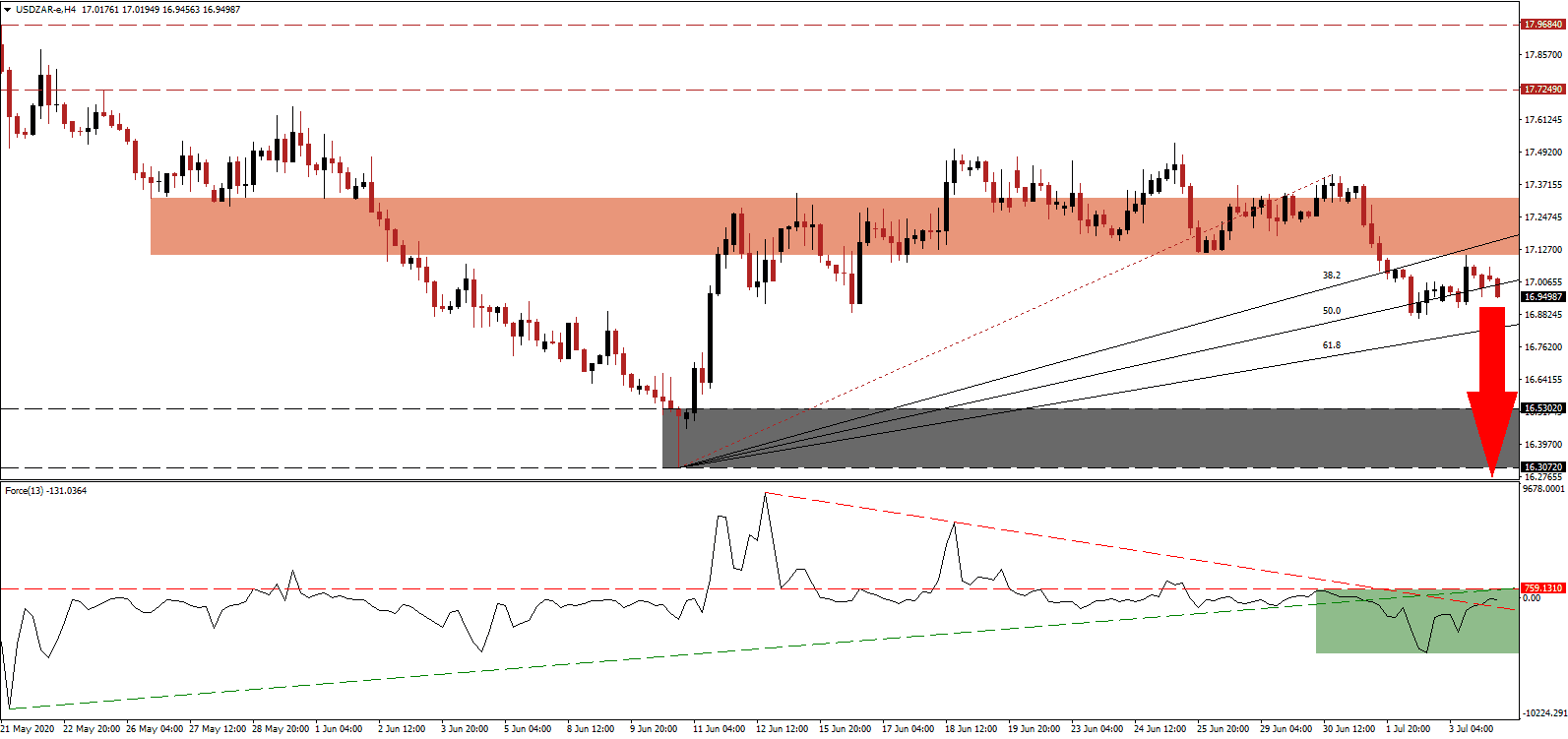

South Africa continues to struggle with the Covid-19 pandemic and is on course to exceed 200,000 infections as soon as today, surpassing Germany and Turkey. The country recorded its first current account surplus in the first quarter of 2020. The last one dates back to 2003. Rather than suggesting a fiscally stable government, it highlights the domestic collapse in demand. The R69.7 billion surplus, or 1.3% of GDP, compares against an R68.0 billion deficit, also 1.3% of GDP, in the fourth quarter. It sufficed to assist in the rejection of price action in the USD/ZAR by its ascending 38.2 Fibonacci Retracement Fan Resistance Level.

The Force Index, a next-generation technical indicator, was able to pierce its descending resistance level to the upside, as marked by the green rectangle, from where the ascending support level, is anticipated to reject a further advance. With the horizontal resistance level maintaining downside pressures and this technical indicator in negative territory, bears remain in complete control of the USD/ZAR.

Confirming deflating demand for imports is the trade surplus, expanding from R102.5 billion in the fourth quarter of 2019 to R208 billion in the first quarter of 2020. It was a combination of a rise in exports and a contraction in imports. The Covid-19 pandemic is forcing South Africa and many other countries to live within their means. It adds to positive pressures on the South African Rand, evident in the downward revision of the short-term resistance zone in the USD/ZAR to reflect increasing bearishness. It is presently located between 17.1044 and 17.3182, as identified by the red rectangle.

US Covid-19 infections continue to soar, and the pandemic is out of control. In the absence of a mire coordinated federal response, state governments are implementing various degrees of countermeasures. Texas Governor Greg Abbot issued a statewide mandatory face-covering order, while Florida’s Ron DeSantis refuses to implement one. Bearish progress in the USD/ZAR is expanding. The breakdown below its 50.0 Fibonacci Retracement Fan Support Level cleared the path into its support zone located between 16.3072 and 16.5302, as marked by the grey rectangle, with more downside favored.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 16.9500

Take Profit @ 16.2000

Stop Loss @ 17.1500

Downside Potential: 7,500 pips

Upside Risk: 2,000 pips

Risk/Reward Ratio: 3.75

In case the Force Index uses its descending resistance level as a platform to extend its advance, the USD/ZAR could push higher. The upside potential, following a downward revision, remains confided to its intra-day high of 17.4080, the end-point of its redraw Fibonacci Retracement Fan sequence. Forex traders should consider any push higher from current levels as an additional selling opportunity, driven by US Dollar weakness.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 17.2500

Take Profit @ 17.4000

Stop Loss @ 17.1500

Upside Potential: 1,500 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 1.50