South Africa, the fifth-most infected country with Covid-19 globally and the most-infected in Africa, faces an ongoing surge in new cases. It forced the government to reinstate a ban on alcohol sales and implement a curfew. Despite the increase in infection, President Ramaphosa will leave the country's five-level coronavirus alert scale at three, allowing most economic activity to resume at current restrictions. The USD/ZAR reversed off of its support zone, but rising bearish momentum is likely to force the next breakdown.

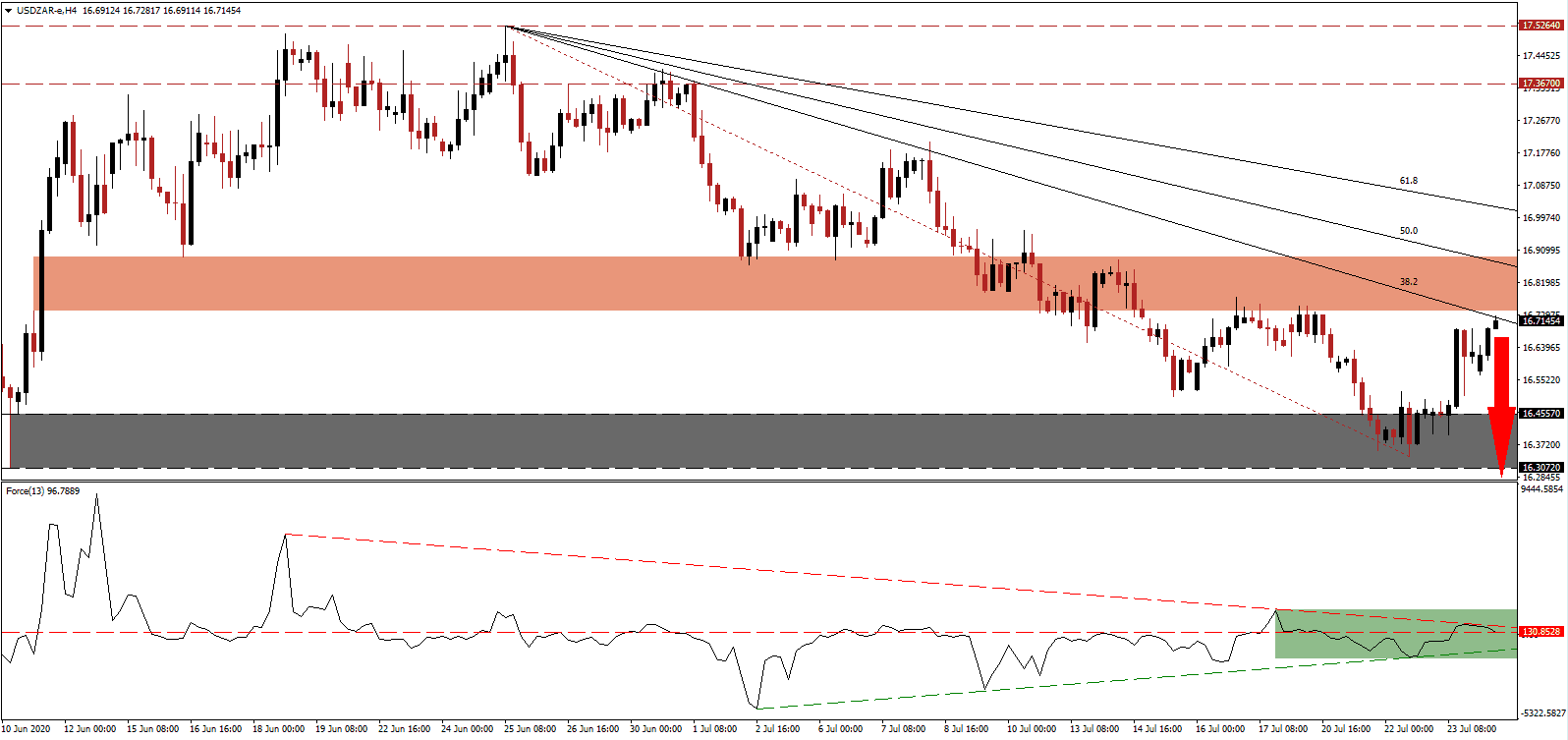

The Force Index, a next-generation technical indicator, was rejected by its descending resistance level and is now in the process of sliding below its descending resistance level, as marked by the green rectangle. From there, an accelerated contraction below its ascending support level is expected to take this technical indicator into negative territory, granting bears complete control over the USD/ZAR.

Over 6,000 deaths were recorded across South Africa, with experts presenting models to the government outlining an estimated Covid-19 death toll projection between 40,000 and 50,000 before the pandemic is under control. President Ramaphosa stressed the priority is to prove those projections wrong. The downward revised short-term resistance zone located between 16.7415 and 16.8899, as marked by the red rectangle, is adding to downside pressures on the USD/ZAR, magnified by intensifying weakness in the US Dollar.

Migration is adding to issues for the South African economy, with an estimated 15% of the population leaving urban centers and returning to their villages. It increases food security problems. In an April survey, 47% of respondents replied they could not afford enough food. Economic conditions in the US are deteriorating swiftly, and experts are concerned over a wave of homelessness due to the expiring $600 weekly government subsidy on initial jobless claims. The descending 38.2 Fibonacci Retracement Fan Resistance Level is well-positioned to force a breakdown in the USD/ZAR below its support zone between 16.3072 and 16.4557, as identified by the grey rectangle. An extension into its next support zone between 15.4522 and 15.7482 is favored to materialize.

USD/ZAR Technical Trading Set-Up - Breakdown Resumption Scenario

Short Entry @ 16.7200

Take Profit @ 15.5200

Stop Loss @ 16.9700

Downside Potential: 12,000 pips

Upside Risk: 2,500 pips

Risk/Reward Ratio: 4.80

A renewed push in the Force Index above its descending resistance level could lead the USD/ZAR temporarily higher. With the Covid-19 pandemic out of control in the US, initial jobless claims on the rise, and support mechanism fading, Forex traders are recommended to sell any rallies from current levels. The upside potential remains limited to its intra-day high of 17.2065.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 17.0700

Take Profit @ 17.2000

Stop Loss @ 16.9700

Upside Potential: 1,300 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 1.30