After South Africa secured a $4.3 billion loan under the Rapid Financing Instrument of the US-based International Monetary Fund (IMF), temporary relief to the balance of payment issues will result in an expanded debt problem. The IMF approved the emergency financial assistance after South Africa entered a crisis for which it requires outside capital, agreed to cooperate with the IMF to solve the problem, and submitted proposed economic policy changes. Following a healthy counter-trend advance, the USD/ZAR was rejected and is likely to enter a new breakdown sequence.

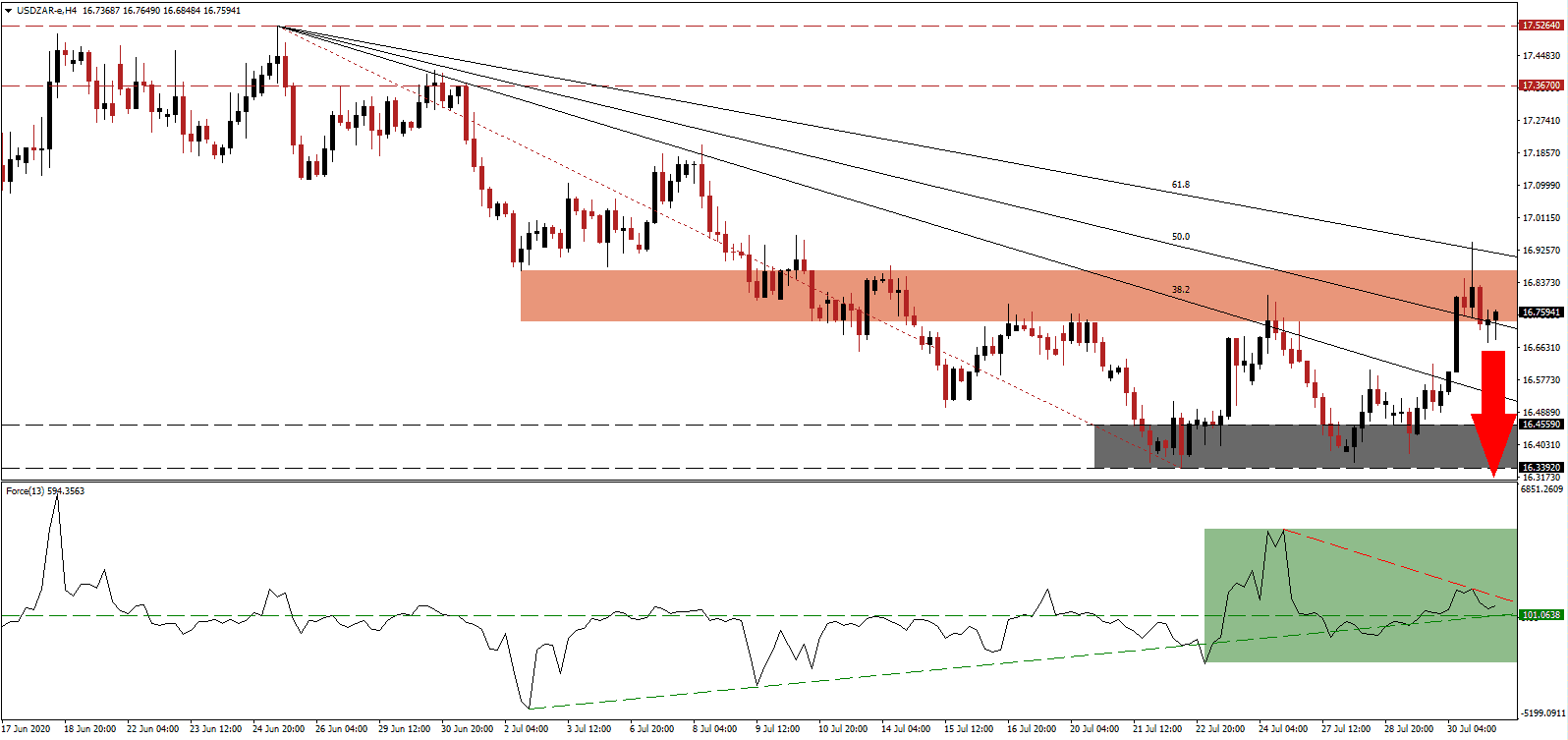

The Force Index, a next-generation technical indicator, recorded a lower high as price action spiked to a higher low, resulting in the formation of a negative divergence. It is now being pressured into retreat by its descending resistance level, as marked by the green rectangle. This technical indicator is positioned to collapse below its ascending support level, which is crossing above its horizontal support level, from where it can correct below the 0 center-line and cede control of the USD/ZAR to bears.

Critics of the IMF loan fear that South Africa will follow the government will not use the funds wisely, leading to further economic deterioration, while losing sovereignty to the IMF. Adding to uncertainties is that the Covid-19 pandemic, which forced Africa’s most industrialized nation to seek a bailout, is likely to last longer than the funds will bridge the balance of payments crisis. Ongoing US Dollar weakness counters bearish pressures on the South African Rand. The descending 61.8 Fibonacci Retracement Fan Resistance Level rejected the USD/ZAR. It now faces a breakdown below its short-term resistance zone located between 16.7315 and 16.8689, as identified by the red rectangle.

Following yesterday’s second-quarter GDP, showing a collapse of 32.9% after the 5.0% drop in the first quarter, the US Dollar faces more profound downside pressure. Magnifying bearish developments was the second consecutive weekly uptick in initial jobless claims and the surge in continuing claims. Economic issues out of the US are rising. They are partially due to the planned reduction in the weekly subsidy to the unemployed from $600 to $200. The USD/ZAR is favored to slide into its support zone located between 16.3392 and 16.4559, as marked by the grey rectangle. A collapse into its next support zone between 15.4522 and 15.7482 is likely.

USD/ZAR Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 16.7500

Take Profit @ 15.4500

Stop Loss @ 16.9500

Downside Potential: 13,000 pips

Upside Risk: 2,000 pips

Risk/Reward Ratio: 6.50

Should the Force Index push above its descending resistance level, the USD/ZAR may attempt a second breakout. Forex traders should take advantage of any price spike with new net sell orders, as the upside potential is reduced to its intra-day high of 17.2065. The Covid-19 pandemic is out of control, and the labor market recovery could take years amid a permanent change in consumer behavior.

USD/ZAR Technical Trading Set-Up - Reduced Breakout Extension Scenario

Long Entry @ 17.0500

Take Profit @ 17.2000

Stop Loss @ 16.9500

Upside Potential: 1,500 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 1.50