The US dollar initially fell during trading on Wednesday against the South African Rand but has bounced enough to show signs of life again. Ultimately, this is a market that I believe is a great proxy for emerging markets in general. This is because the South African Rand is a great proxy for Africa in general.

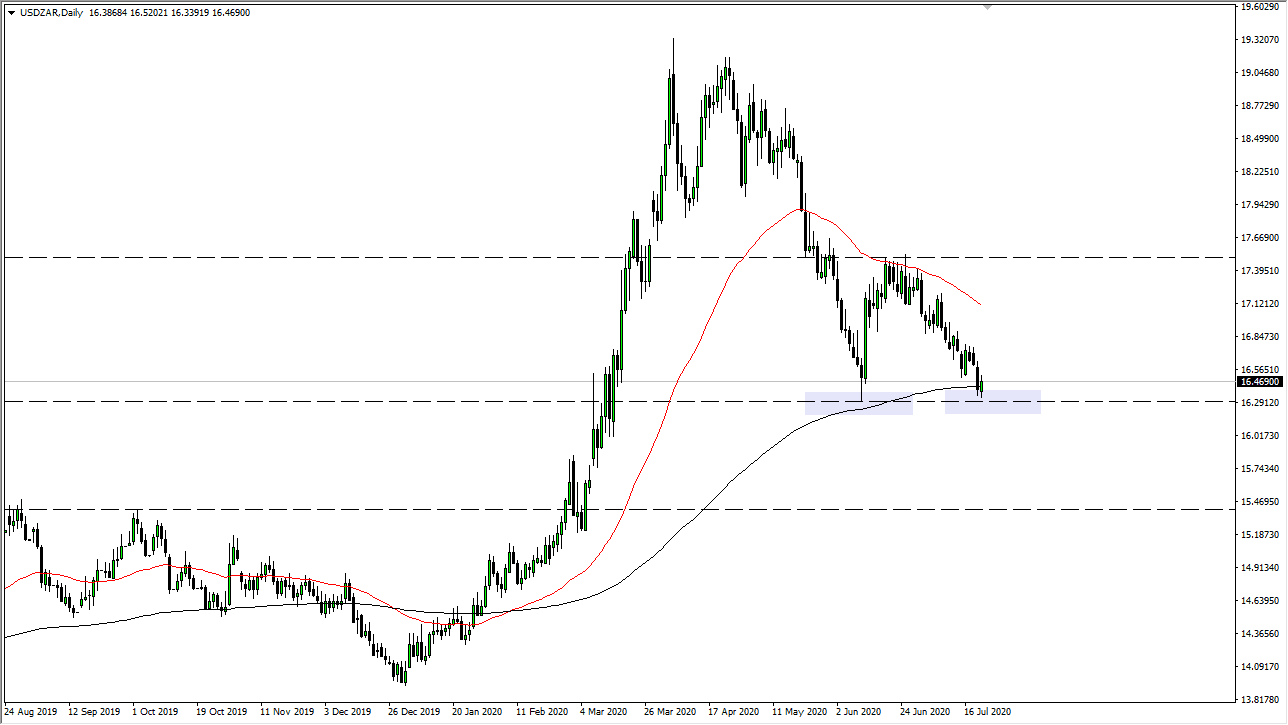

As we approach the 16.30 Rand level, there has been buying in the past as it was where we had bounced from on June 10. In fact, the market rallied all the way to the 17.40 Rand level, before rolling over again. Now the question is whether or not this 16.30 Rand level is going to end up being a “double bottom”, or will it simply be an area that we break through eventually. If that is going to be the question, we need to simply look at the reaction in this general vicinity. What I would point out is that all markets seem to be against the US dollar in general, so the question is whether or not things are so bad for the greenback that it is going to collapse against emerging market currencies?

If we do bounce from here, then we could go looking towards the 17.40 Rand level. If we break above there, then it will be a complete change in trend, but I think at this point it is obvious that the US dollar is in complete trouble. I do not expect this area below to hold, and if we break down below there it is likely that we go looking towards the 15.40 Rand level. That being said, the South African Rand will probably attract less inflow than some of the other major currencies. Another thing that should be paid attention to is the fact that the 200 day EMA is sitting right in the middle of the candlestick, so I think we have a couple of days’ worth of volatility and then we will have clarity. This is starting to set up for a significant move that we can take advantage of, so if we can wipe out the candle for Monday to the upside, then I would be a buyer. Ultimately, a daily close below that 16.30 Rand level will have me selling this market going forward.