the-board. It is because of this that I keep this chart open during the week.

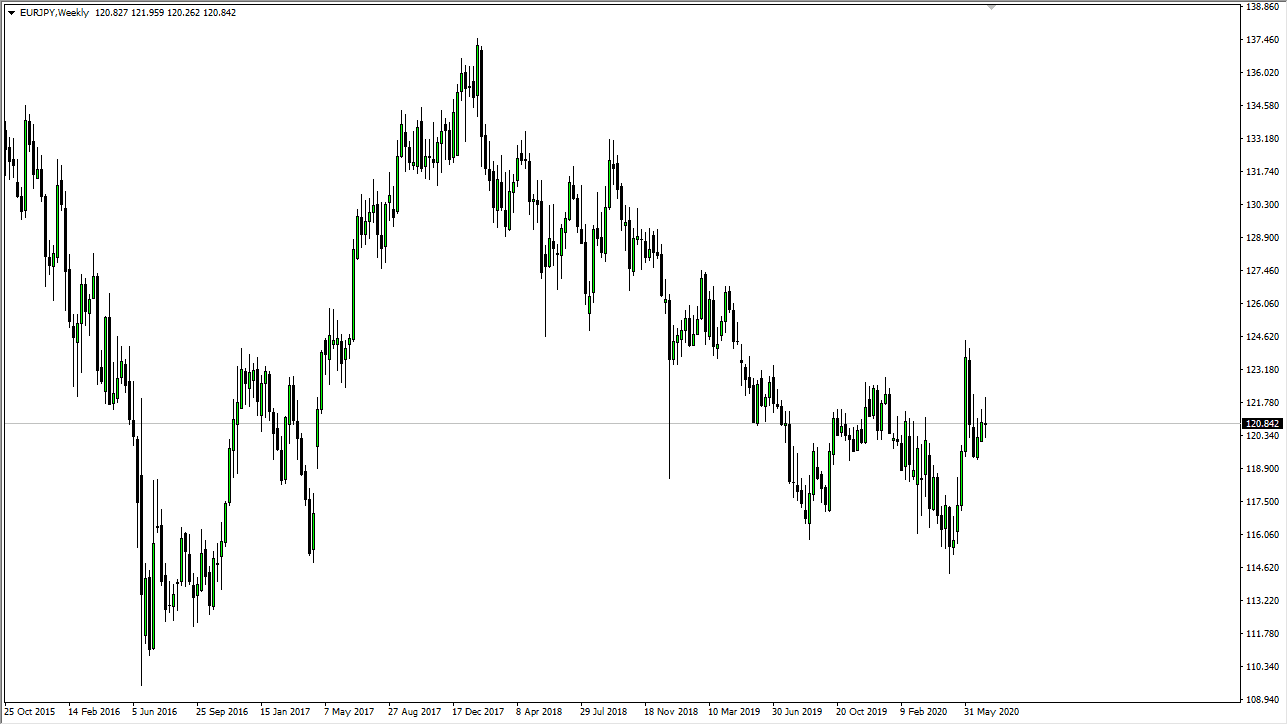

EUR/JPY

The Euro has been choppy against the Japanese yen during the week, forming a bit of a shooting star. However, the Friday candlestick was a hammer, so I think at this point, what we are going to do is trade within the shooting star of this past week for the next one. This lays out a significant range between the ¥120 level, and the ¥122 level above there. Expect a lot of choppiness over the next couple of days.