Frustrated South African President Cyril Ramaphosa revised the conditions to the level three Covid-19 restrictions to ban the sale of alcohol to prevent related hospital submission. Reports of virus-infected patients being turned away from healthcare facilities raised concerns and highlight the estimated shortage of 12,000 personnel and essential equipment, particularly in rural areas. The Bureau for Economic Research (BER) cautioned that the alcohol ban would harm economic activity. South Africa is the ten-most Covid-19 infected country globally, but the USD/ZAR faces rejection by its downward revised short-term resistance zone.

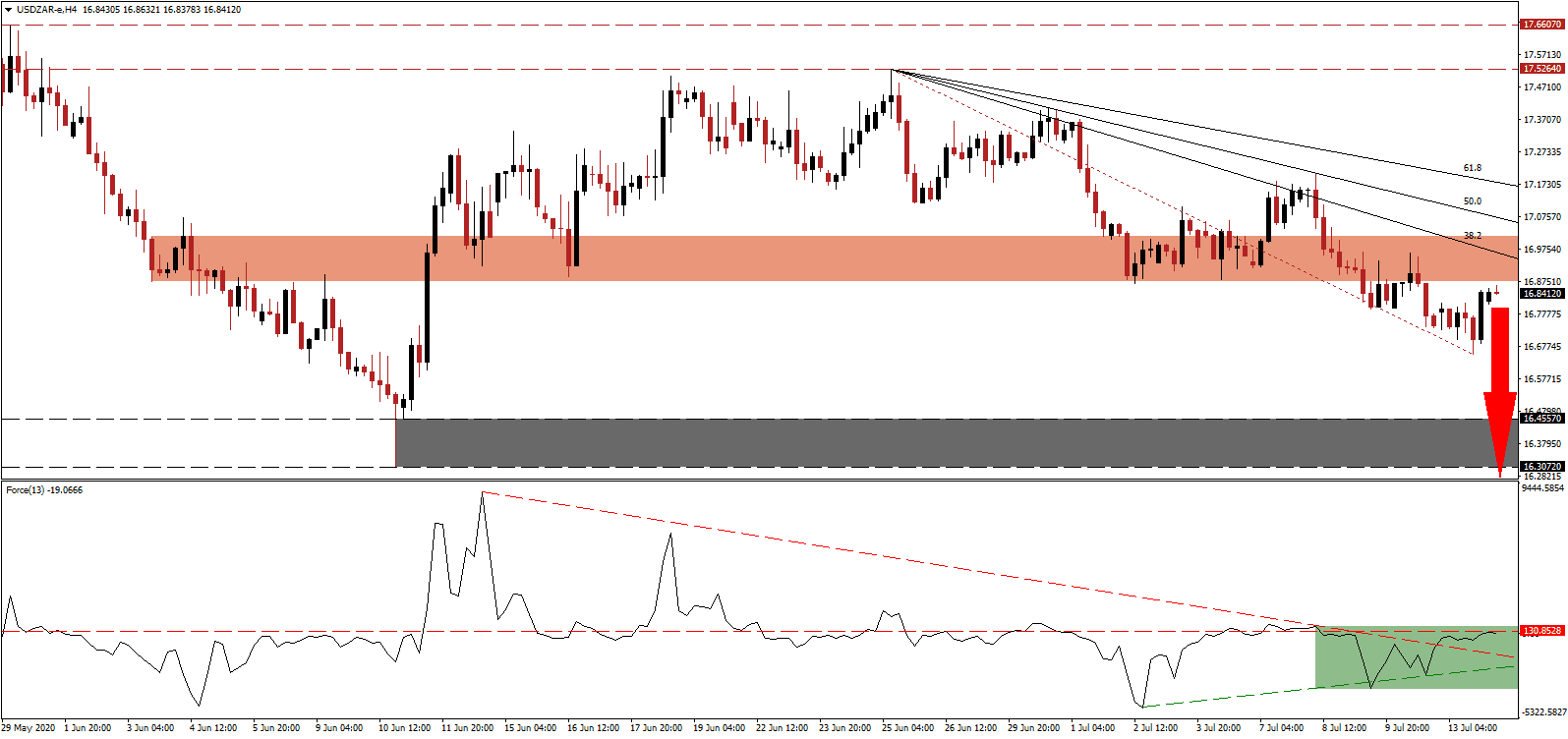

The Force Index, a next-generation technical indicator, was able to form a series of higher lows, and a positive divergence materialized. It represents a bullish indicator, which failed to deliver the usual upside pressure. The horizontal resistance level is challenging its advance, as marked by the green rectangle, from where a correction below its descending resistance level is anticipated. Bears wait for this technical indicator to collapse below its ascending support level to regain complete control over the USD/ZAR.

Adding to South African economic pressures is the stage two load shedding by utility Eskom as multiple generators failed. Cold weather spiked electricity demand, which outstripped supply. A nationwide truck-driver strike is magnifying supply-chain issues, and non-participating trucks are torched across the country. Despite the worsening conditions, the sell-off in the USD/ZAR is positioned to accelerate to the downside. Price action recovered into its short-term resistance zone located between 16.8770 and 17.0152, as identified by the red rectangle, with an expansion in breakdown pressures.

Calls for more pro-investment monetary policy by the South African Reserve Bank to finance proposed infrastructure projects are on the rise. Presently, the government lacks the capabilities to fund the healthcare sector or implement essential projects. Delivering a dominant bearish catalyst for this currency pair is the roll-back of the economic re-opening process across the US, due to the out-of-control Covid-19 pandemic. The descending 50.0 Fibonacci Retracement Fan Resistance Level is expected to force the USD/ZAR into its compressed support zone between 16.3072 and 16.4557, as marked by the grey rectangle. More downside is probable.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 16.8400

Take Profit @ 16.3000

Stop Loss @ 16.9700

Downside Potential: 5,400 pips

Upside Risk: 1,300 pips

Risk/Reward Ratio: 4.15

More upside in the Force Index following the breakout above its descending resistance level could push the USD/ZAR temporarily higher. With the US forced to ban and restrict activities, the US Dollar remains under downside pressure. Implemented stimuli are set to expire this month, adding to an increasingly bearish outlook for the economy. Forex traders are advised to sell any rallies as the upside is limited to its intra-day high of 17.2065, a previous pivot point that resulted in the most recent sell-off.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 17.0500

Take Profit @ 17.2000

Stop Loss @ 16.9700

Upside Potential: 1,500 pips

Downside Risk: 800 pips

Risk/Reward Ratio: 1.88